Looking back on specialty finance stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Sixth Street Specialty Lending (NYSE: TSLX) and its peers.

Specialty finance companies provide targeted lending or financial services for specific industries or needs. They benefit from expertise in particular sectors, often reduced competition in specialized niches, and tailored underwriting that can yield higher margins. Challenges include concentration risk in specific industries, difficulty achieving scale efficiencies, and potential vulnerability during sector-specific downturns affecting their specialized markets.

The 10 specialty finance stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 5.8%.

Thankfully, share prices of the companies have been resilient as they are up 9.1% on average since the latest earnings results.

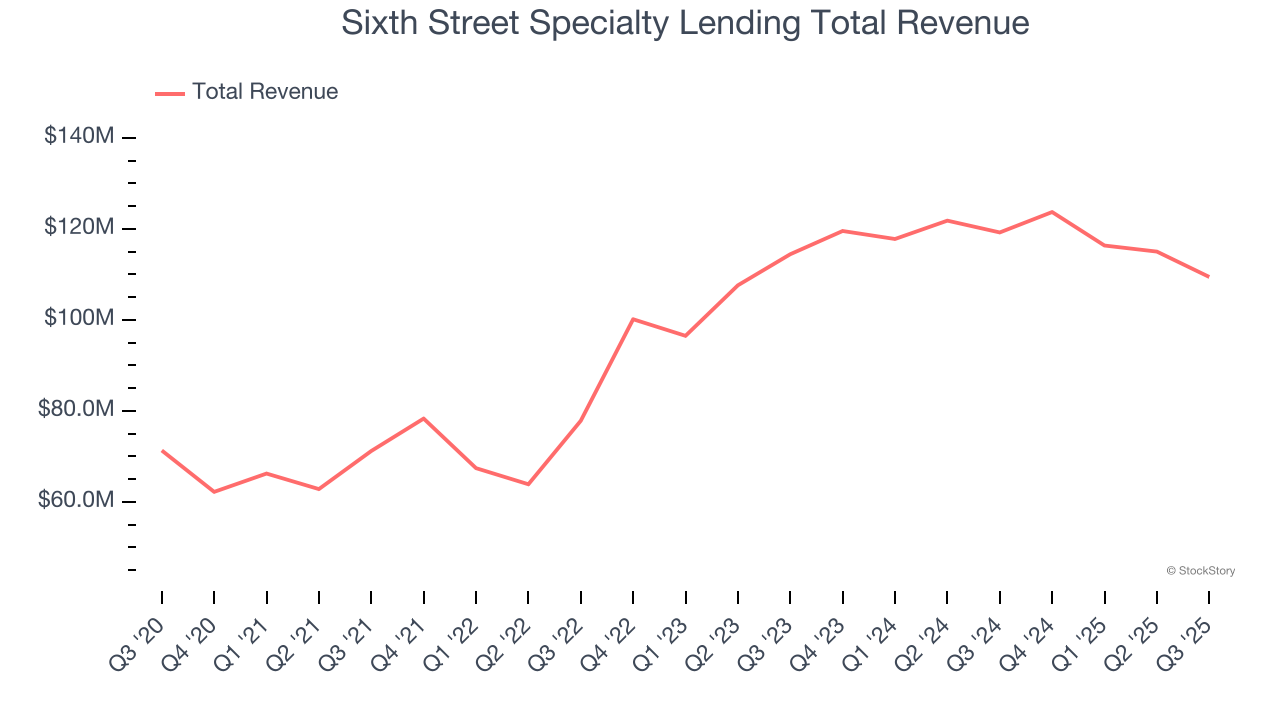

Sixth Street Specialty Lending (NYSE: TSLX)

Originally launched as TPG Specialty Lending before rebranding in 2020, Sixth Street Specialty Lending (NYSE: TSLX) is a business development company that provides customized financing solutions to middle-market companies across various industries.

Sixth Street Specialty Lending reported revenues of $109.4 million, down 8.2% year on year. This print fell short of analysts’ expectations by 30.5%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ revenue and EPS estimates.

The stock is down 1.8% since reporting and currently trades at $21.92.

Read our full report on Sixth Street Specialty Lending here, it’s free for active Edge members.

