With a market cap of $218.8 billion, Abbott Laboratories (ABT) is a global healthcare leader with a diversified portfolio spanning medical devices, diagnostics, nutrition, and branded generic pharmaceuticals. The North Chicago, Illinois-based company is best known for innovations like its FreeStyle Libre glucose monitoring system. Abbott plays a major role in chronic disease management, lab testing technologies, and specialized nutrition with brands such as Ensure, Pedialyte, and Similac.

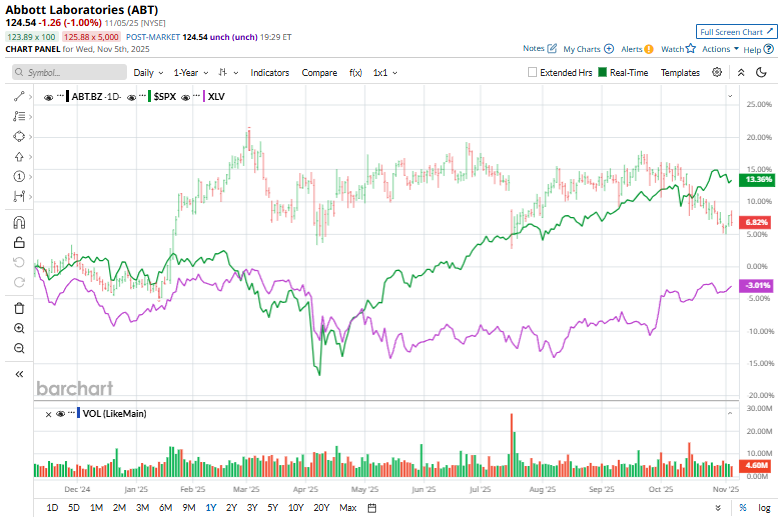

Over the past year, ABT shares have soared 5.8%, trailing the broader S&P 500 Index ($SPX), which has gained 17.5%. Moreover, ABT stock has risen 10.1% on a YTD basis, compared to SPX's 15.6% rise.

Looking closer, Abbott has outpaced the Health Care Select Sector SPDR Fund's (XLV) 1.5% decrease over the past 52 weeks and 5.9% rise in 2025.

On Oct. 15, shares of Abbott Laboratories dropped 2.9% after the company reported FY2025 Q3 results. While Revenue came in at $11.37 billion, up 6.9% year over year, it missed the Wall Street expectations. On the bright side, adjusted EPS rose 7.4% to $1.30, matching market expectations. Abbott reaffirmed its full-year 2025 outlook, maintaining organic sales growth guidance of 7.5%–8.0% (excluding COVID-related testing) and 6.0%–7.0% (including it). The company also kept the midpoint of its adjusted EPS outlook and narrowed the range to $5.12–$5.18, representing double-digit growth at the midpoint.

For the fiscal year ending in December 2025, analysts expect ABT’s EPS to grow 10.3% year-over-year to $5.15. The company's earnings surprise history is promising. It topped or met the consensus estimates in the last four quarters.

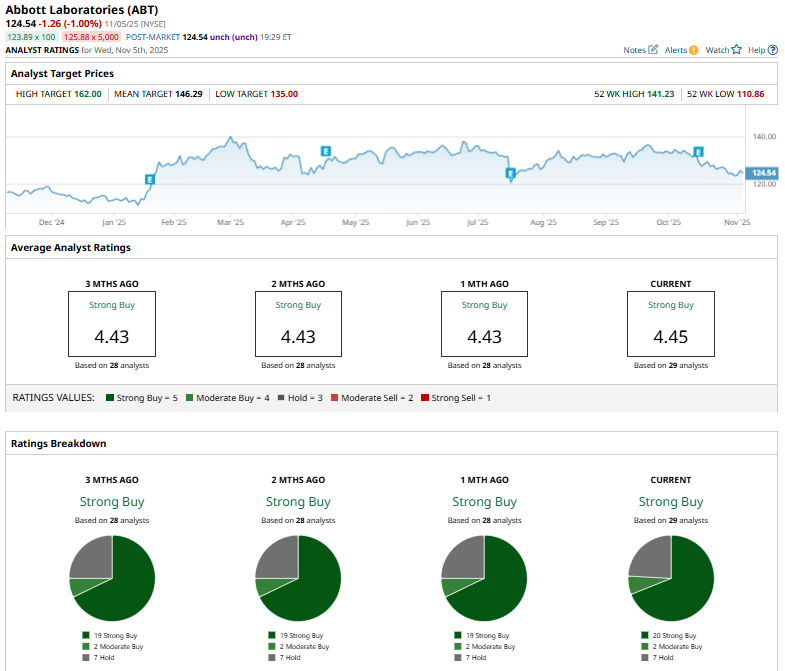

Among the 29 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 20 “Strong Buy” ratings, two “Moderate Buys,” and seven “Holds.”

The current configuration is more bullish than a month ago, when 19 analysts advised a “Strong Buy” for the stock.

On Oct. 17, Citi analyst Joanne Wuensch reaffirmed her “Buy” rating on Abbott Laboratories. On the same day, the stock also received a “Buy” rating from Benchmark Co. analyst Bruce Jackson.

The mean price target of $146.29 implies a premium of 17.5% from the current price levels. The Street-high price target of $162 indicates a potential upside of 30.1%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart