Camden National Bank has been treading water for the past six months, recording a small return of 4.2% while holding steady at $45.11. The stock also fell short of the S&P 500’s 10.5% gain during that period.

Is now the time to buy Camden National Bank, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Camden National Bank Not Exciting?

We're swiping left on Camden National Bank for now. Here are three reasons why CAC doesn't excite us and a stock we'd rather own.

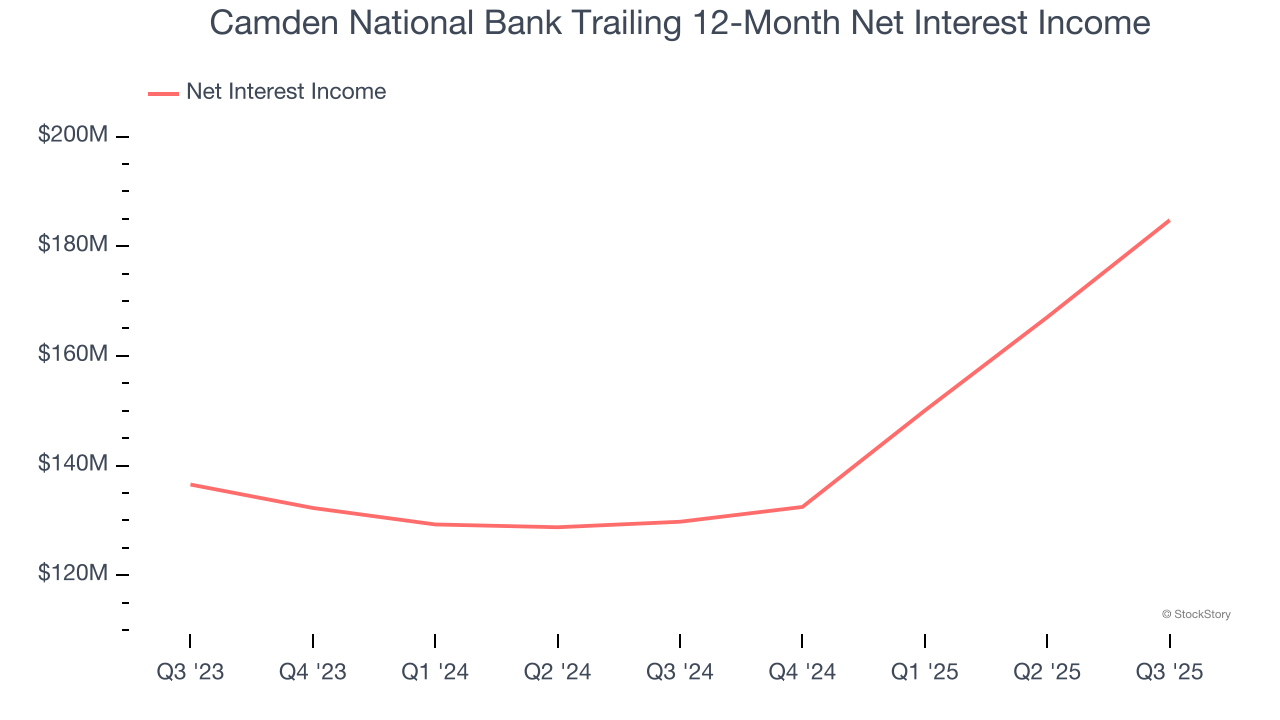

1. Net Interest Income Points to Soft Demand

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

Camden National Bank’s net interest income has grown at a 6.8% annualized rate over the last five years, worse than the broader banking industry. Its growth was driven by an increase in its outstanding loans as its net interest margin, which represents how much a bank earns in relation to its outstanding loan book, was flat throughout that period.

