As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the specialized consumer services industry, including ADT (NYSE: ADT) and its peers.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

While some specialized consumer services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.7% since the latest earnings results.

ADT (NYSE: ADT)

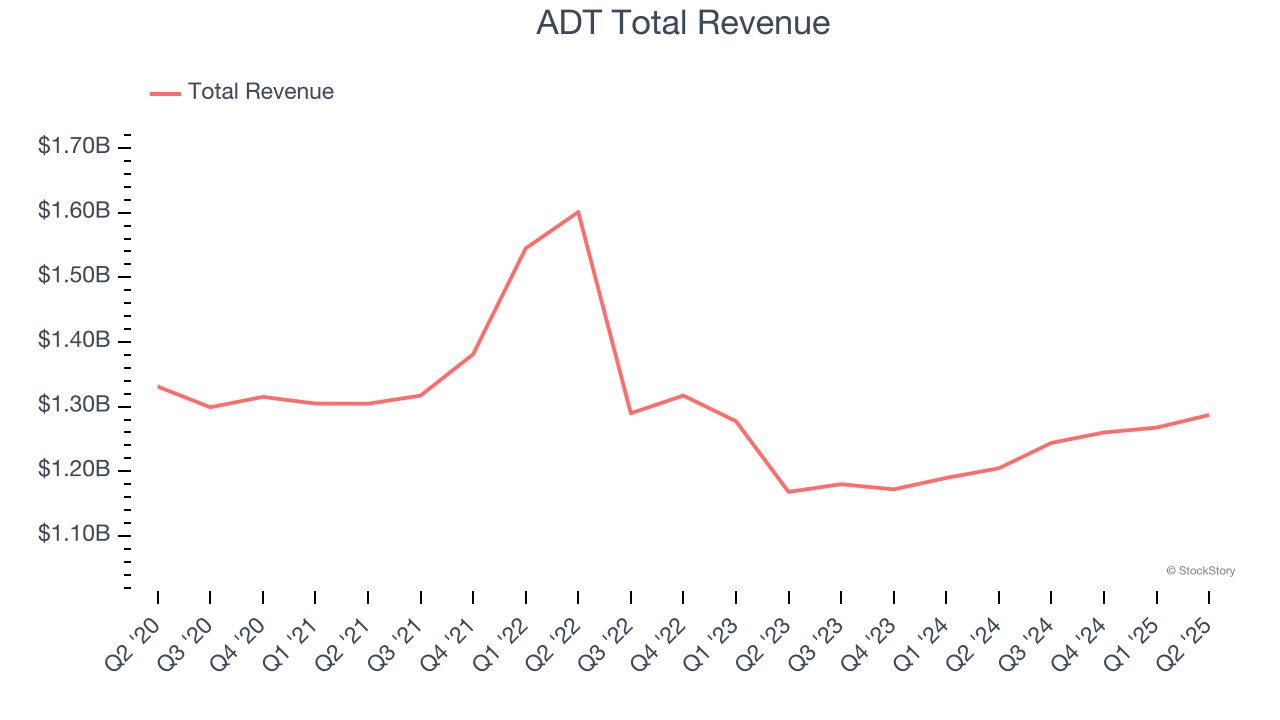

Founded in 1874 and headquartered in Boca Raton, Florida, ADT (NYSE: ADT) is a provider of security, automation, and smart home solutions, offering comprehensive services for home and business protection.

ADT reported revenues of $1.29 billion, up 6.8% year on year. This print exceeded analysts’ expectations by 0.9%. Despite the top-line beat, it was still a mixed quarter for the company with a beat of analysts’ EPS estimates but full-year revenue guidance meeting analysts’ expectations.

“ADT delivered another strong quarter, highlighted by record recurring monthly revenue, robust cash flow generation, and strong earnings per share growth. These results reflect the resilience of our business and effective execution of our strategy,” said ADT Chairman, President and CEO, Jim DeVries.

Interestingly, the stock is up 3.6% since reporting and currently trades at $8.73.

Is now the time to buy ADT? Access our full analysis of the earnings results here, it’s free.

