TransDigm Group Incorporated (TDG), based in Cleveland, Ohio, develops and supplies highly engineered aerospace components used across major commercial and military aircraft. Its portfolio covers actuators, controls, ignition systems, pumps, avionics, and interior hardware, supporting critical aircraft functions.

With a market cap of approximately $76.3 billion, TDG stands firmly in “large-cap” territory, reflecting its strength in mission-critical aviation products. The company benefits from dependable aftermarket demand and strong pricing power.

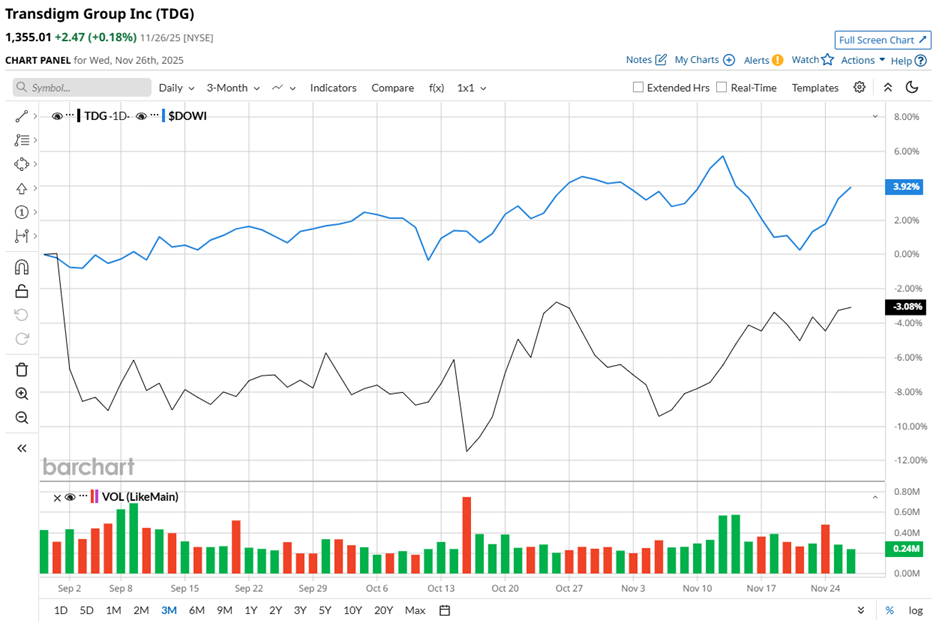

The stock has faced a softer stretch recently. TDG stock slipped 16.6% from its July peak of $1,623.82, and the past three months added another 4.1% decline. Meanwhile, the Dow Jones Industrial Average ($DOWI) gained 4.4% over the same time frame.

However, the broader view reveals a steadier trend. Over the past 52 weeks, TDG rose 7.3%, outpacing the Dow’s 5.7%. In 2025, TDG gained 6.9%, lagging behind the Dow Jones’ 11.5% climb on a year-to-date (YTD) basis.

Its technical picture adds useful context. TDG has traded above its 50-day moving average since mid-Nov, which signals improving short-term momentum. At the same time, the stock remains below its 200-day moving average since September, indicating that the longer-term trend still carries pressure despite the recent rebound.

The company’s fiscal 2025 Q4 results, unveiled on Nov. 12, added a clearer anchor as the stock rose nearly 1.1%, gaining $13.97 in a single trading session. Net sales increased 11.5% year over year (YoY) to $2.44 billion, exceeding Street’s expectations of $2.41 billion. Adjusted EPS improved 10.1% annually to $10.82 and came in ahead of analyst forecasts.

The results strengthen the view that TDG’s core businesses continue to benefit from steady demand across commercial and defense aviation. Management expects the commercial OEM segment to deliver the strongest growth ahead, supported by ongoing expansion in the commercial aftermarket and consistent demand in defense markets.

For fiscal year 2026, TDG’s management projects net sales between $9.75 billion and $9.95 billion, compared with $8.83 billion in fiscal 2025, an increase of 11.5% at the midpoint. Adjusted EPS is expected to land between $36.49 and $38.53, compared with $37.33 per share in fiscal 2025, an increase of 0.5% at the midpoint compared to the prior year.

A comparison with its rival, General Dynamics Corporation (GD), which gained 20.6% over the past 52 weeks and 29.1% YTD, shows TDG is moving at a more measured pace.

Despite recent stock price weakness, TDG’s foundations remain strong enough for analysts to anticipate a potential breakout over the next year. The 23 analysts covering TDG assign it a “Moderate Buy” consensus rating, and the mean price target of $1,581.38 implies a potential upside of 16.7% from current levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart