As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at transportation and logistics stocks, starting with Union Pacific (NYSE: UNP).

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for transportation and logistics companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Companies that win in this space boast speed, reach, reliability, and last-mile efficiency while those who do not see their market shares diminish. Like other industrials companies, transportation and logistics companies are at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs influence profit margins.

The 30 transportation and logistics stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was 0.9% below.

While some transportation and logistics stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.4% since the latest earnings results.

Union Pacific (NYSE: UNP)

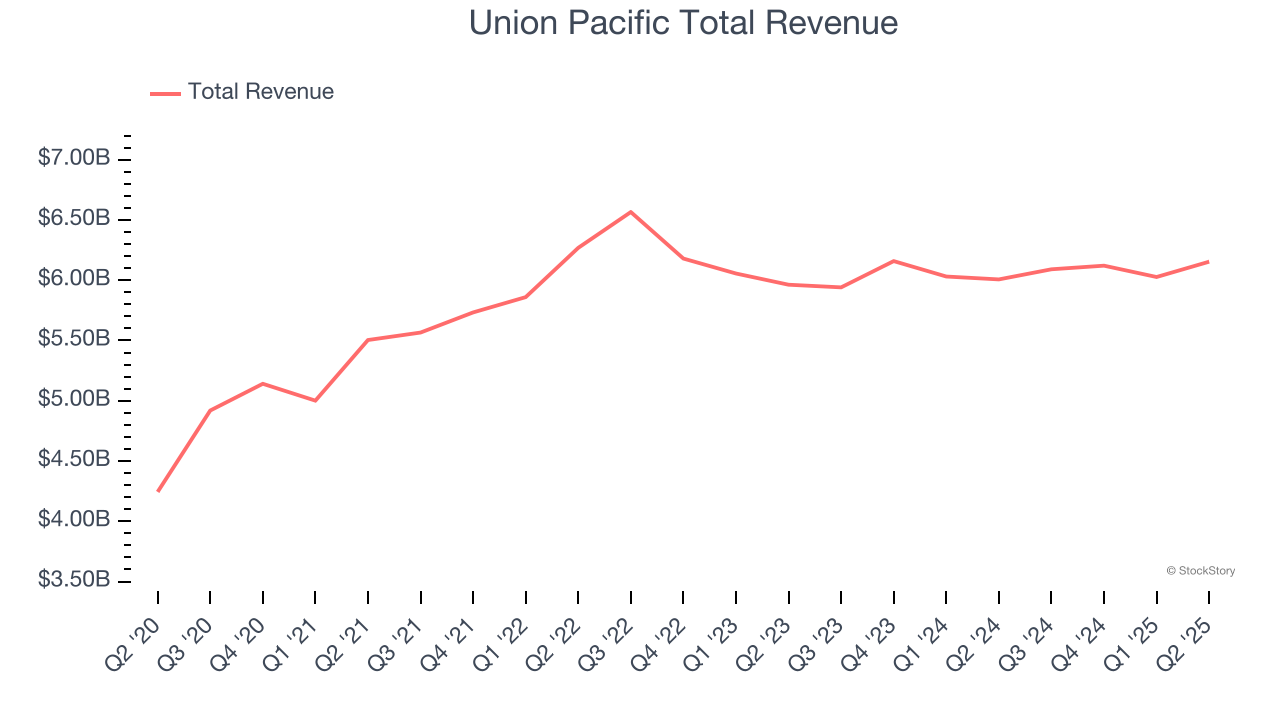

Part of the transcontinental railroad project, Union Pacific (NYSE: UNP) is a freight transportation company that operates a major railroad network.

Union Pacific reported revenues of $6.15 billion, up 2.4% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a decent beat of analysts’ adjusted operating income estimates.

Unsurprisingly, the stock is down 3.9% since reporting and currently trades at $222.10.

Is now the time to buy Union Pacific? Access our full analysis of the earnings results here, it’s free.

