Genomics company Illumina (NASDAQ: ILMN) reported Q4 CY2024 results exceeding the market’s revenue expectations, but sales were flat year on year at $1.1 billion. On the other hand, the company’s full-year revenue guidance of $4.34 billion at the midpoint came in 1.2% below analysts’ estimates. Its non-GAAP profit of $0.86 per share was 6.9% below analysts’ consensus estimates.

Is now the time to buy Illumina? Find out by accessing our full research report, it’s free.

Illumina (ILMN) Q4 CY2024 Highlights:

- Revenue: $1.1 billion vs analyst estimates of $1.08 billion (flat year on year, 2.1% beat)

- Adjusted EPS: $0.86 vs analyst expectations of $0.92 (6.9% miss)

- Adjusted Operating Income: $218 million vs analyst estimates of $218.1 million (19.7% margin, in line)

- Management’s revenue guidance for the upcoming financial year 2025 is $4.34 billion at the midpoint, missing analyst estimates by 1.2% and implying 0.2% growth (vs -2.3% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $4.58 at the midpoint, beating analyst estimates by 2.7%

- Operating Margin: 15.9%, up from -14.9% in the same quarter last year

- Free Cash Flow Margin: 29.2%, up from 15.8% in the same quarter last year

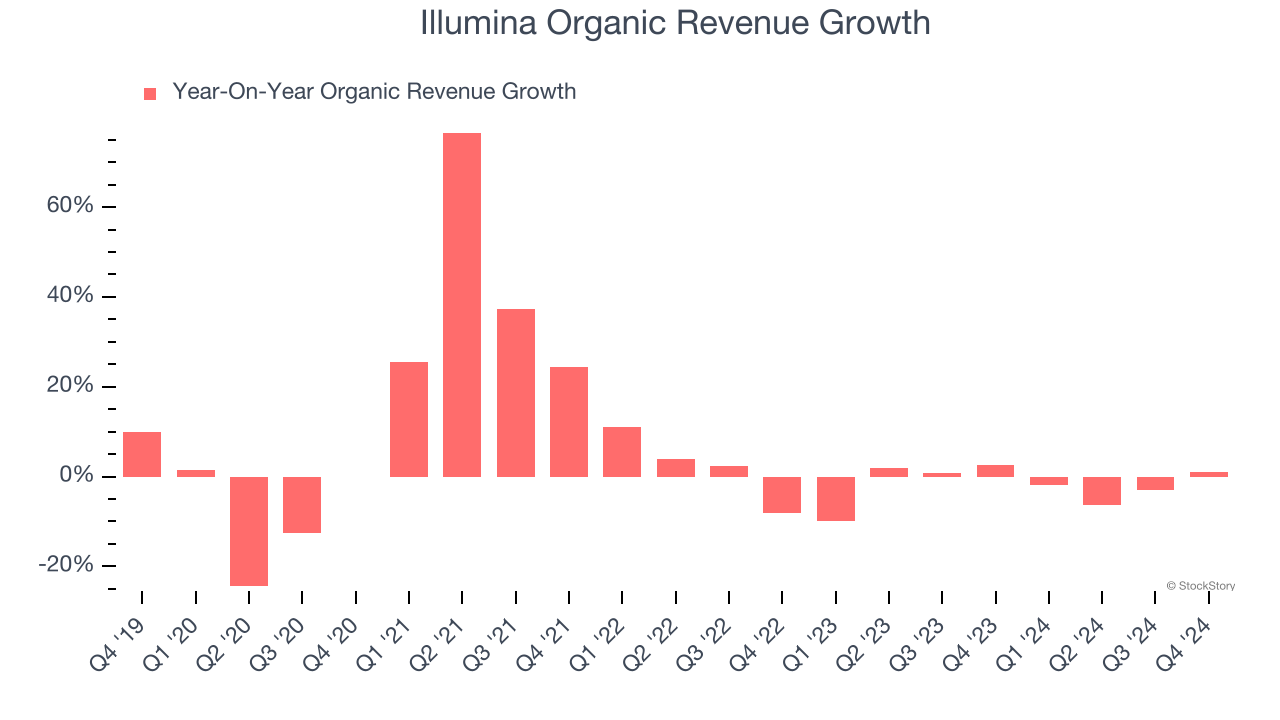

- Organic Revenue rose 1% year on year (2.5% in the same quarter last year)

- Market Capitalization: $19.77 billion

"The Illumina team delivered fourth quarter revenue that exceeded our expectations, and we made significant progress in 2024 toward our goals to drive customer-centric innovation, margin expansion, and EPS growth," said Jacob Thaysen, Chief Executive Officer.

