Healthcare diagnostics company QuidelOrtho (NASDAQ: QDEL) met Wall Street’s revenue expectations in Q2 CY2025, but sales fell by 3.6% year on year to $613.9 million. On the other hand, the company’s full-year revenue guidance of $2.71 billion at the midpoint came in 0.5% below analysts’ estimates. Its non-GAAP profit of $0.12 per share was significantly above analysts’ consensus estimates.

Is now the time to buy QuidelOrtho? Find out by accessing our full research report, it’s free.

QuidelOrtho (QDEL) Q2 CY2025 Highlights:

- Revenue: $613.9 million vs analyst estimates of $611 million (3.6% year-on-year decline, in line)

- Adjusted EPS: $0.12 vs analyst estimates of $0.01 (significant beat)

- Adjusted EBITDA: $106.8 million vs analyst estimates of $95.86 million (17.4% margin, 11.4% beat)

- The company reconfirmed its revenue guidance for the full year of $2.71 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $2.32 at the midpoint

- EBITDA guidance for the full year is $595 million at the midpoint, in line with analyst expectations

- Operating Margin: -29.4%, down from -18.4% in the same quarter last year

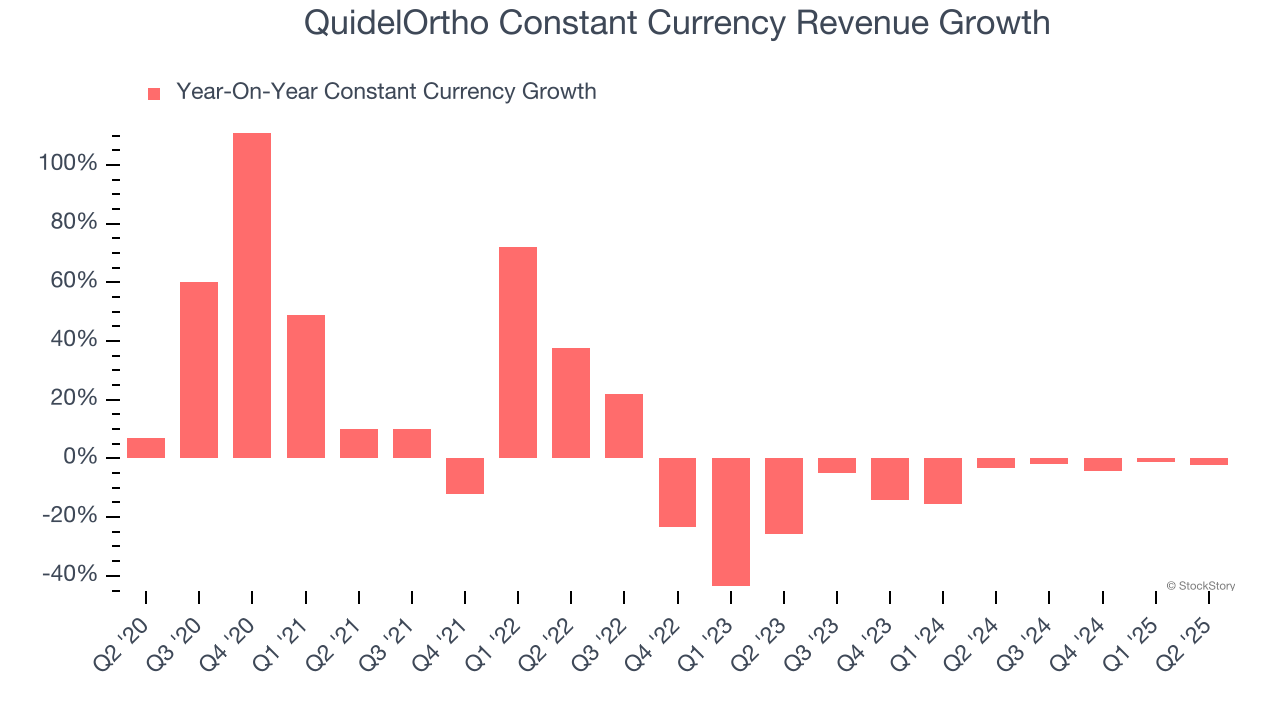

- Constant Currency Revenue fell 2.4% year on year, in line with the same quarter last year

- Market Capitalization: $1.63 billion

"Our second quarter results demonstrate our continuing commitment to commercial and operational execution," said Brian J. Blaser, President and Chief Executive Officer, QuidelOrtho.

