AI-powered lending platform Upstart (NASDAQ: UPST) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 102% year on year to $257.3 million. On top of that, next quarter’s revenue guidance ($280 million at the midpoint) was surprisingly good and 3.9% above what analysts were expecting. Its non-GAAP profit of $0.36 per share was 41.6% above analysts’ consensus estimates.

Is now the time to buy Upstart? Find out by accessing our full research report, it’s free.

Upstart (UPST) Q2 CY2025 Highlights:

- Revenue: $257.3 million vs analyst estimates of $226.5 million (102% year-on-year growth, 13.6% beat)

- Adjusted EPS: $0.36 vs analyst estimates of $0.25 (41.6% beat)

- Adjusted EBITDA: $53.05 million vs analyst estimates of $37.02 million (20.6% margin, 43.3% beat)

- The company lifted its revenue guidance for the full year to $1.06 billion at the midpoint from $1.01 billion, a 4.5% increase

- EBITDA guidance for Q3 CY2025 is $56 million at the midpoint, above analyst estimates of $52.64 million

- Operating Margin: 1.8%, up from -43.5% in the same quarter last year

- Free Cash Flow was -$112.7 million compared to -$31.45 million in the previous quarter

- Market Capitalization: $7.88 billion

“A year ago, you saw the first signs that Upstart was returning to growth mode - and today you can see it in full bloom,” said Dave Girouard, Co-founder and CEO of Upstart.

Company Overview

Founded by the former head of Google's enterprise business, Upstart (NASDAQ: UPST) is an AI-powered lending platform facilitating loans for banks and consumers.

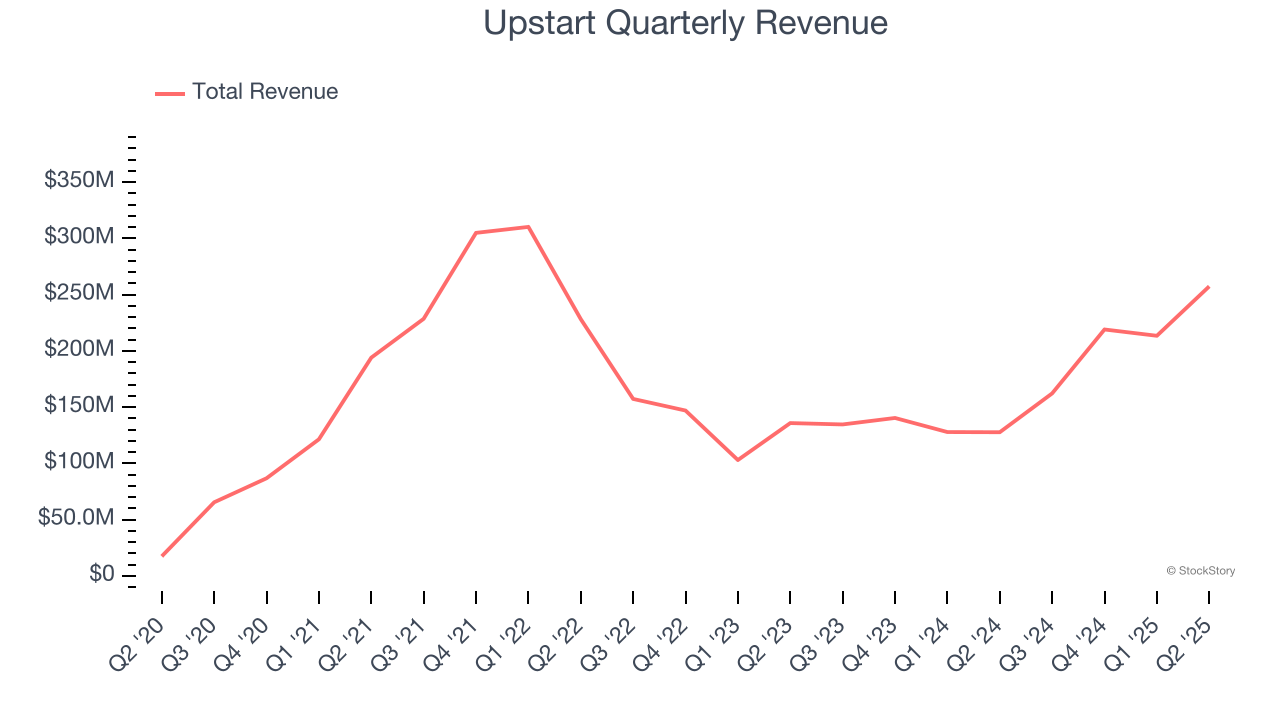

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Upstart’s demand was weak over the last three years as its sales fell at a 7.4% annual rate. This wasn’t a great result and is a rough starting point for our analysis.