Company Overview

Founded in 1998, Illumina (NASDAQ: ILMN) is a provider of genomic sequencing and analysis technologies for applications in research, clinical diagnostics, and life sciences.

Genomics & Sequencing

Genomics and sequencing companies within the life sciences industry provide the technology for increasingly personalized medicine, drug discovery, and disease research. These firms leverage cutting-edge platforms for high-throughput sequencing and genomic analysis, enabling researchers and healthcare providers to better understand genetic underpinnings of diseases. While the industry enjoys high barriers to entry due to proprietary technology and intellectual property, the business model also faces significant R&D costs, reliance on continued innovation, and exposure to shifts in academic, biotech, and clinical research funding. Over the next few years, the subsector is well-positioned to benefit from tailwinds such as increasing adoption of precision medicine, expanded applications for sequencing technologies in areas like oncology and rare disease diagnostics, and growing use of genomic data in drug development. Advances in artificial intelligence could further enhance the speed and accuracy of genomic insights. However, potential headwinds include price sensitivity among research institutions and healthcare systems that are constantly trying to contain and lower costs. Additionally, regulations around data privacy and genomic testing are not yet set in stone, adding uncertainty to the industry.

Sales Growth

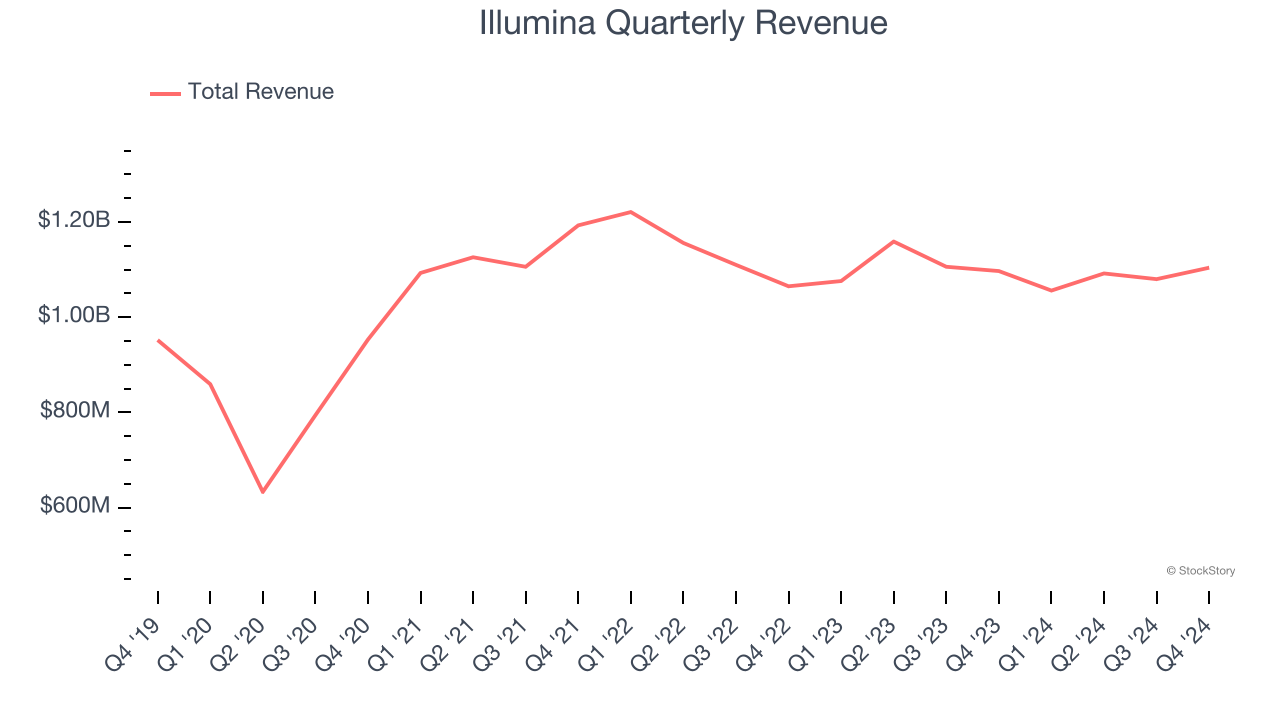

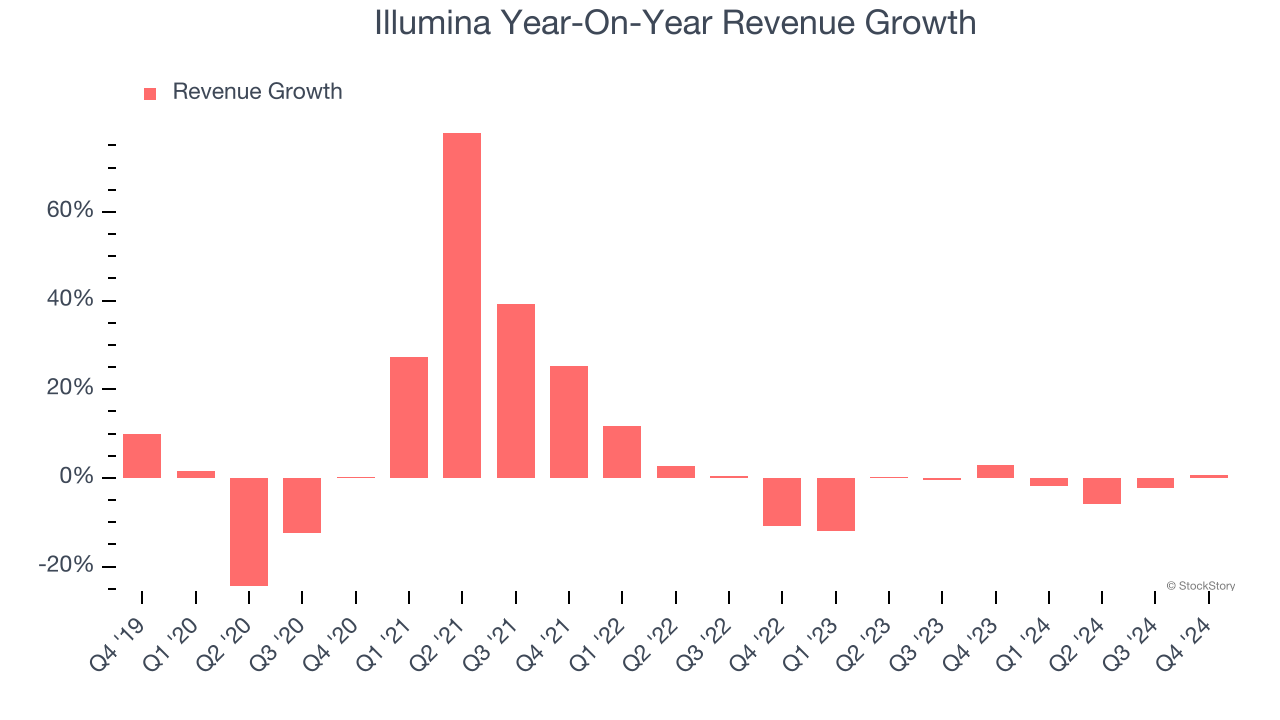

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Illumina’s 4.1% annualized revenue growth over the last five years was mediocre. This was below our standard for the healthcare sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Illumina’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.4% annually.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Illumina’s organic revenue averaged 1.9% year-on-year declines. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Illumina’s $1.1 billion of revenue was flat year on year but beat Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 2.4% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Adjusted Operating Margin

