Well, that was fun … On the whole, we went nowhere this week but what an exciting time getting there. First we were down, now we are up but, in the end – we're nowhere and the longer-term trend is still down from 4,550 for the month on the S&P 500 while the Nasdaq is 500 points off the September high of 15,700 . Still, it's not much of a pullback and Q3 earnings are just around the corner and next week is a BIG data week with Durable Goods, Retail Inventories, Consumer Confidence, Q2 GDP (3rd Estimate), PMI, Personal Income & Spending and Consumer Sentiment. Non-Farm Payroll won't be out until the following Friday and the UK just had a big drop in Consumer Confidence which, of course, leading Economorons failed to project – so it's likely we get more of the same over here. We also have the very wide divergence of GDP expectations from the Atlanta Fed, who see Q3 around 3.5% while Leading Economorons are forecasting an AVERAGE of 8.5% (so some are higher than that). And those estimates have pretty much doubled in the past two weeks in what can only be explained by blatant manipulation in order to keep Consumers consuming and to keep Investors investing until the Banksters are able to fully cash out. What data have you seen in the past two weeks that added 3.5% to our GDP? Certainly the Fed hasn't seen it yet the usual assortment of crooked, lying and just plain incompetent "analysts" they consult with seem to think manna is faling from heaven all of a sudden. And maybe it is as Joe and Janet are working to give us another $3.5Tn and THAT would be a GDP booster, wouldn't it? Speaking of Janet Yellen – haven't we gone like a whole year without the Treasury Secretary making news? Isn't that kind of weird after 4 years of Mnuchin causing chaos every other day? In fact, you barely hear about Biden compared to Trump – probably still more about Trump, in fact… Of course, it's only $3.5Tn…

Well, that was fun…

Well, that was fun…

On the whole, we went nowhere this week but what an exciting time getting there. First we were down, now we are up but, in the end – we're nowhere and the longer-term trend is still down from 4,550 for the month on the S&P 500 while the Nasdaq is 500 points off the September high of 15,700.

Still, it's not much of a pullback and Q3 earnings are just around the corner and next week is a BIG data week with Durable Goods, Retail Inventories, Consumer Confidence, Q2 GDP (3rd Estimate), PMI, Personal Income & Spending and Consumer Sentiment. Non-Farm Payroll won't be out until the following Friday and the UK just had a big drop in Consumer Confidence which, of course, leading Economorons failed to project – so it's likely we get more of the same over here.

We also have the very wide divergence of GDP expectations from the Atlanta Fed, who see Q3 around 3.5% while Leading Economorons are forecasting an AVERAGE of 8.5% (so some are higher than that). And those estimates have pretty much doubled in the past two weeks in what can only be explained by blatant manipulation in order to keep Consumers consuming and to keep Investors investing until the Banksters are able to fully cash out.

We also have the very wide divergence of GDP expectations from the Atlanta Fed, who see Q3 around 3.5% while Leading Economorons are forecasting an AVERAGE of 8.5% (so some are higher than that). And those estimates have pretty much doubled in the past two weeks in what can only be explained by blatant manipulation in order to keep Consumers consuming and to keep Investors investing until the Banksters are able to fully cash out.

What data have you seen in the past two weeks that added 3.5% to our GDP? Certainly the Fed hasn't seen it yet the usual assortment of crooked, lying and just plain incompetent "analysts" they consult with seem to think manna is faling from heaven all of a sudden.