Company Overview

Born from the 2022 merger of Quidel and Ortho Clinical Diagnostics, QuidelOrtho (NASDAQ: QDEL) develops and manufactures diagnostic testing solutions for healthcare providers, from rapid point-of-care tests to complex laboratory instruments and systems.

Revenue Growth

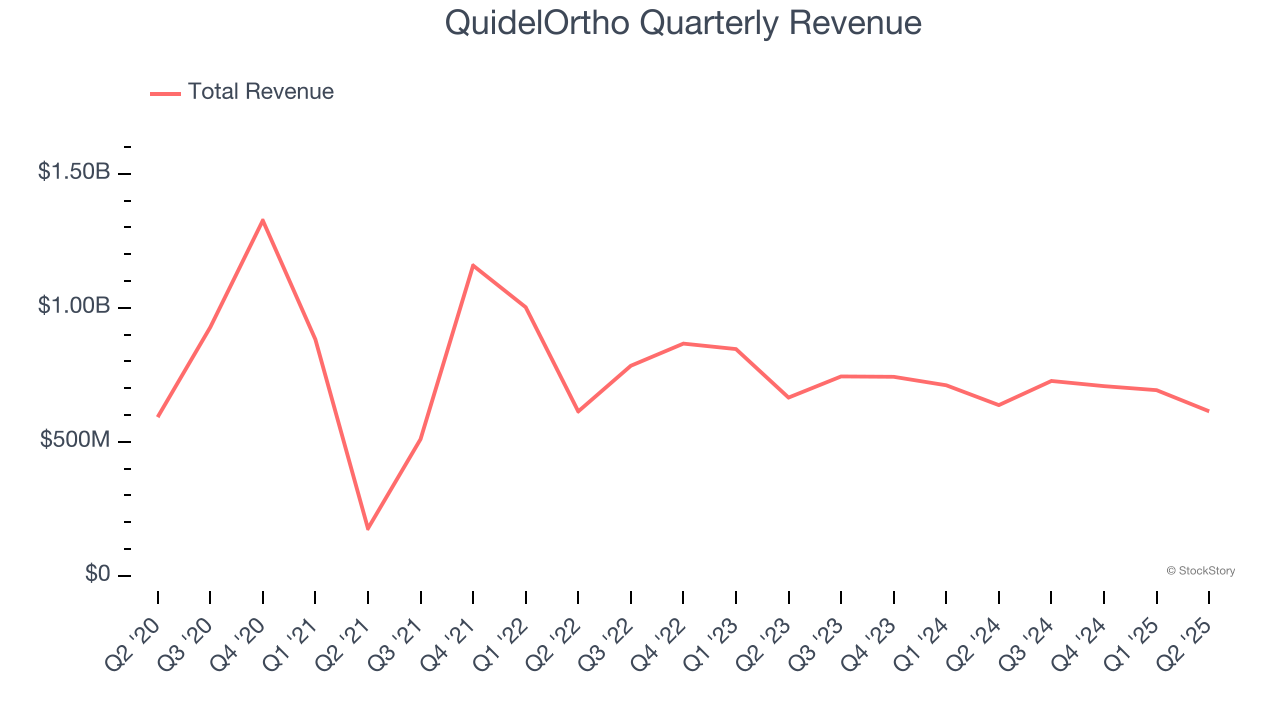

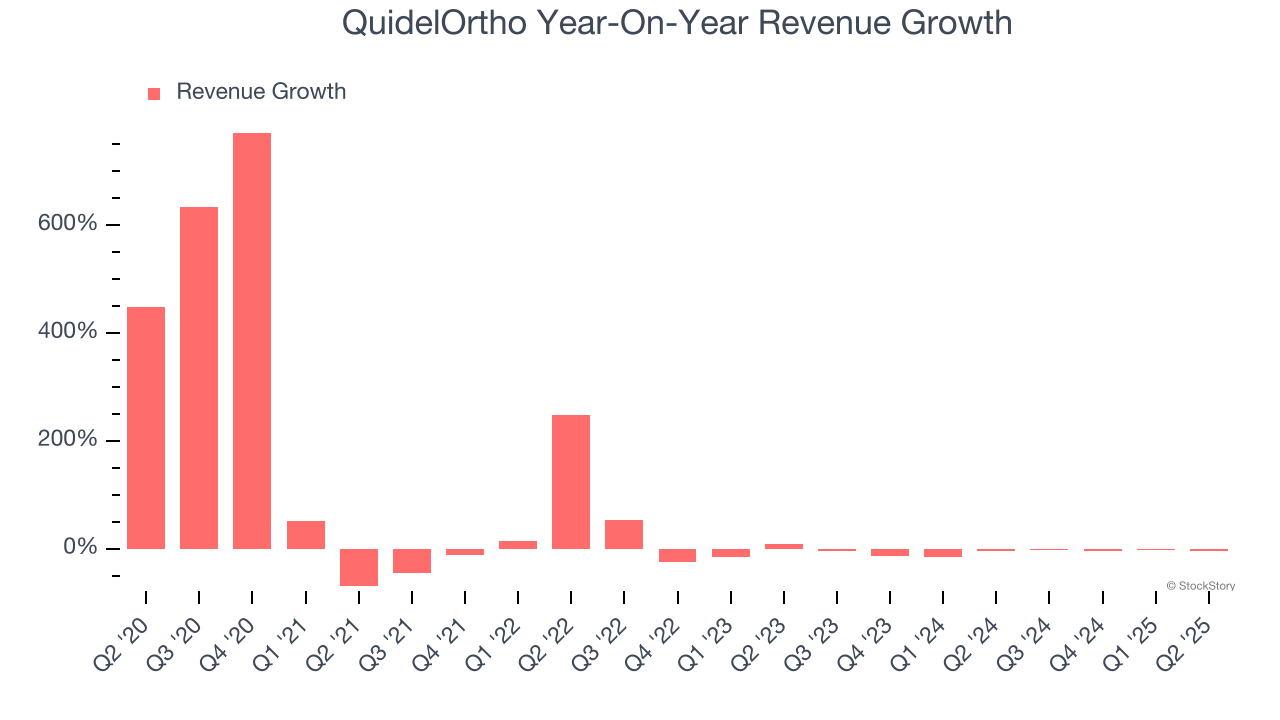

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, QuidelOrtho grew its sales at a solid 13.5% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. QuidelOrtho’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 6.9% over the last two years.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 6% year-on-year declines. Because this number aligns with its normal revenue growth, we can see that QuidelOrtho has properly hedged its foreign currency exposure.

This quarter, QuidelOrtho reported a rather uninspiring 3.6% year-on-year revenue decline to $613.9 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.1% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