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

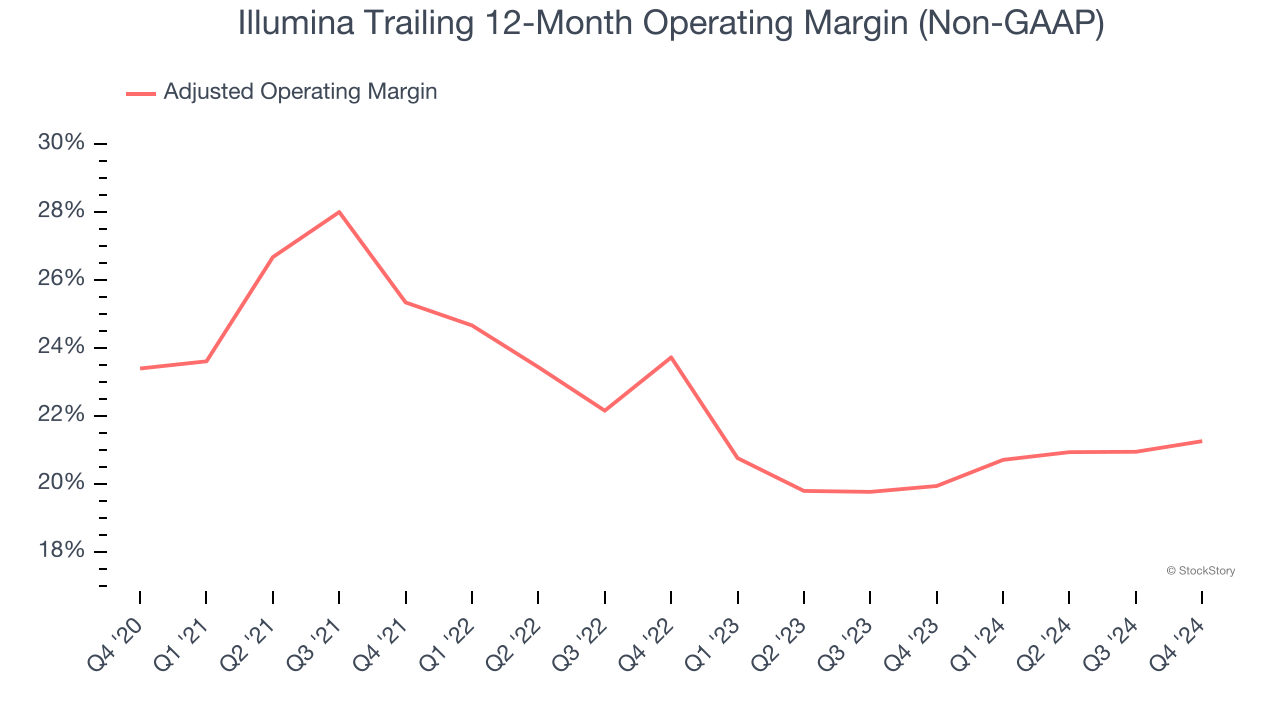

Illumina has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average adjusted operating margin of 22.7%.

Analyzing the trend in its profitability, Illumina’s adjusted operating margin decreased by 2.1 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 2.5 percentage points. This performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Illumina generated an adjusted operating profit margin of 19.7%, up 1.2 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