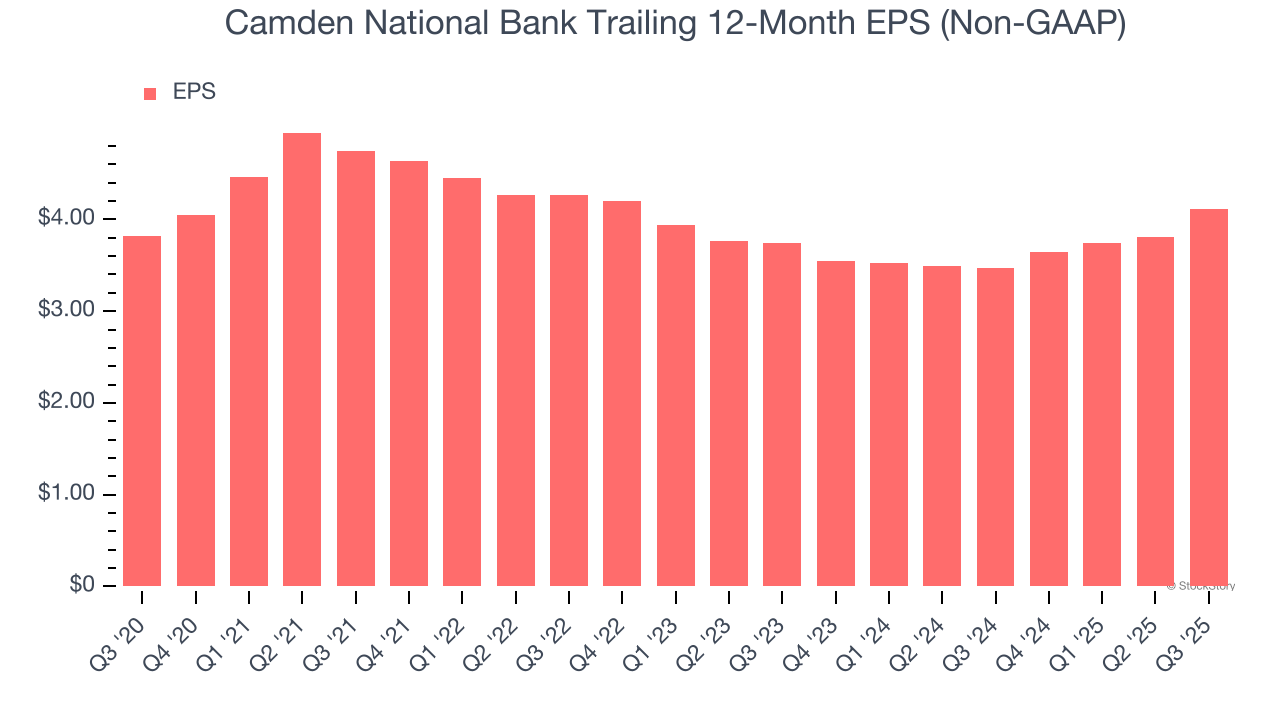

2. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Camden National Bank’s EPS grew at a weak 1.5% compounded annual growth rate over the last five years, lower than its 5.4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

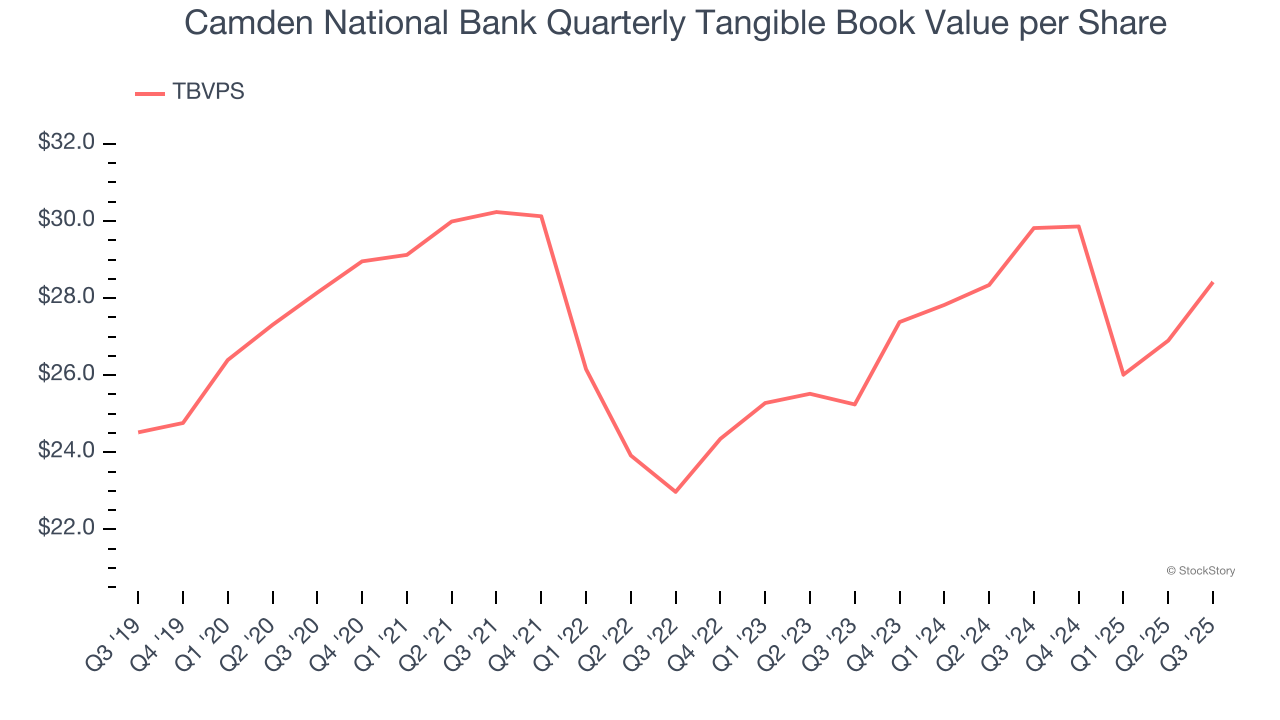

3. Substandard TBVPS Growth Indicates Limited Asset Expansion

Tangible book value per share (TBVPS) serves as a key indicator of a bank’s financial strength, representing the hard assets available to shareholders after removing intangible assets that could evaporate during financial distress.

Disappointingly for investors, Camden National Bank’s TBVPS grew at a tepid 6.1% annual clip over the last two years.

Final Judgment

Camden National Bank’s business quality ultimately falls short of our standards. With its shares lagging the market recently, the stock trades at 1.1× forward P/B (or $45.11 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere. We’d suggest looking at our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of Camden National Bank

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.