Cornwall Capital Management, LP (“Cornwall”), an investment manager whose funds beneficially own approximately 26% of the outstanding shares of Keweenaw Land Association, Limited (OTC Pink:KEWL) (“Keweenaw” or the “company”), today released an in-depth presentation and sent a letter to Keweenaw shareholders detailing the company’s prolonged underperformance, lack of strategic direction, and deeply entrenched board, and Cornwall’s 4 Point Plan to help steward the company to success over the long-term.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180321006274/en/

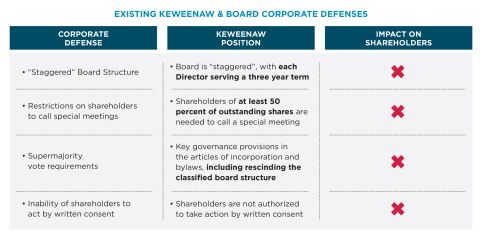

Existing Keweenaw and Board Corporate Defenses Graphic (Graphic: Business Wire)

In connection with Keweenaw’s Annual Meeting of Shareholders to be held April 12, 2018, Cornwall urges ALL shareholders to protect the value of their investment by voting the WHITE proxy card TODAY “FOR” the election of Cornwall’s three independent nominees, Mr. Ian Haft, Mr. Steve Winch, and Mr. Paul Sonkin, to the Keweenaw board.

Cornwall’s presentation for a new Keweenaw and its letter to shareholders are available at: http://www.innisfreema.com/annual/KEWL/.

The full text of the letter also follows.

March 21, 2018

Fellow Keweenaw Shareholders,

I am writing to request your support for Cornwall’s three highly-experienced nominees in connection with Keweenaw Land Association, Limited’s (“Keweenaw” or the “company”) upcoming April 12th Annual Meeting of Shareholders. For far too long, Keweenaw’s board has sought to maintain the status quo – protecting itself through a complex web of corporate defenses designed to prevent open shareholder engagement and good corporate governance – while shareholder value has deteriorated. Shareholders need to take action.

Cornwall is taking action today because we want to help steward the company to success over the long-term.As Keweenaw’s largest investor, owning 26% of its outstanding shares, and as a long-term investor, first investing in Keweenaw over a decade ago, Cornwall is strongly aligned with its fellow Keweenaw shareholders.

As owners of this company, we need to make changes to protect our investment and improve Keweenaw’s value. As a result of Keweenaw’s significant financial and operational underperformance, failed harvest strategy, and imprudent acquisitions overseen by the incumbent board, it is clear that change is required immediately in order to end this cycle of shareholder value destruction.

For many years, Keweenaw’s lack of strategic direction, coupled with its board’s poor execution and frequent reversal of various initiatives, has contributed to significant financial and operational losses. Take for example Keweenaw’s plans to convert to a REIT effective for the 2018 tax year. Previously, Keweenaw stated a REIT conversion:

- “doesn’t make sense for a company like Keweenaw;”

- “is not in the shareholders’ best interests;”

- “would be costly and strategically unattractive;” and

- would not be “economical.”

Now, the company has completely reversed itself, deciding to move forward with such a conversion. Notably, when Keweenaw does undertake an important strategic initiative, it fails frequently, and at a high cost to the company. Cases in point: Keweenaw recently undertook a mismanaged sale process, which failed, and an equity recapitalization, which failed – both at high cost to the company.

A coherent and cohesive strategy – designed to reposition the company for revenue growth, and in turn, shareholder value creation – is desperately needed at Keweenaw. As a large, longstanding investor in Keweenaw, committed to its operational and financial success over the long-term, Cornwall has developed a straightforward plan, backed by experienced professionals, to maximize value for all shareholders.

Importantly, we are not advocating for a fire sale of the company. We believe the best way to increase shareholder value today is to execute on our 4 Point Plan, detailed below, to grow the company’s cash flows, improve its operating margins, and implement best practice corporate governance.

Cornwall intends to work closely alongside Keweenaw’s existing senior management team to execute our plan for a New Keweenaw.

I strongly urge you to help improve the value of Keweenaw for the benefit of ALL shareholders by voting your WHITE proxy card TODAYto elect Cornwall’s nominees – Mr. Ian Haft, Mr. Steve Winch, and Mr. Paul Sonkin – to the Keweenaw board.

