Visteon has been treading water for the past six months, recording a small loss of 4% while holding steady at $104.33. The stock also fell short of the S&P 500’s 10.5% gain during that period.

Given the weaker price action, is now a good time to buy VC? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does VC Stock Spark Debate?

Originally spun off from Ford Motor Company in 2000, Visteon (NYSE: VC) designs and manufactures cockpit electronics for vehicles, including digital instrument clusters, displays, infotainment systems, and battery management systems.

Two Positive Attributes:

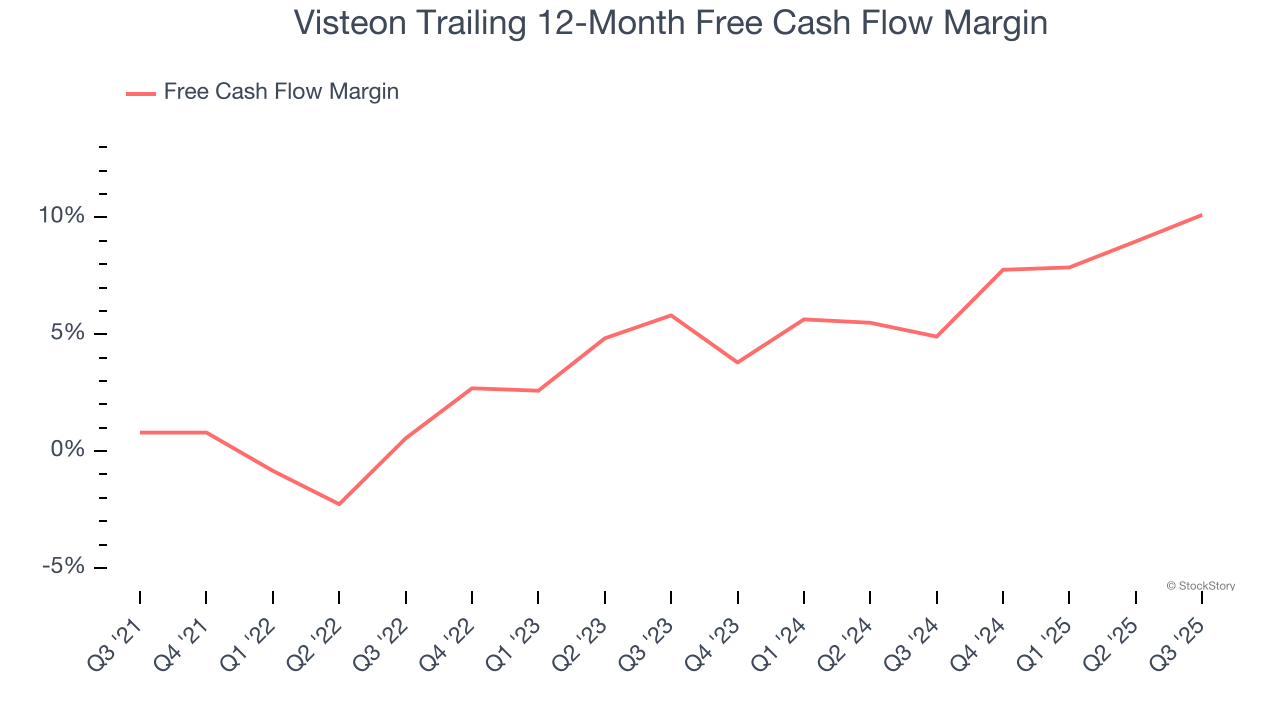

1. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Visteon’s margin expanded by 9.3 percentage points over the last five years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Visteon’s free cash flow margin for the trailing 12 months was 10.1%.

2. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Visteon’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

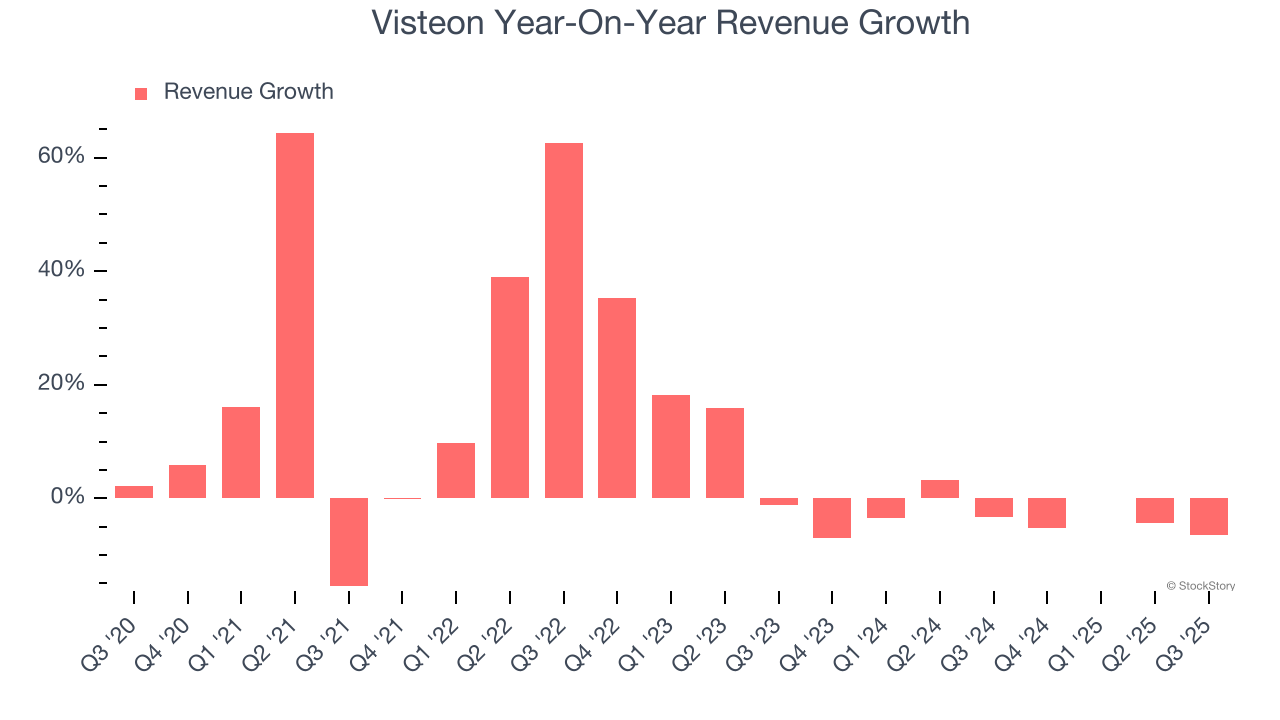

Revenue Tumbling Downwards

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Visteon’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.4% over the last two years. Visteon isn’t alone in its struggles as the Automobile Manufacturing industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

Final Judgment

Visteon has huge potential even though it has some open questions. With its shares lagging the market recently, the stock trades at 11.1× forward P/E (or $104.33 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Visteon

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.