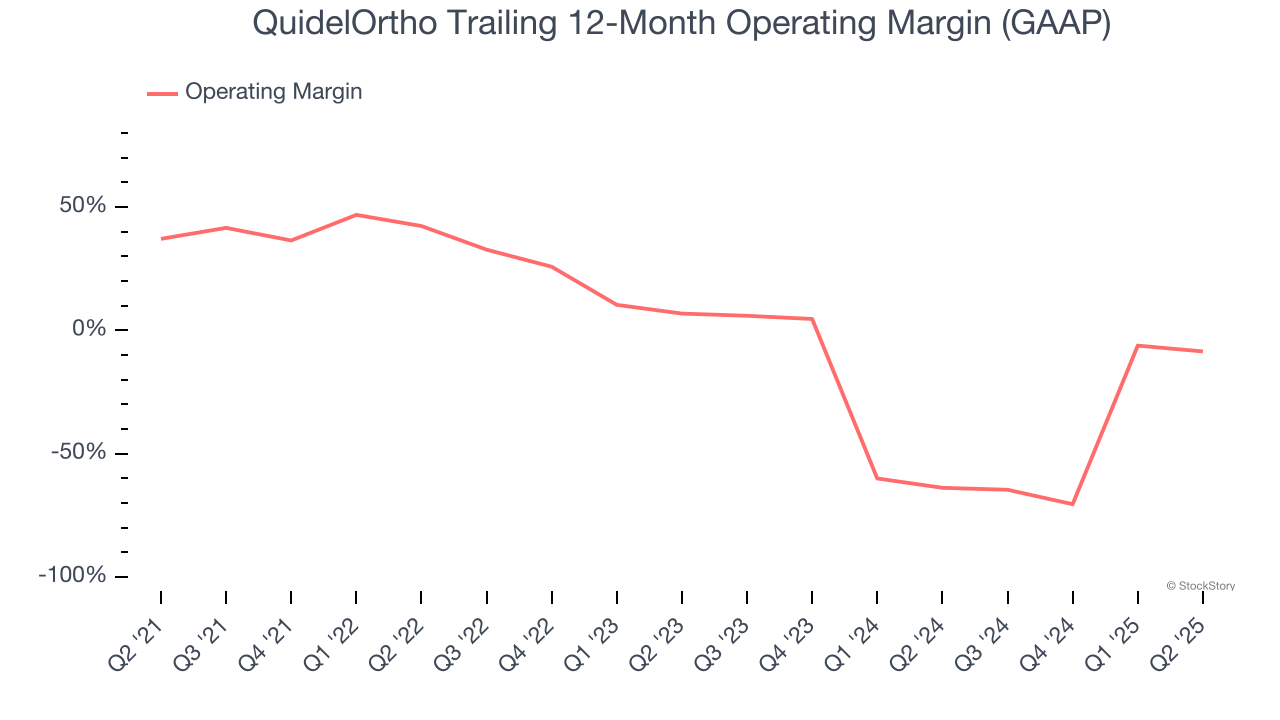

Operating Margin

QuidelOrtho was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.2% was weak for a healthcare business.

Looking at the trend in its profitability, QuidelOrtho’s operating margin decreased by 45.7 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 15.3 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q2, QuidelOrtho generated an operating margin profit margin of negative 29.4%, down 11 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