CORNWALL’S 4 POINT PLAN TO RETURN KEWEENAW TO SUCCESS

1. CORNWALL WILL REVITALIZE KEWEENAW BY INCREASING HARVEST RATES AND ALIGNING COMPENSATION WITH LONG-TERM OBJECTIVES

Simply put, Keweenaw seems to lack an understanding of its principal asset, timber inventory, as evidenced by the 2017 timber inventory cruise. The company has and continues to harvest far below its long-term sustainable harvest growth rate, resulting in it dramatically underperforming its peers and the broader market. If elected, Cornwall’s nominees intend to responsibly increase harvest rates and reposition the company for cash flow growth.

Furthermore, as it currently stands, Keweenaw’s employee compensation does not appear to align with the company’s long-term business objectives. Cornwall believes that aligning compensation of existing management and other employees with long-term business objectives – including cash flow and yield-based metrics – will help foster a culture of ownership and performance to revitalize the business.

2. CORNWALL WILL IMPLEMENT A COST REDUCTION STRATEGY TO IMPROVE OPERATING EXPENSES

Operational challenges have hurt Keweenaw for years. Keweenaw has spent countless shareholder dollars on unnecessary board-related expenses, and capitalized costs in connection with the company’s failed timberland fund and strategic review. If elected, Cornwall’s nominees will make it a priority to conduct a standard, overhead expense review in an attempt to cut extraordinary costs. Specifically, Cornwall will seek to reduce board expenses by eliminating the Chairman’s salary and other non-essential board-related expenses.

3. CORNWALL WILL REFORM CORPORATE GOVERNANCE TO ENSURE SHAREHOLDER RESPONSIVENESS

Keweenaw has suffered greatly as a result of its deeply entrenched board of legacy directors who have served for decades. These tenured directors have gone to great lengths to keep themselves in control of the company, isolating themselves through a complex web of dated corporate defenses.

Existing Keweenaw and Board Corporate Defenses

See: Existing Keweenaw and Board Corporate Defenses Graphic

Cornwall is committed to restoring accountability in the boardroom. If elected, Cornwall’s nominees will conduct a thorough review of board best practices to enhance corporate governance through a series of reforms and operational changes – including eliminating a staggered board, removing supermajority provisions, improving disclosure of timber inventory, and engaging in regular communication with shareholders – that will have a direct, positive effect on ALL shareholders.

Proposed Cornwall Approach for Governance Best Practice

See: Proposed Cornwall Approach for Governance Best Practice Graphic

4. CORNWALL WILL SEEK TO QUICKLY STABILIZE KEWEENAW’S BALANCE SHEET

If elected, Cornwall’s nominees will seek to cease ALL value-destroying acquisitions to help repair the balance sheet. Accordingly, Cornwall will seek to ensure that management’s focus is on value creating initiatives, paying down debt, and monetizing non-timber assets.

CORNWALL’S NOMINEES ARE THE RIGHT PEOPLE TO IMPLEMENT A STRATEGIC PLAN FOR A NEW AND HIGHLY IMPROVED KEWEENAW

Cornwall’s three highly-qualified nominees have the deep financial expertise and significant public and private company board experience required to restore value at Keweenaw for the benefit of ALL Keweenaw stakeholders. If elected, Cornwall’s nominees will be committed to working alongside the incumbent directors and management to execute our 4 Point Plan to drive operational and financial outperformance – providing the oversight and accountability over management required to achieve this goal.

Do not be misguided by Keweenaw’s misleading and confusing statements. I strongly encourage you to protect your investment by voting “FOR” Cornwall’s nominees on your WHITE proxy card today.

Sincerely,

James A. Mai

Managing Member of Cornwall GP,

the General Partner of Cornwall Master LP

Important Information:

In connection with its solicitation of proxies for the 2018 annual meeting of Keweenaw Land Association, Limited (the “Company”), Cornwall Capital Management, L.P. and certain of its affiliates (collectively, “Cornwall”) intend to make available additional information to the shareholders of the Company. CORNWALL STRONGLY ADVISES ALL COMPANY SHAREHOLDERS TO READ ALL ADDITIONAL INFORMATION WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION.

View source version on businesswire.com: https://www.businesswire.com/news/home/20180321006274/en/

Contacts:

Gasthalter & Co.

Jonathan Gasthalter/Amanda

Klein, 212-257-4170

or

Investors:

Innisfree M&A

Incorporated

Scott Winter/Jonathan Salzberger, 212-750-5833

swinter@innisfreema.com/jsalzberger@innisfreema.com