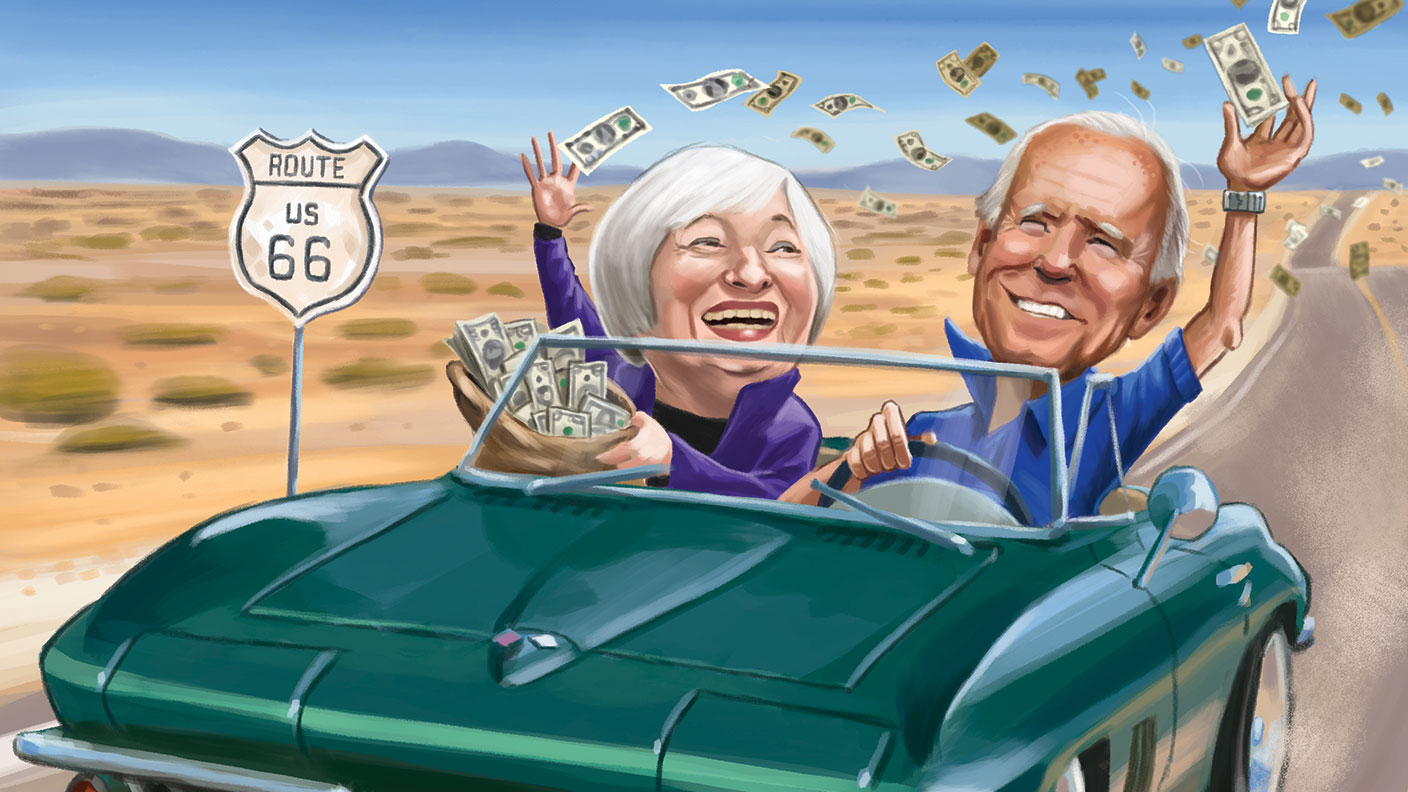

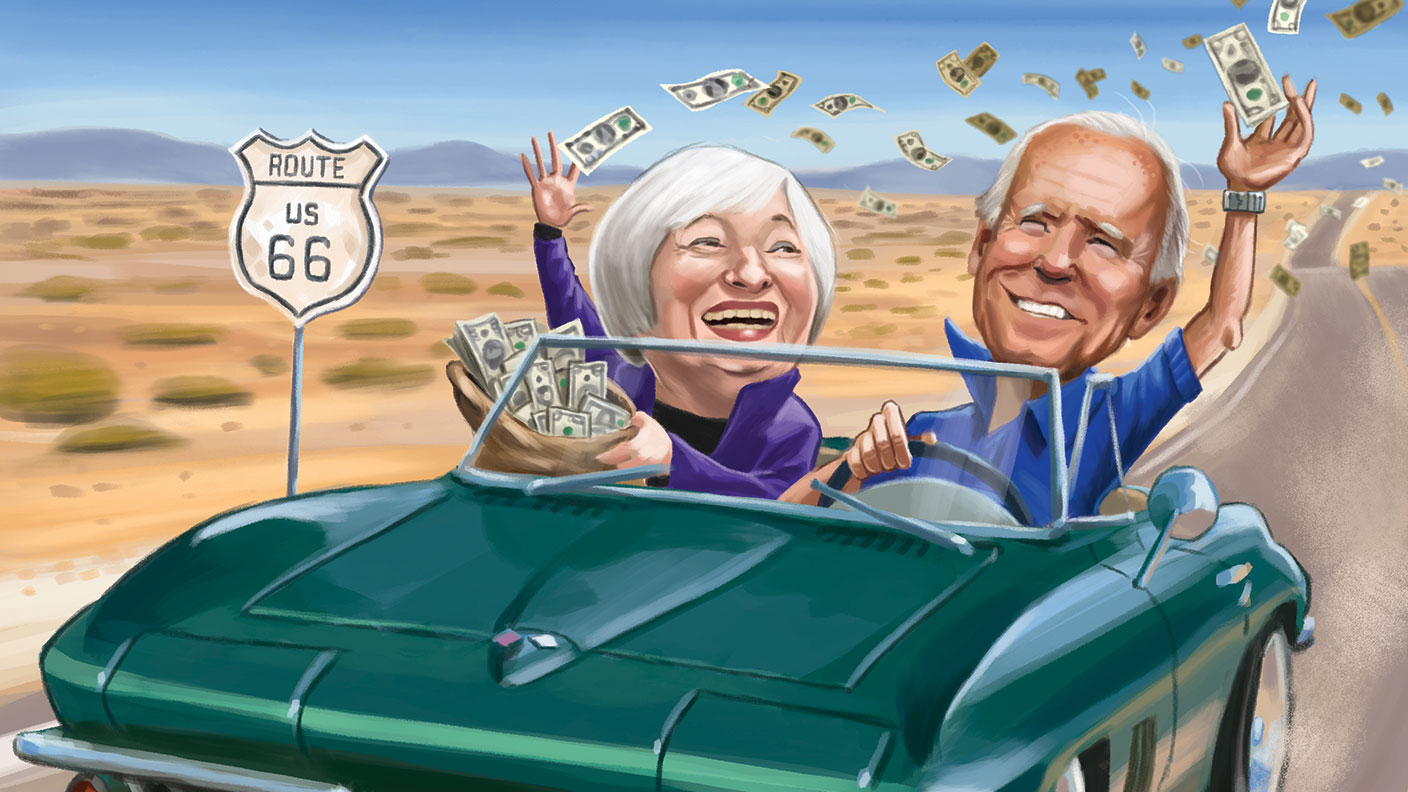

And maybe it is as Joe and Janet are working to give us another $3.5Tn and THAT would be a GDP booster, wouldn't it? Speaking of Janet Yellen – haven't we gone like a whole year without the Treasury Secretary making news? Isn't that kind of weird after 4 years of Mnuchin causing chaos every other day? In fact, you barely hear about Biden compared to Trump – probably still more about Trump, in fact…

And maybe it is as Joe and Janet are working to give us another $3.5Tn and THAT would be a GDP booster, wouldn't it? Speaking of Janet Yellen – haven't we gone like a whole year without the Treasury Secretary making news? Isn't that kind of weird after 4 years of Mnuchin causing chaos every other day? In fact, you barely hear about Biden compared to Trump – probably still more about Trump, in fact…

Of course, it's only $3.5Tn…

Well, that was fun…

Well, that was fun…  We also have the very wide divergence of GDP expectations from the Atlanta Fed, who see Q3 around 3.5% while Leading Economorons are forecasting an AVERAGE of 8.5% (so some are higher than that). And those estimates have pretty much doubled in the past two weeks in what can only be explained by blatant manipulation in order to keep Consumers consuming and to keep Investors investing until the Banksters are able to fully cash out.

We also have the very wide divergence of GDP expectations from the Atlanta Fed, who see Q3 around 3.5% while Leading Economorons are forecasting an AVERAGE of 8.5% (so some are higher than that). And those estimates have pretty much doubled in the past two weeks in what can only be explained by blatant manipulation in order to keep Consumers consuming and to keep Investors investing until the Banksters are able to fully cash out.  And maybe it is as Joe and Janet are working to give us another $3.5Tn and THAT would be a GDP booster, wouldn't it? Speaking of Janet Yellen – haven't we gone like a whole year without the Treasury Secretary making news? Isn't that kind of weird after 4 years of Mnuchin causing chaos every other day? In fact, you barely hear about Biden compared to Trump – probably still more about Trump, in fact…

And maybe it is as Joe and Janet are working to give us another $3.5Tn and THAT would be a GDP booster, wouldn't it? Speaking of Janet Yellen – haven't we gone like a whole year without the Treasury Secretary making news? Isn't that kind of weird after 4 years of Mnuchin causing chaos every other day? In fact, you barely hear about Biden compared to Trump – probably still more about Trump, in fact…