Financial services company Equitable Holdings (NYSE: EQH) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 34.7% year on year to $2.36 billion. Its non-GAAP profit of $1.10 per share was 15.4% below analysts’ consensus estimates.

Is now the time to buy Equitable Holdings? Find out by accessing our full research report, it’s free.

Equitable Holdings (EQH) Q2 CY2025 Highlights:

- Net Premiums Earned: $260 million

- Revenue: $2.36 billion vs analyst estimates of $3.98 billion (34.7% year-on-year decline, 40.7% miss)

- Pre-Tax Profit Margin: -15.4% (34.2 percentage point year-on-year decrease)

- Adjusted EPS: $1.10 vs analyst expectations of $1.30 (15.4% miss)

- Market Capitalization: $15.38 billion

“We reported second quarter Non-GAAP operating earnings per share of $1.10, or $1.41 excluding notable items, down 8% from the prior year quarter. While results were below our expectations in the quarter, primarily due to elevated mortality in our Individual Life block, we continue to see strong organic growth momentum, highlighted by net flows of $1.9 billion in Retirement and $2.0 billion in Wealth Management. In addition, we achieved several strategic milestones. Most notably, we closed our Individual Life reinsurance transaction with RGA on July 31st creating over $2 billion of value, further strengthening our balance sheet and reducing our exposure to future mortality claims by 75%. This will enhance focus on our core growth drivers of retirement, asset management and wealth management and drive significant shareholder value as we redeploy the proceeds,” said Mark Pearson, President and Chief Executive Officer.

Company Overview

Tracing its roots back to 1859 as one of America's oldest financial institutions, Equitable Holdings (NYSE: EQH) provides retirement planning, asset management, and life insurance products through its two main franchises, Equitable and AllianceBernstein.

Revenue Growth

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services.