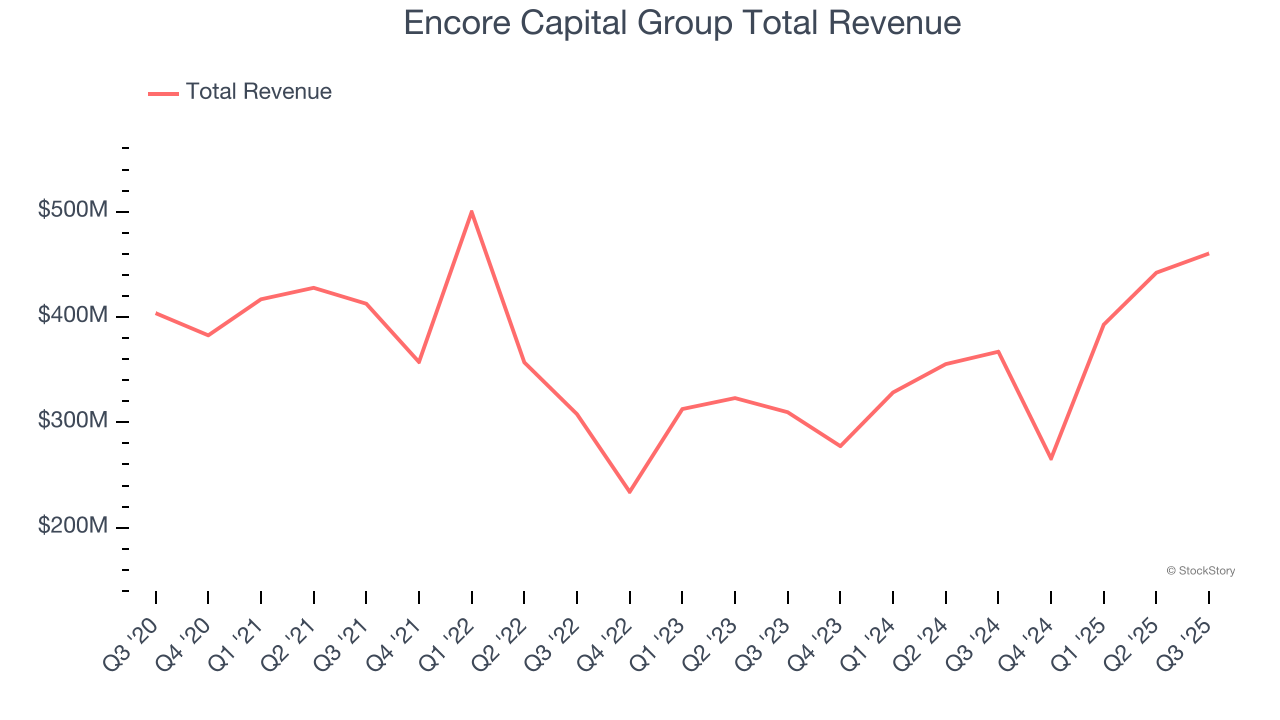

Best Q3: Encore Capital Group (NASDAQ: ECPG)

Operating in the often misunderstood world of debt collection since 1999, Encore Capital Group (NASDAQ: ECPG) purchases portfolios of defaulted consumer debt at deep discounts and works with individuals to recover these obligations while helping them toward financial recovery.

Encore Capital Group reported revenues of $460.4 million, up 25.4% year on year, outperforming analysts’ expectations by 11.9%. The business had an incredible quarter with a beat of analysts’ EPS and revenue estimates.

The market seems happy with the results as the stock is up 31.1% since reporting. It currently trades at $56.06.

Is now the time to buy Encore Capital Group? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: DigitalBridge (NYSE: DBRG)

Transforming from a traditional real estate investor to a digital-focused powerhouse in 2021, DigitalBridge Group (NYSE: DBRG) is a global digital infrastructure investment firm that manages capital and operates assets across data centers, cell towers, fiber networks, and edge infrastructure.

DigitalBridge reported revenues of $3.82 million, down 95% year on year, falling short of analysts’ expectations by 96.2%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and revenue estimates.

DigitalBridge delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 20.8% since the results and currently trades at $15.34.

Read our full analysis of DigitalBridge’s results here.

PROG (NYSE: PRG)

Evolving from its origins as Aaron's, Inc. before rebranding in 2020, PROG Holdings (NYSE: PRG) provides alternative payment solutions including lease-to-own options and second-look credit products for consumers who may not qualify for traditional financing.

PROG reported revenues of $595.1 million, down 1.8% year on year. This result topped analysts’ expectations by 1.5%. It was a strong quarter as it also produced a beat of analysts’ EPS and EBITDA estimates.

The stock is down 7.1% since reporting and currently trades at $30.40.

Read our full, actionable report on PROG here, it’s free for active Edge members.

Farmer Mac (NYSE: AGM)

Created by Congress in 1987 to build a bridge between Wall Street and rural America, Farmer Mac (NYSE: AGM) provides a secondary market for agricultural and rural loans, helping lenders increase their liquidity and lending capacity to serve rural America.

Farmer Mac reported revenues of $94.96 million, up 11.1% year on year. This print lagged analysts' expectations by 6%. Overall, it was a softer quarter as it also produced a significant miss of analysts’ revenue estimates.

The stock is up 11.5% since reporting and currently trades at $176.36.

Read our full, actionable report on Farmer Mac here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.