Today, a large volume of out-of-the-money (OTM) call options in Tesla, Inc. (TSLA) highlights the underlying value of TSLA stock. We recently wrote in a Barchart article that TSLA could be worth over $501 per share. Investors are buying large amounts of one-month $480.00 strike price calls.

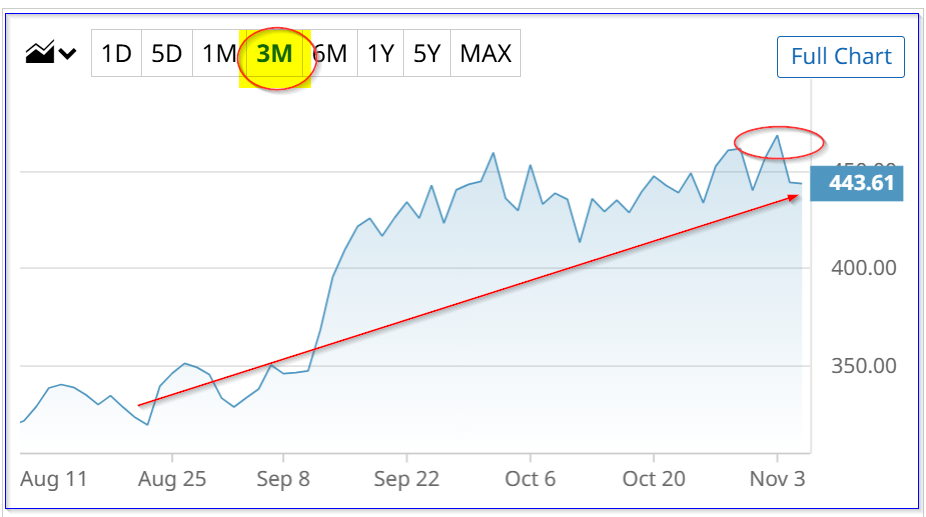

TSLA is trading at $447.00 in morning trading on Wednesday, Nov. 5. This is down from its recent peak of $468.37 on Nov. 3, following Tesla's Oct. 22 Q3 shareholder deck release.

On Oct. 26, my Barchart article ("Tesla's Strong FCF Margins Could Imply TSLA Stock is Worth Over $500") showed that TSLA stock could be worth as much as $501.81. This was based on its strong free cash flow (FCF) and FCF margins.

I argued, for example, that using a 6% FCF margin and analysts' estimates of $95.633 billion in 2026 revenue, its FCF in 2026 would be $5.738 billion

Using a 0.34% FCF yield metric, Tesla stock would be worth $1.688 trillion (i.e., $5.738b / 0.0034)

That is +13.5% higher than today's market value of $1.487 trillion, according to Yahoo! Finance.

So, 1.135 x $447.00 price today = $507 price target

This is even higher than my prior target price. As a result, some investors may also think that it's time to buy short-term call options.

Heavy Call Options Volume in TSLA Stock

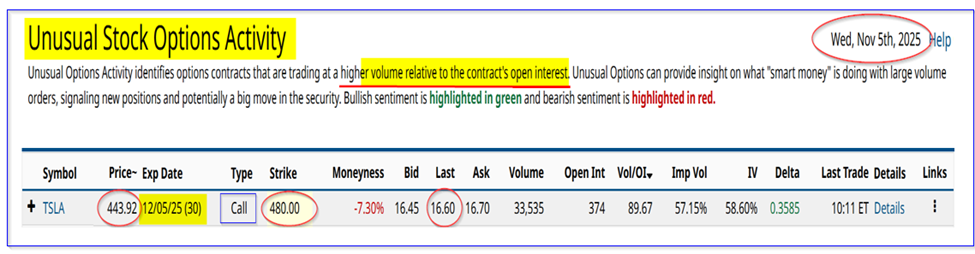

The heavy volume in TSLA stock call options today is evident in today's Barchart Unusual Stock Options Activity Report.

It shows that over 33,500 call options expiring in one month on Dec. 5, 2025, have traded at the $480.00 call option exercise price. Moreover, the premium was $16.60, so investors buying these calls may believe that TSLA stock will rise to $496.60, for their investment to begin to have any intrinsic value.