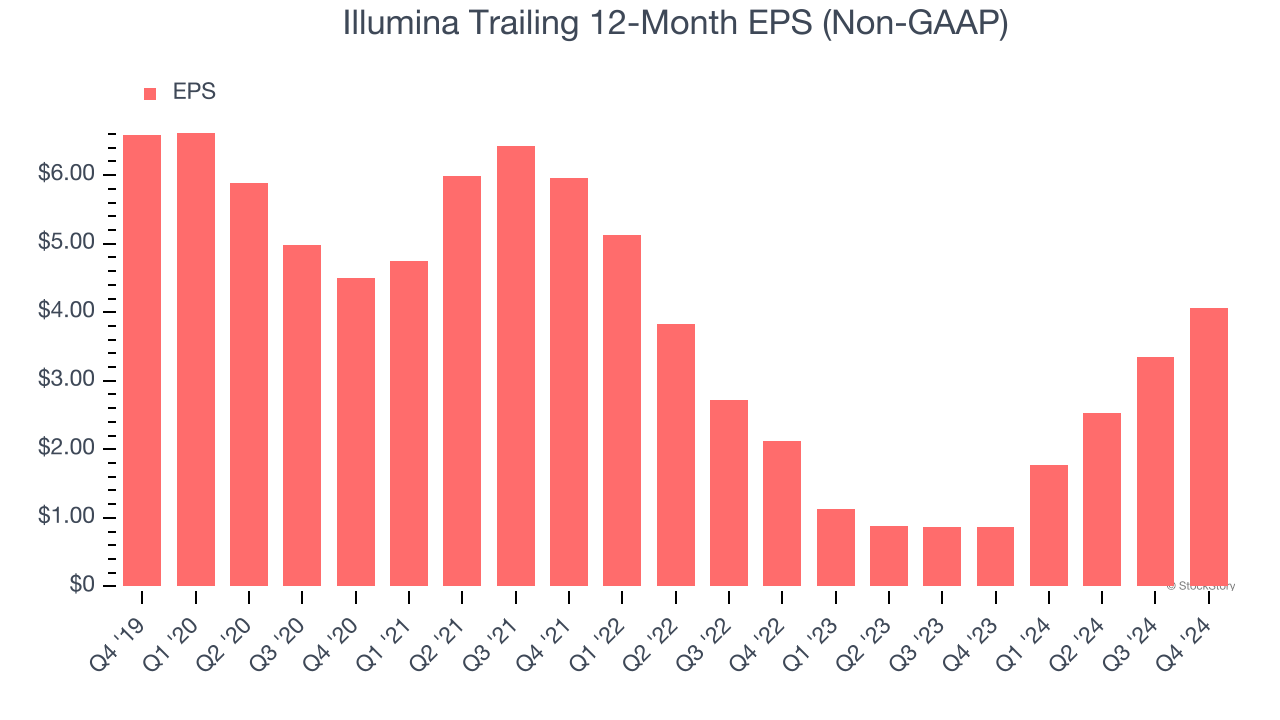

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

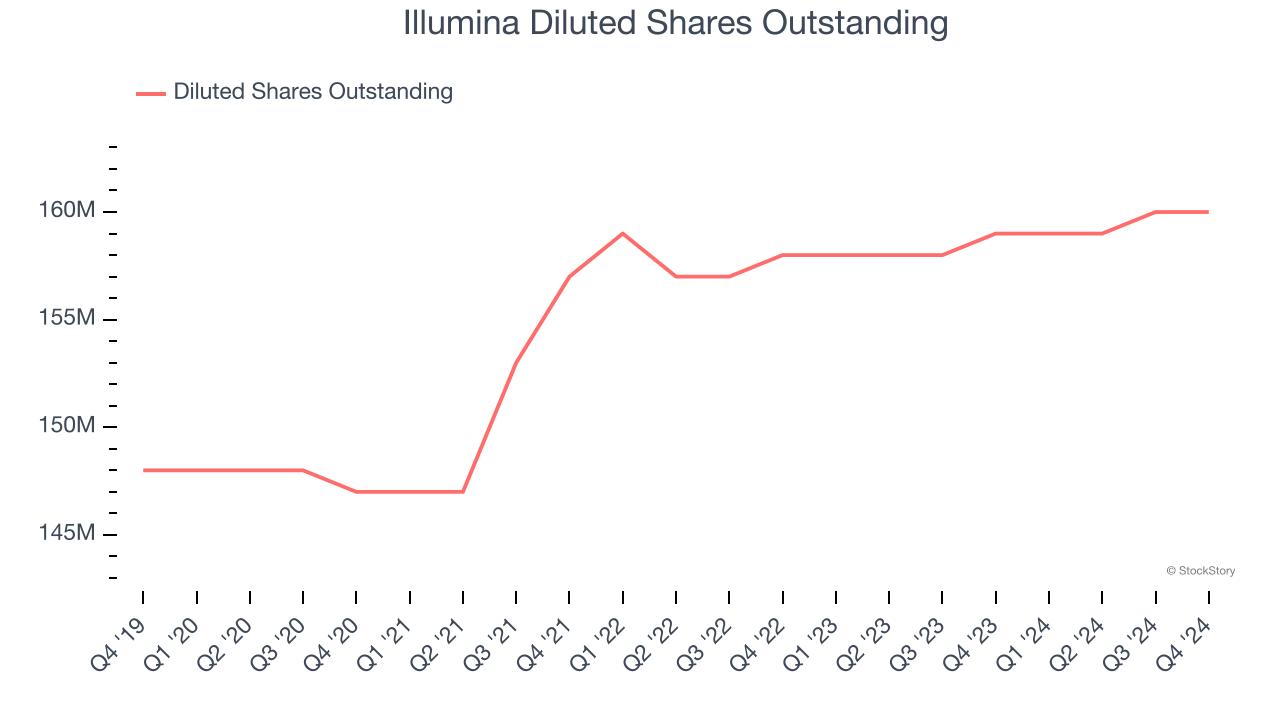

Sadly for Illumina, its EPS declined by 9.2% annually over the last five years while its revenue grew by 4.1%. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Illumina’s earnings to better understand the drivers of its performance. As we mentioned earlier, Illumina’s adjusted operating margin improved this quarter but declined by 2.1 percentage points over the last five years. Its share count also grew by 8.1%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Illumina reported EPS at $0.86, up from $0.14 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Illumina’s full-year EPS of $4.07 to grow 9%.

Key Takeaways from Illumina’s Q4 Results

We enjoyed seeing Illumina exceed analysts’ organic revenue expectations this quarter, where it broke its three-quarter streak of organic revenue declines. We were also glad its full-year EPS guidance outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance fell slightly short. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The areas below expectations seem to be driving the move, and the stock traded down 4.9% to $116.81 immediately following the results.

So should you invest in Illumina right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.