Biotech company Amgen (NASDAQ: AMGN) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 9.4% year on year to $9.18 billion. The company expects the full year’s revenue to be around $35.5 billion, close to analysts’ estimates. Its non-GAAP profit of $6.02 per share was 14.1% above analysts’ consensus estimates.

Is now the time to buy Amgen? Find out by accessing our full research report, it’s free.

Amgen (AMGN) Q2 CY2025 Highlights:

- Revenue: $9.18 billion vs analyst estimates of $8.94 billion (9.4% year-on-year growth, 2.7% beat)

- Adjusted EPS: $6.02 vs analyst estimates of $5.28 (14.1% beat)

- The company lifted its revenue guidance for the full year to $35.5 billion at the midpoint from $35 billion, a 1.4% increase

- Management slightly raised its full-year Adjusted EPS guidance to $20.75 at the midpoint

- Operating Margin: 28.9%, up from 22.8% in the same quarter last year

- Free Cash Flow Margin: 20.8%, down from 26.5% in the same quarter last year

- Market Capitalization: $161.4 billion

"We're delivering strong performance and reaching more patients with innovative medicines and biosimilars that address serious diseases. We continue to invest in science that enables longer, healthier lives and supports sustainable, long-term growth," said Robert A. Bradway, chairman and chief executive officer.

Company Overview

Founded in 1980 during the early days of the biotechnology revolution, Amgen (NASDAQ: AMGN) is a biotechnology company that discovers, develops, and manufactures innovative medicines to treat serious illnesses like cancer, osteoporosis, and autoimmune diseases.