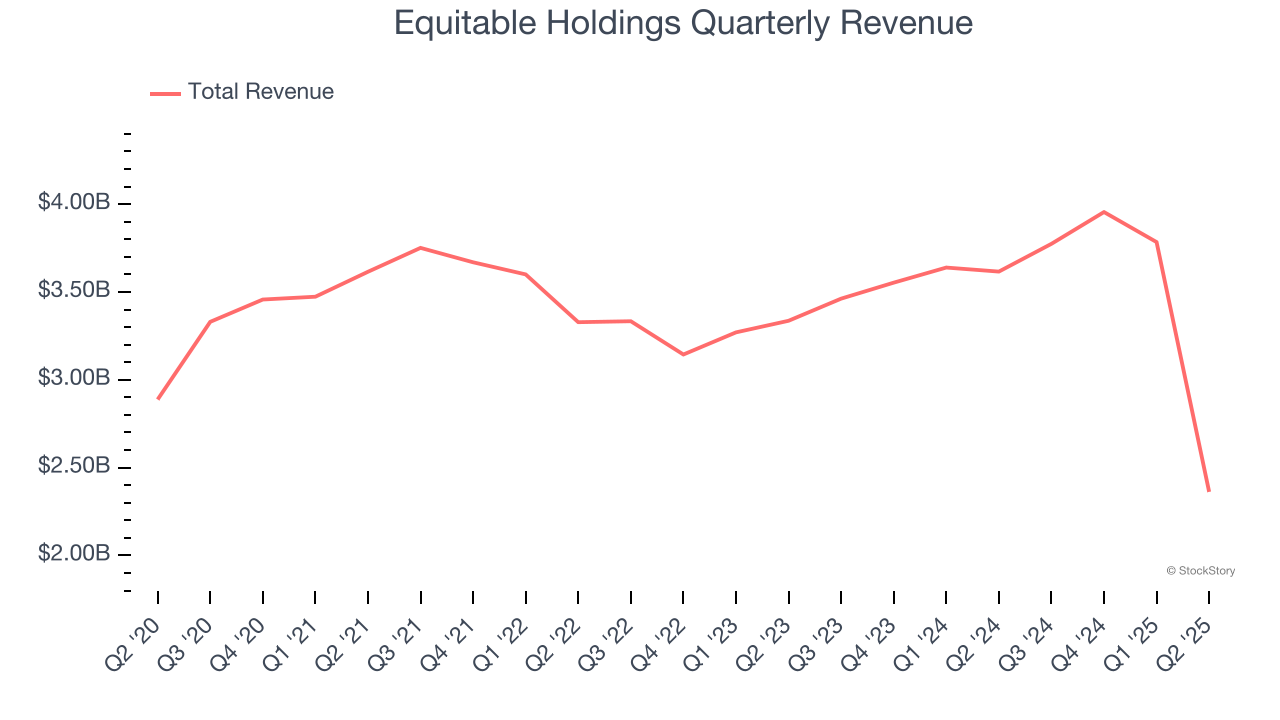

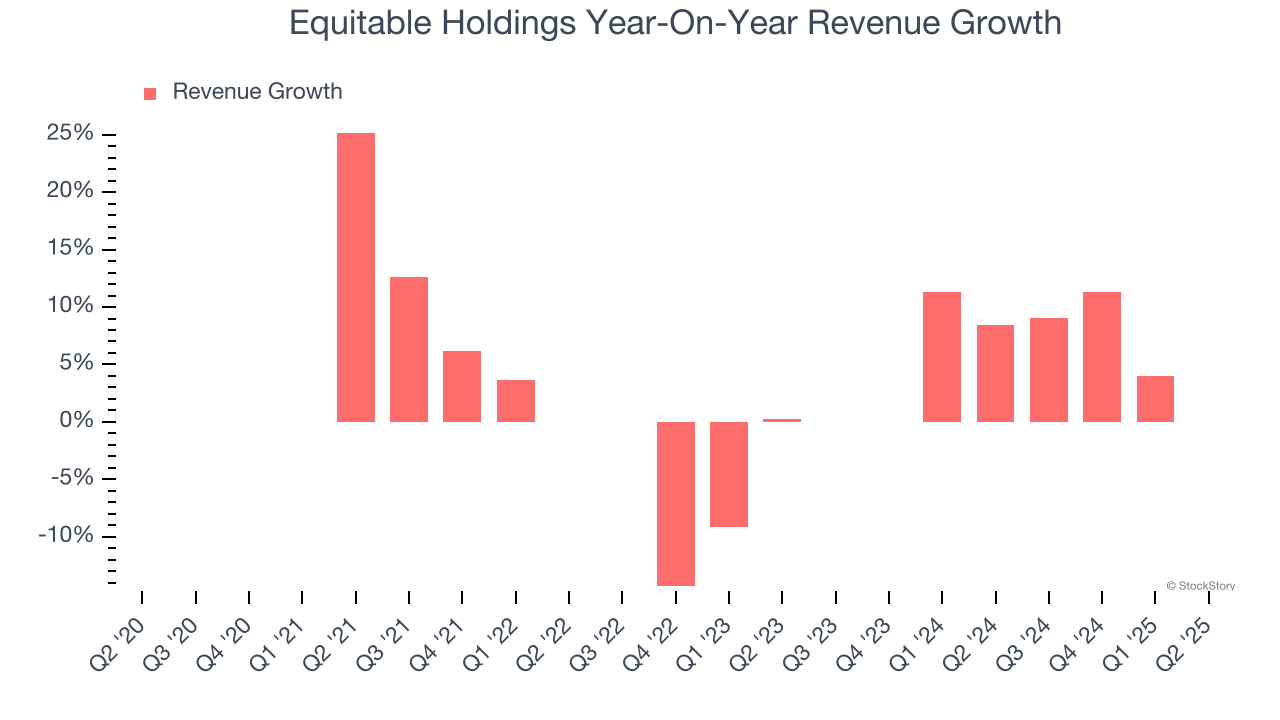

Unfortunately, Equitable Holdings struggled to consistently increase demand as its $13.88 billion of revenue for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a lower quality business.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Equitable Holdings’s annualized revenue growth of 3% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Equitable Holdings missed Wall Street’s estimates and reported a rather uninspiring 34.7% year-on-year revenue decline, generating $2.36 billion of revenue.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Equitable Holdings’s Q2 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 1.8% to $50 immediately after reporting.

Equitable Holdings didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.