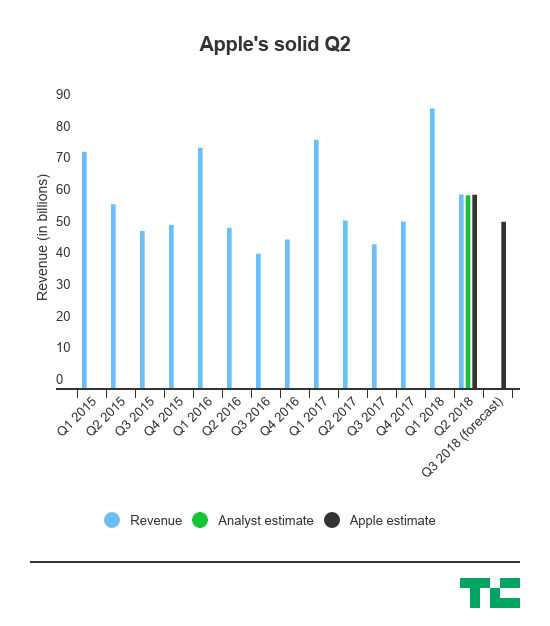

Apple ended up with a pretty decent report for its second quarter, beating analyst expectations on most of its metrics — but it is making a huge move in terms of returning capital to investors.

The company said it is announcing a new $100 billion buyback program and increasing its dividend by 16%. That means that Apple investors are going to get more of an opportunity to snap up the value the company has created over time as it’s continued to grow significantly. Not surprisingly, the stock is soaring (by Apple standards) in extended trading, with shares rising nearly 5% after the report.

Last quarter Apple CFO Luca Maestri said the company expected to be “net cash neutral” over time, signaling that it might start returning more capital to shareholders through its dividend and share buyback programs. That’ll be important for the company, which thanks to the tax bill last year will be able to repatriate a significant amount of the cash it holds outside of the U.S.

The rest of the line was a pretty solid beat on expectations Apple’s services revenue continues to grow as it looks to create a steady additional revenue stream. All that’s important too, of course, but the big news here is the set of buybacks. Here’s the bottom line:

- Q1 Revenue: $61.1 billion, compared to analyst estimates of $60.86 billion. Apple projected between $60 billion and $62 billion. It’s an increase of 14% year-over-year.

- Q1 Earnings: $2.73 per share, compared to analyst estimates of $2.60 per share.

- Q1 iPhone shipments: 52.2 million units sold, compared to Wall Street estimates of 51.9 million iPhones sold.

- Q1 iPad shipments: 9.1 million units

- Q1 Mac shipments: 4.1 million units

- Q1 Services revenue: $9.2 billion, up 31% year-over-year

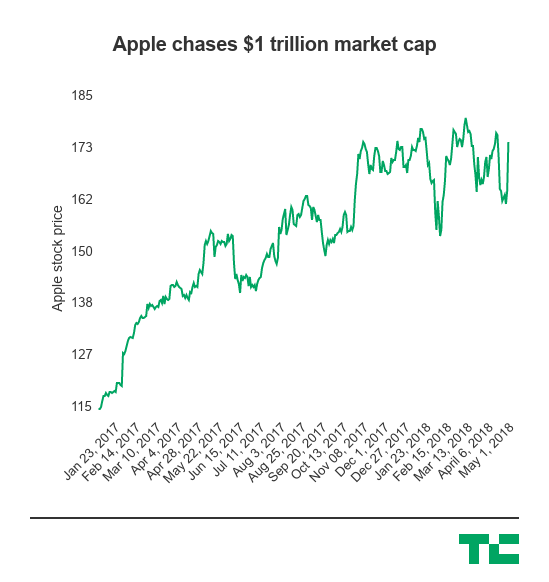

Toward the end of last year, it seemed like Apple was inching closer to being a company with a market cap over $1 trillion. That’s a completely symbolic number, but nonetheless would be a significant milestone for the iPhone maker that looks to figure out what a next-generation smartphone looks like. Apple’s stock has by no means been in a tailspin, but it hasn’t really done anything either as expectations start to drop a bit following the launch of the iPhone X.