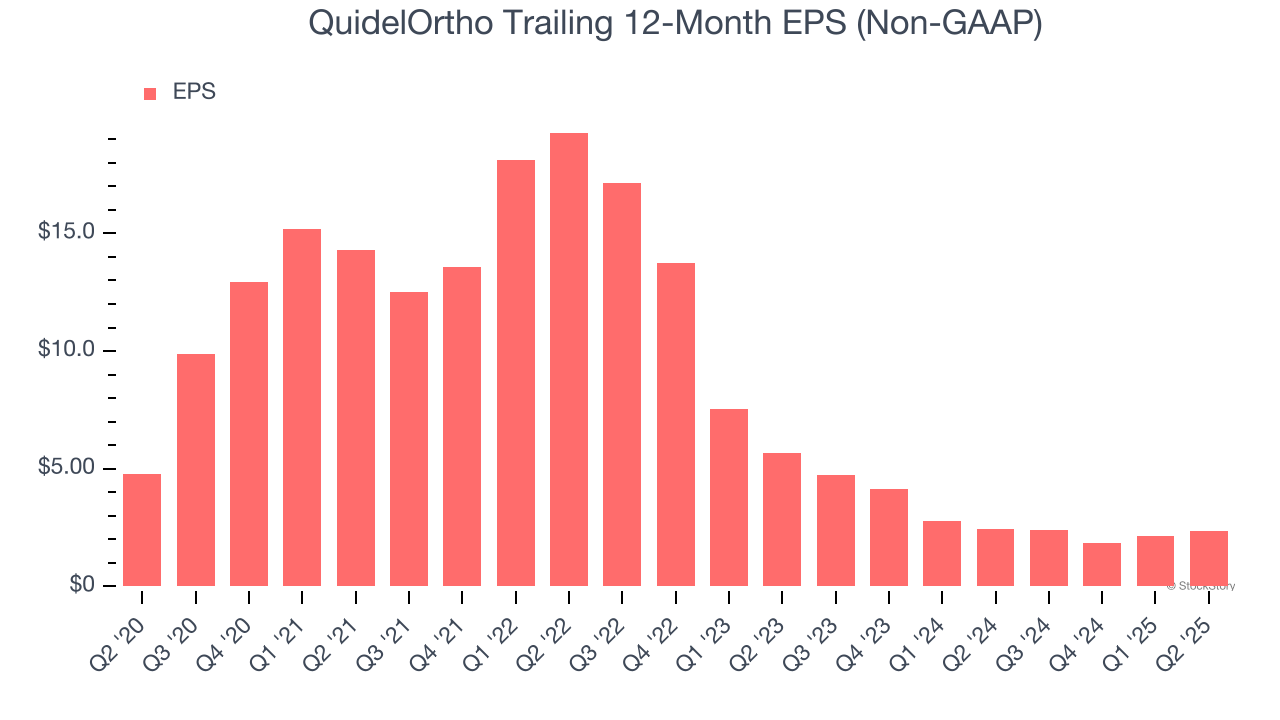

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

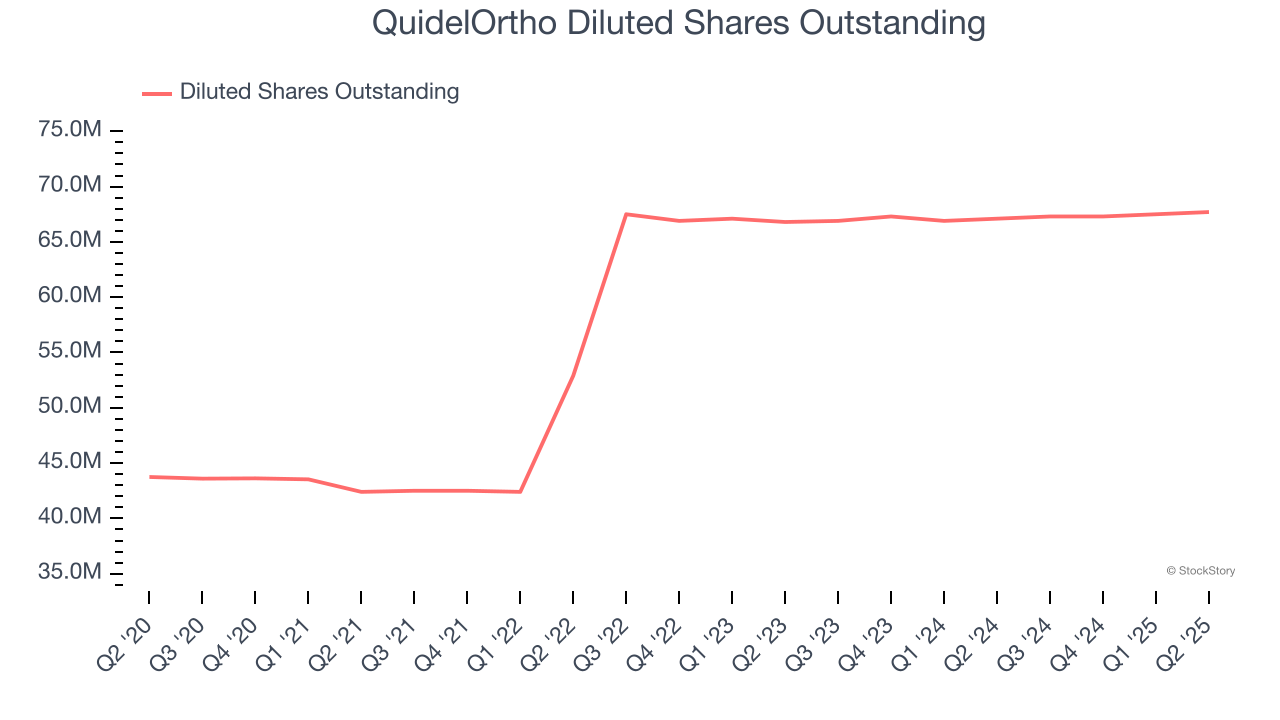

Sadly for QuidelOrtho, its EPS declined by 13.3% annually over the last five years while its revenue grew by 13.5%. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into QuidelOrtho’s earnings to better understand the drivers of its performance. As we mentioned earlier, QuidelOrtho’s operating margin declined by 45.7 percentage points over the last five years. Its share count also grew by 54.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q2, QuidelOrtho reported adjusted EPS at $0.12, up from negative $0.07 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects QuidelOrtho’s full-year EPS of $2.34 to grow 20%.

Key Takeaways from QuidelOrtho’s Q2 Results

We were impressed by how significantly QuidelOrtho blew past analysts’ EBITDA and EPS expectations this quarter. On the other hand, its full-year EPS guidance missed. Overall, this quarter was mixed, but the market seems willing to forgive weak guidance and focus instead on the strong reported results. The stock traded up 8.3% to $25.67 immediately following the results.

So should you invest in QuidelOrtho right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.