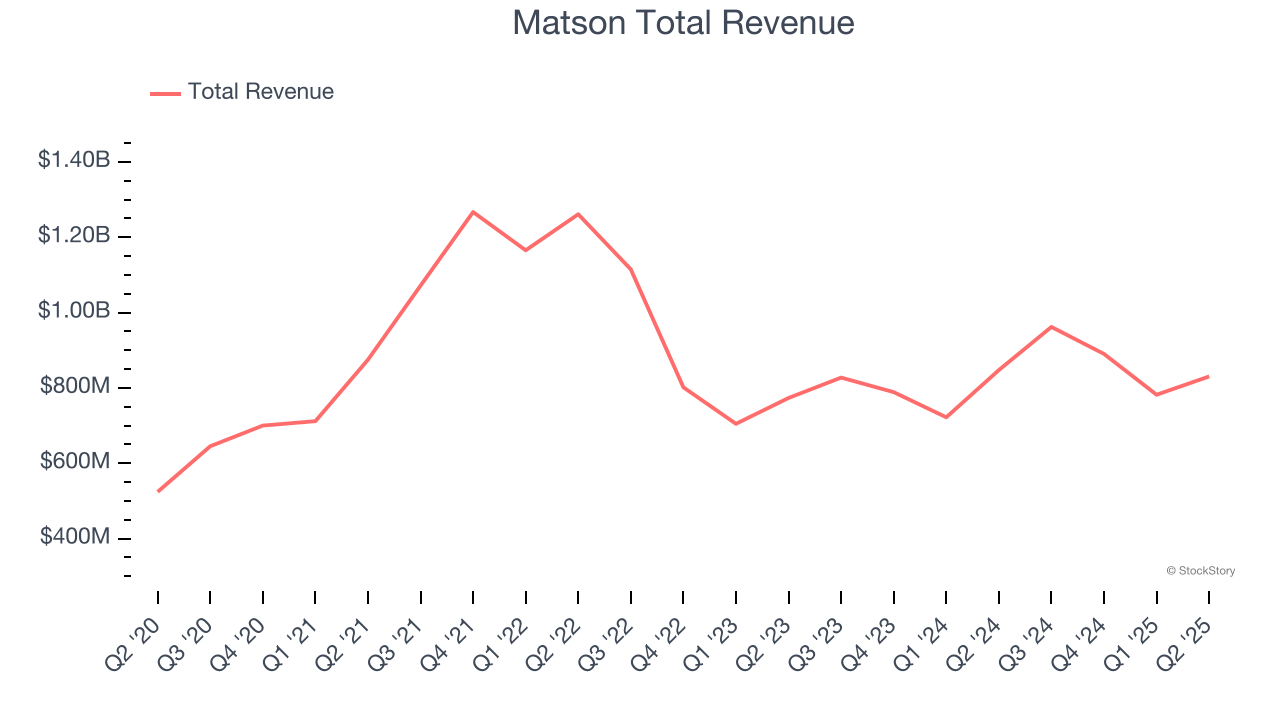

Best Q2: Matson (NYSE: MATX)

Founded by a Swedish orphan, Matson (NYSE: MATX) is a provider of ocean transportation and logistics services.

Matson reported revenues of $830.5 million, down 2% year on year, outperforming analysts’ expectations by 2.6%. The business had a stunning quarter with a beat of analysts’ EPS and EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.4% since reporting. It currently trades at $104.33.

Is now the time to buy Matson? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Heartland Express (NASDAQ: HTLD)

Founded by the son of a trucker, Heartland Express (NASDAQ: HTLD) offers full-truckload deliveries across the United States and Mexico.

Heartland Express reported revenues of $210.4 million, down 23.4% year on year, falling short of analysts’ expectations by 10.4%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

Heartland Express delivered the weakest performance against analyst estimates in the group. The stock is flat since the results and currently trades at $8.63.

Read our full analysis of Heartland Express’s results here.

Covenant Logistics (NYSE: CVLG)

Started with 25 trucks and 50 trailers, Covenant Logistics (NASDAQ: CVLG) is a provider of expedited long haul freight services, offering a range of logistics solutions.

Covenant Logistics reported revenues of $302.9 million, up 5.3% year on year. This print topped analysts’ expectations by 3.7%. It was a strong quarter as it also recorded an impressive beat of analysts’ Freight revenue estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 1.5% since reporting and currently trades at $24.03.

Read our full, actionable report on Covenant Logistics here, it’s free.

FedEx (NYSE: FDX)

Sporting one of the largest air cargo fleets in the world, FedEx (NYSE: FDX) is a global provider of parcel and cargo delivery services.

FedEx reported revenues of $22.22 billion, flat year on year. This number beat analysts’ expectations by 1.9%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ adjusted operating income estimates and a decent beat of analysts’ EBITDA estimates.

The stock is down 2.3% since reporting and currently trades at $224.

Read our full, actionable report on FedEx here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.