This quarter, Upstart reported magnificent year-on-year revenue growth of 102%, and its $257.3 million of revenue beat Wall Street’s estimates by 13.6%. Company management is currently guiding for a 72.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 35.6% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping and indicates its newer products and services will catalyze better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

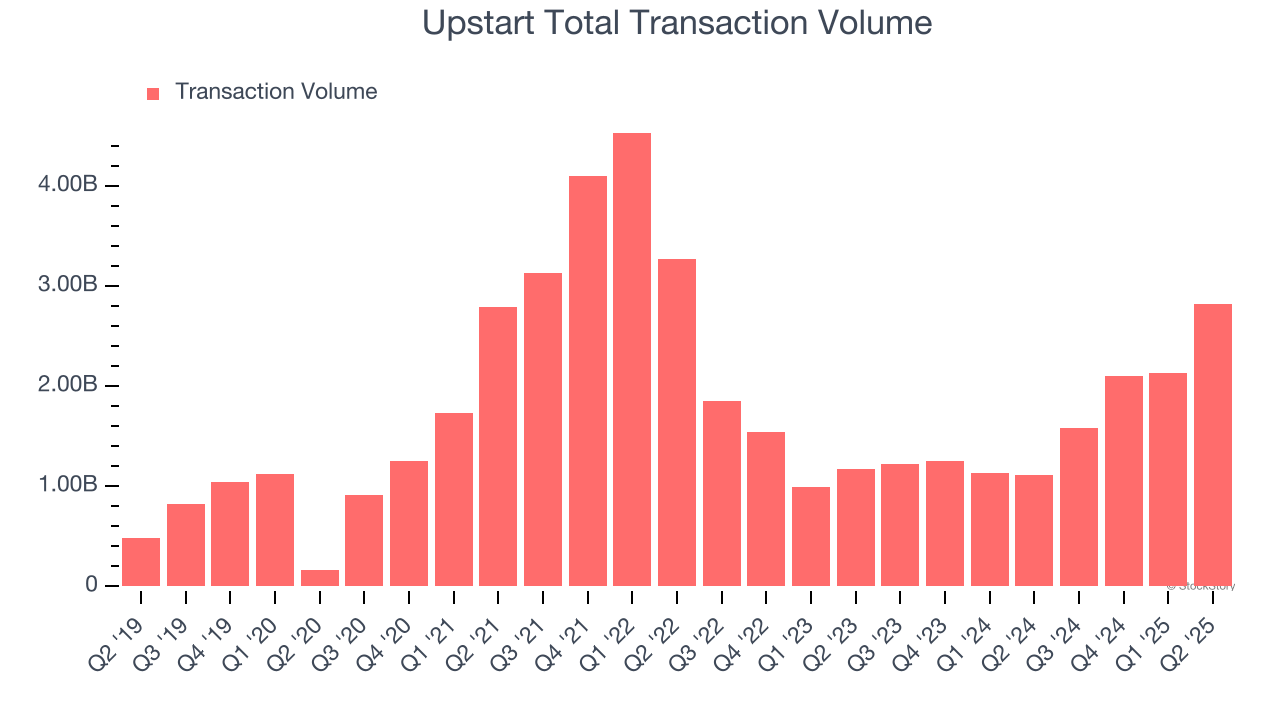

Total Transaction Volume

Total transaction volumes show the aggregate dollar value of loans processed on Upstart’s platform. This is the number from which the company will ultimately collect fees, and the higher it is, the more accurate its software becomes at assessing credit risk.

Upstart’s transaction volume punched in at $2.82 billion in Q2, and over the last four quarters, its growth was fantastic as it averaged 85.2% year-on-year increases. This alternate topline metric grew faster than total sales, meaning its loan processing fees outpaced the interest income from loans retained on its balance sheet. If this trend continues, it would lower Upstart’s risk profile as it would reduce its exposure to delinquencies and defaults.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Upstart’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

Key Takeaways from Upstart’s Q2 Results

We were impressed by Upstart’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 10.9% to $73.70 immediately following the results.

Big picture, is Upstart a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.