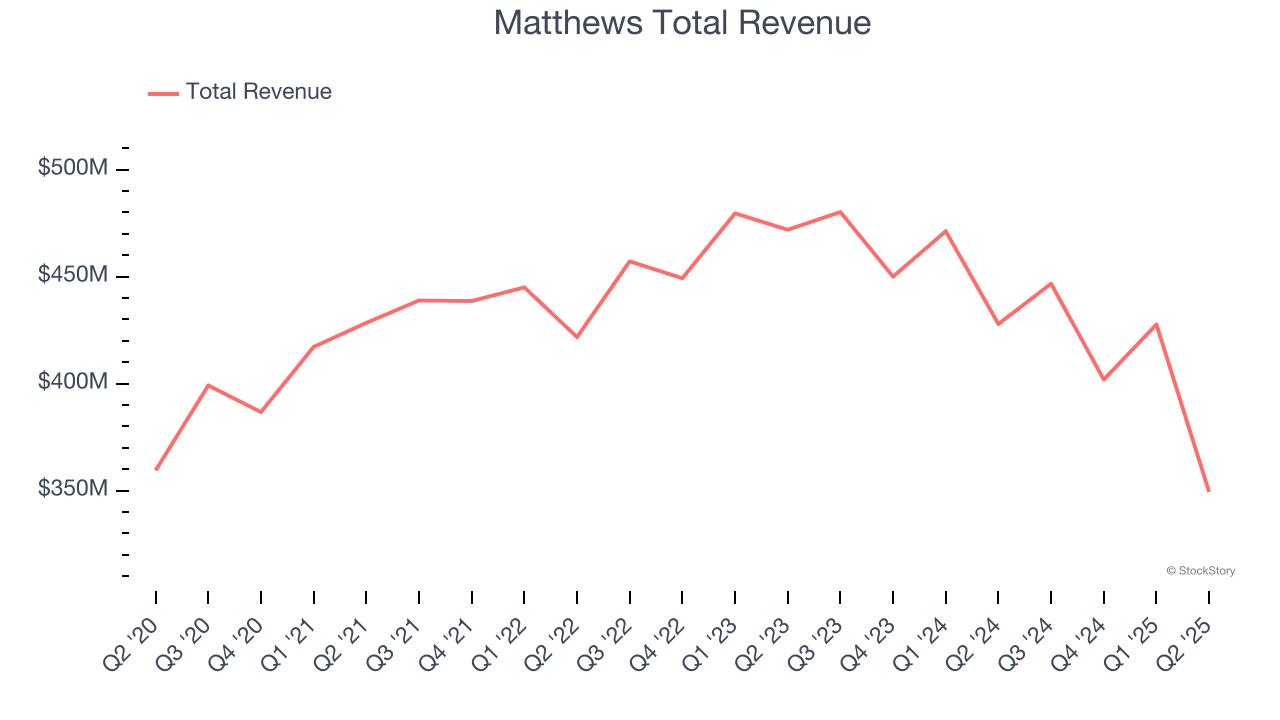

Best Q2: Matthews (NASDAQ: MATW)

Originally a death care company, Matthews International (NASDAQ: MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Matthews reported revenues of $349.4 million, down 18.3% year on year, outperforming analysts’ expectations by 8.5%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and full-year EBITDA guidance beating analysts’ expectations.

Matthews delivered the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 3.4% since reporting. It currently trades at $24.89.

Is now the time to buy Matthews? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: LKQ (NASDAQ: LKQ)

A global distributor of vehicle parts and accessories, LKQ (NASDAQ: LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

LKQ reported revenues of $3.64 billion, down 1.9% year on year, in line with analysts’ expectations. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 16.3% since the results and currently trades at $32.34.

Read our full analysis of LKQ’s results here.

WeightWatchers (NASDAQ: WW)

Known by many for its old cable television commercials, WeightWatchers (NASDAQ: WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

WeightWatchers reported revenues of $189.2 million, down 6.4% year on year. This print surpassed analysts’ expectations by 6.2%. Overall, it was a very strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

WeightWatchers had the weakest full-year guidance update among its peers. The stock is down 15.1% since reporting and currently trades at $32.35.

Read our full, actionable report on WeightWatchers here, it’s free.

H&R Block (NYSE: HRB)

Founded in 1955 by brothers Henry W. Bloch and Richard A. Bloch, H&R Block (NYSE: HRB) is a tax preparation company offering professional tax assistance and financial solutions to individuals and small businesses.

H&R Block reported revenues of $1.11 billion, up 4.6% year on year. This number topped analysts’ expectations by 1.6%. More broadly, it was a mixed quarter as it also logged full-year revenue guidance beating analysts’ expectations but .

The stock is flat since reporting and currently trades at $51.37.

Read our full, actionable report on H&R Block here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.