That is a potential rise of +11.0% over today's price of $447.00.

The point here is that TSLA call options buyers are very bullish in the near-term. They may be seeing the $507 price happening sooner rather than later.

Moreover, some of these call option buyers are expecting to sell their calls at higher prices, assuming TSLA keeps rising.

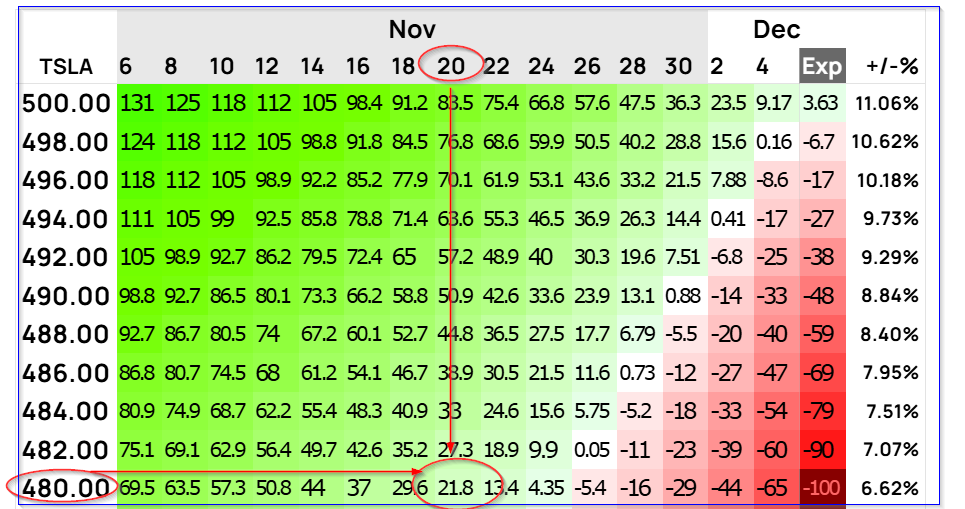

For example, if TSLA rises to $480 by Nov. 20, it's possible that the call option price could rise to $21.80, according to a calculation on the site optionsprofitcalculator.com.

That would be a gain of +31.30% for the option buyer at the $16.60 price, and at the premium now of $19.30, it would be a gain of +13.0%.

Covered Call Play

On the other hand, short-sellers of these OTM calls are also bullish, especially if they are selling covered calls.

For example, the $16.60 premium represents a covered call yield of 3.7% (i.e., $16.60/$447.00) over the next month.

Moreover, even if TSLA rises to just below $480, say $479.00, the investor gets to keep that unrealized gain. So the potential total return at $479 is +7.16% capital gain plus 3.7% yield, or +10.86%.

That is even before there is an obligation to sell shares at $480.00. So, in effect, this is a bullish play for these covered call investors.

The bottom line is that TSLA stock looks undervalued here. Some investors are playing this by investing in or shorting out-of-the-money calls.

Another play is short-put sales.

Shorting OTM Puts

This play involves selling short out-of-the-money (OTM) put options. I discussed this in my last Barchart article on Tesla on Oct. 26. It means entering an order to “Sell to Open” an out-of-the-money (OTM) put option using cash as collateral.

At the time, TSLA was at $433.72, and I recommended shorting the $400.00 put expiring Nov. 28. At the time, it was at $11.28 in the midpoint, providing the short-seller an immediate yield of about 3.0% (i.e., $11.28/$400.00 = 0.029875).

Today, the premium has fallen to $7.20 at the midpoint, making that trade very profitable. In fact, it still provides a short-seller an immediate yield of 1.80% (i.e., $7.20/$400.00) for just 3 weeks).

Moreover, the strike price is over 10.5% below today's trading price, providing good downside protection.

For aggressive, less-risk-averse investors, they could use the short-put sale proceeds of $7.20 to defray some of the cost of the $480.00 call option purchase ($19.30). That could provide good upside potential if TSLA stock keeps rising.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart