Over the last six months, Alight’s shares have sunk to $6.25, producing a disappointing 13.9% loss while the S&P 500 was flat. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Alight, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even though the stock has become cheaper, we don't have much confidence in Alight. Here are three reasons why ALIT doesn't excite us and a stock we'd rather own.

Why Do We Think Alight Will Underperform?

Born from a corporate spinoff in 2017 to focus on employee experience technology, Alight (NYSE: ALIT) provides human capital management solutions that help companies administer employee benefits, payroll, and workforce management systems.

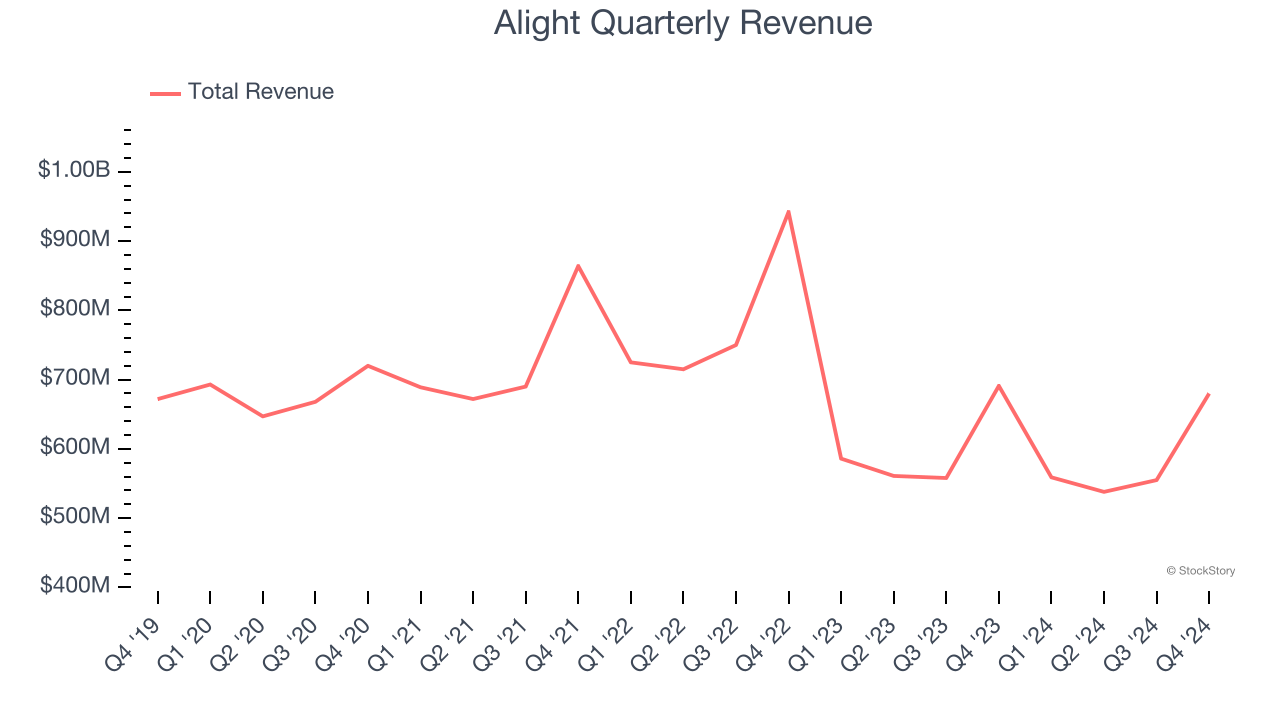

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Alight struggled to consistently generate demand over the last five years as its sales dropped at a 1% annual rate. This wasn’t a great result and is a sign of poor business quality.

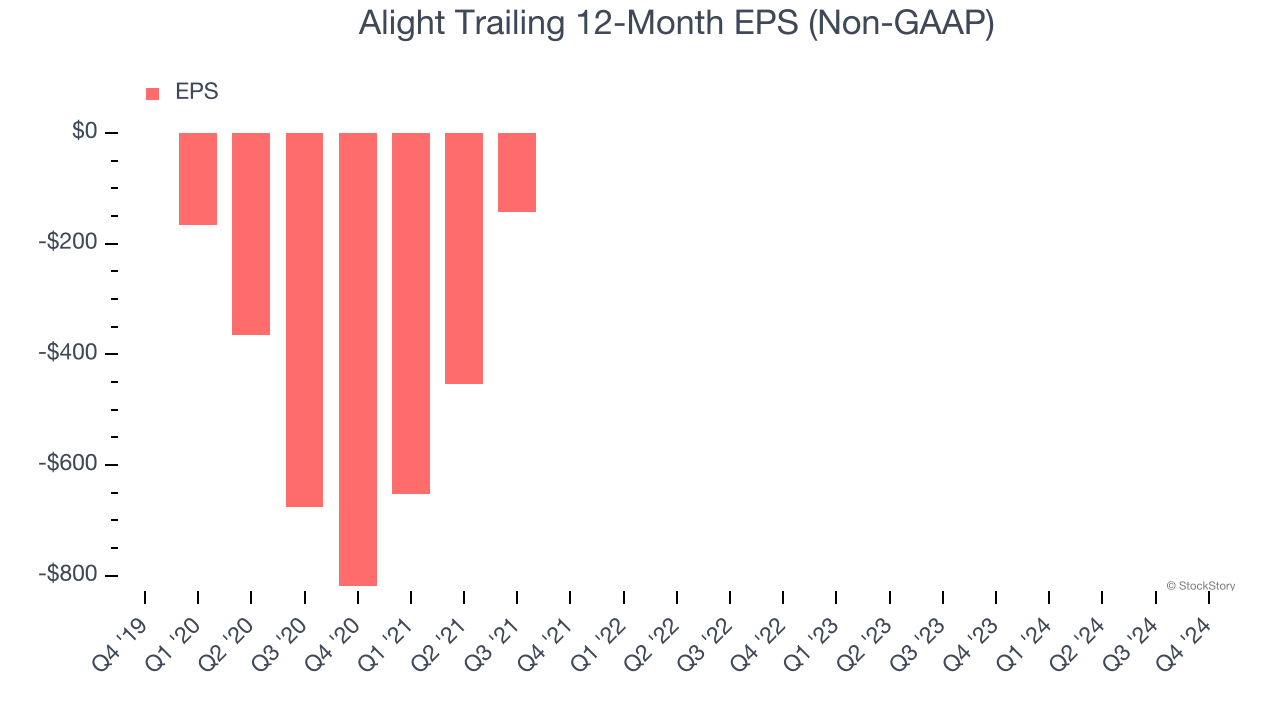

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Alight, its EPS and revenue declined by 2.3% and 13.7% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Alight’s low margin of safety could leave its stock price susceptible to large downswings.

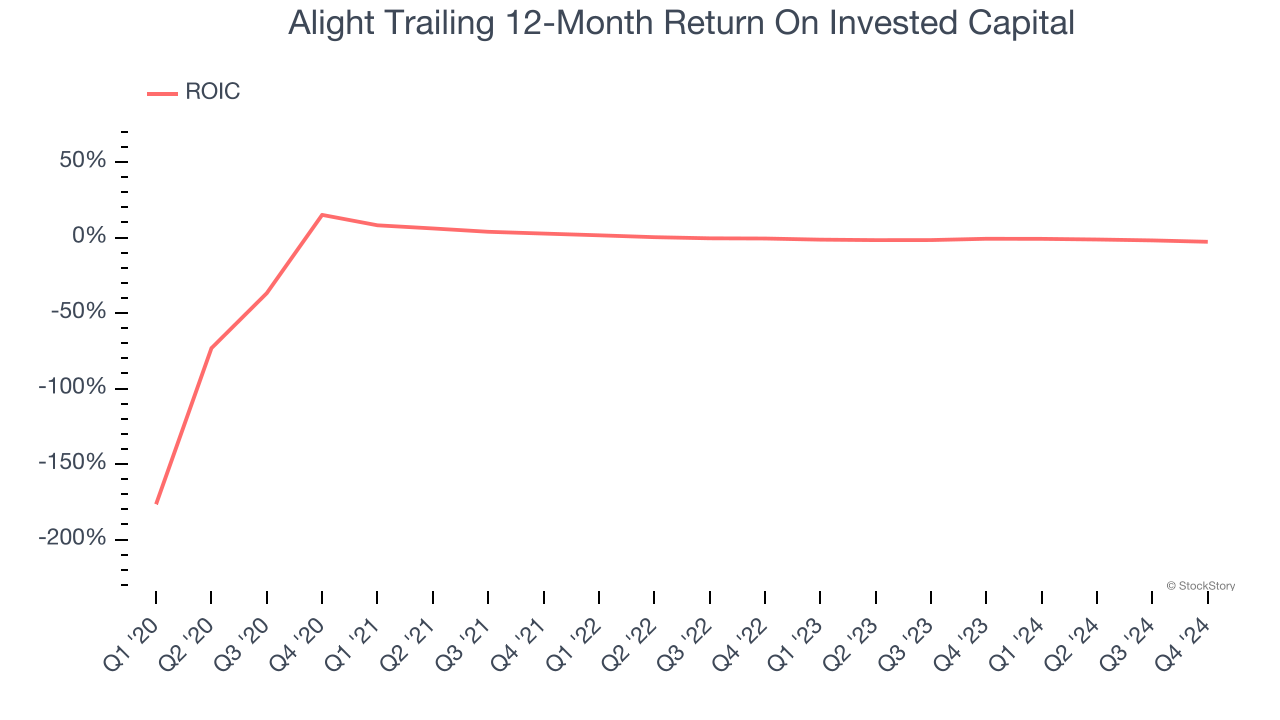

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Alight’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Alight, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 9.6× forward price-to-earnings (or $6.25 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d recommend looking at one of our all-time favorite software stocks.

Stocks We Would Buy Instead of Alight

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.