Revenue Growth

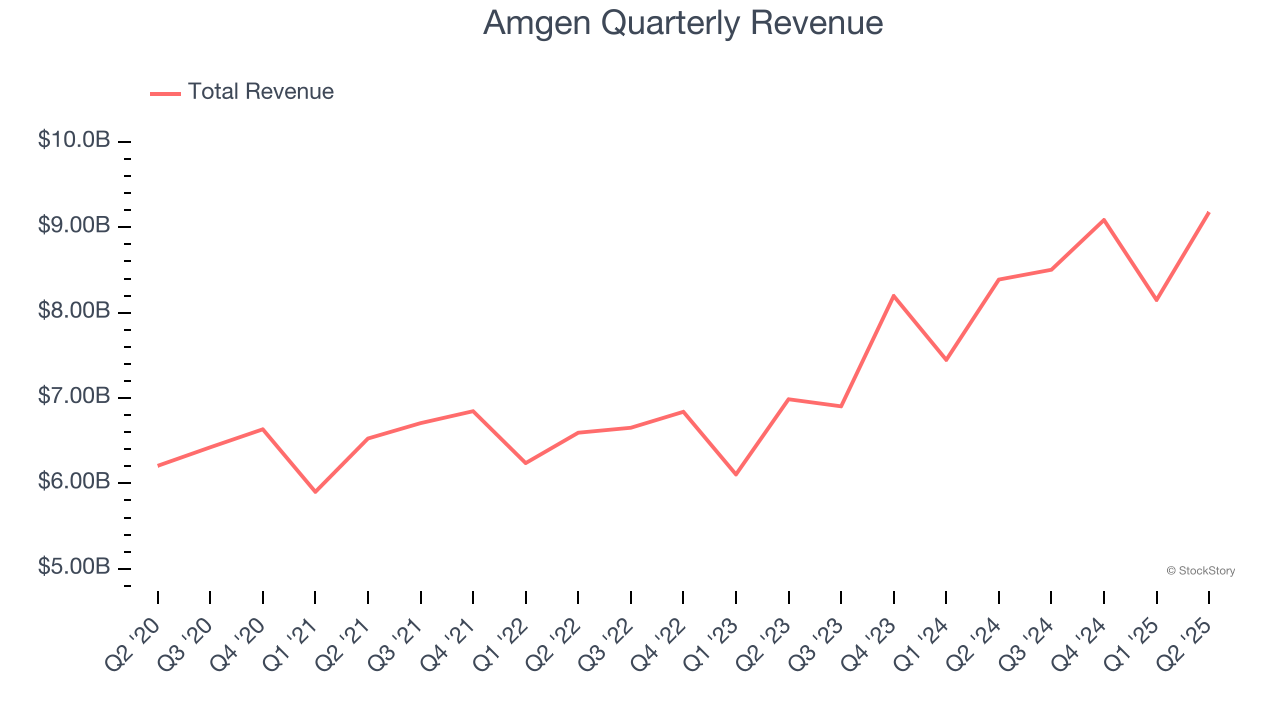

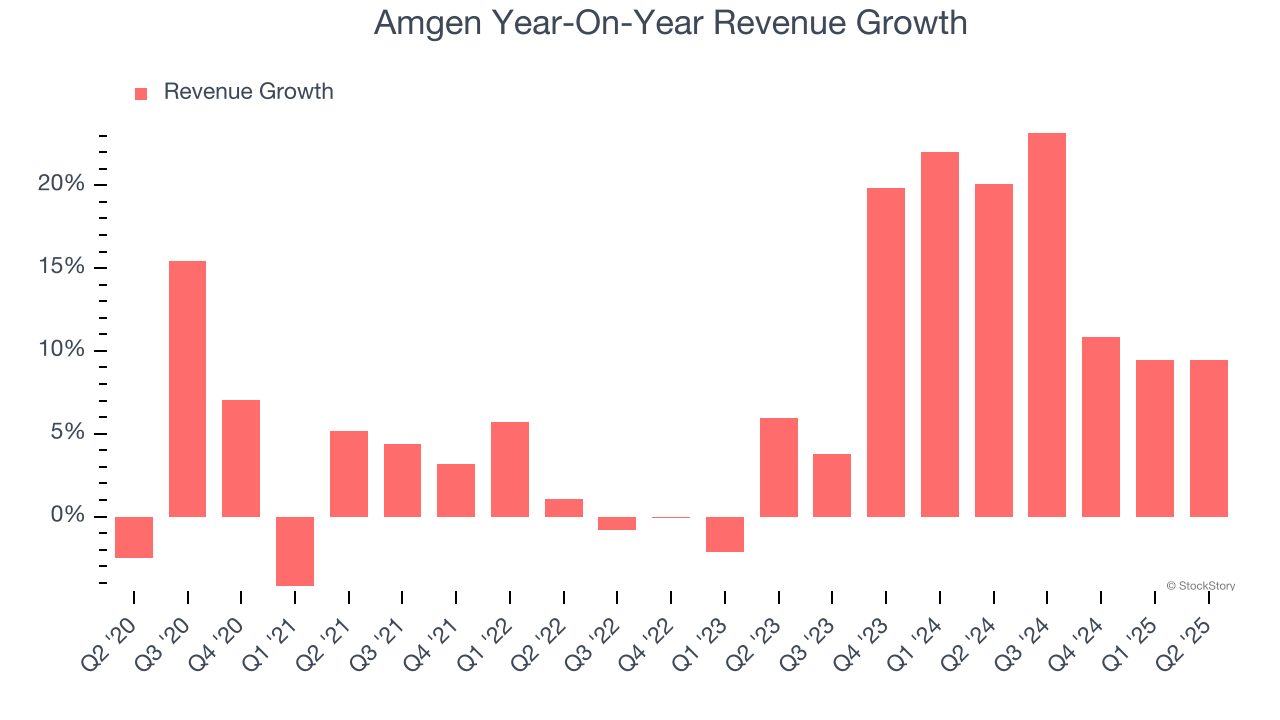

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Amgen’s 7.7% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Amgen’s annualized revenue growth of 14.6% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

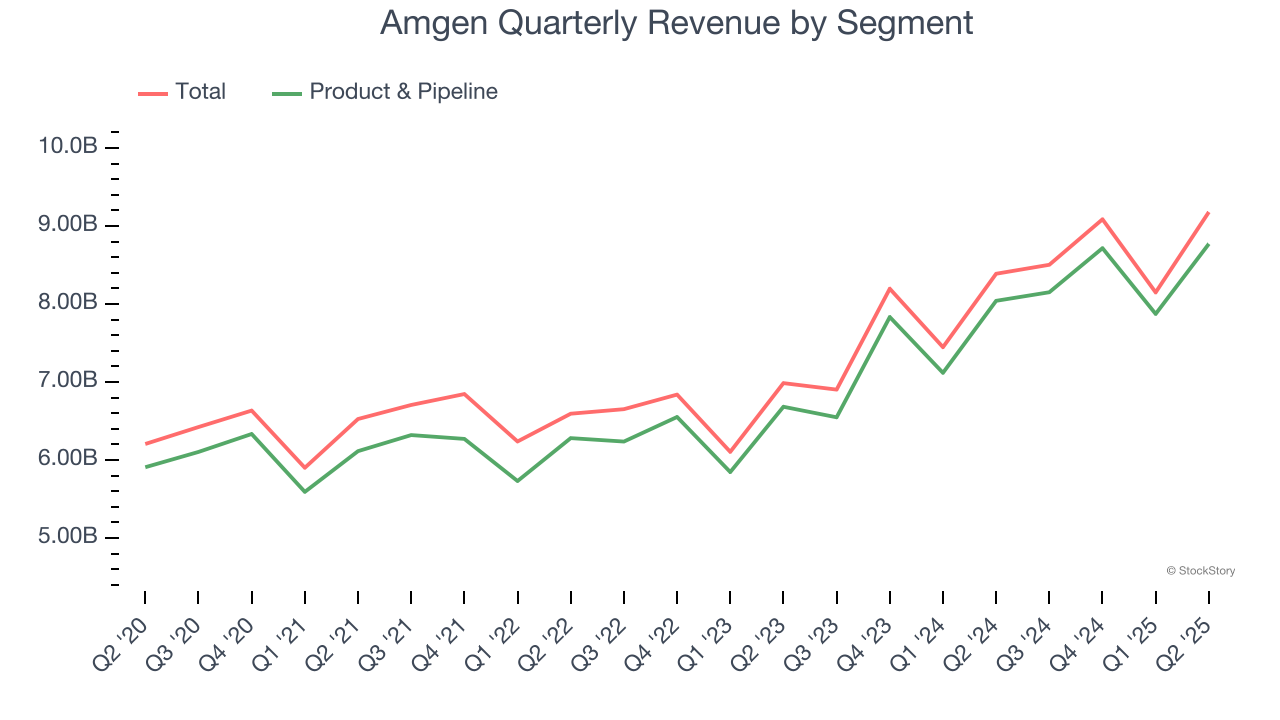

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Product & Pipeline. Over the last two years, Amgen’s Product & Pipeline revenue averaged 15.3% year-on-year growth.

This quarter, Amgen reported year-on-year revenue growth of 9.4%, and its $9.18 billion of revenue exceeded Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

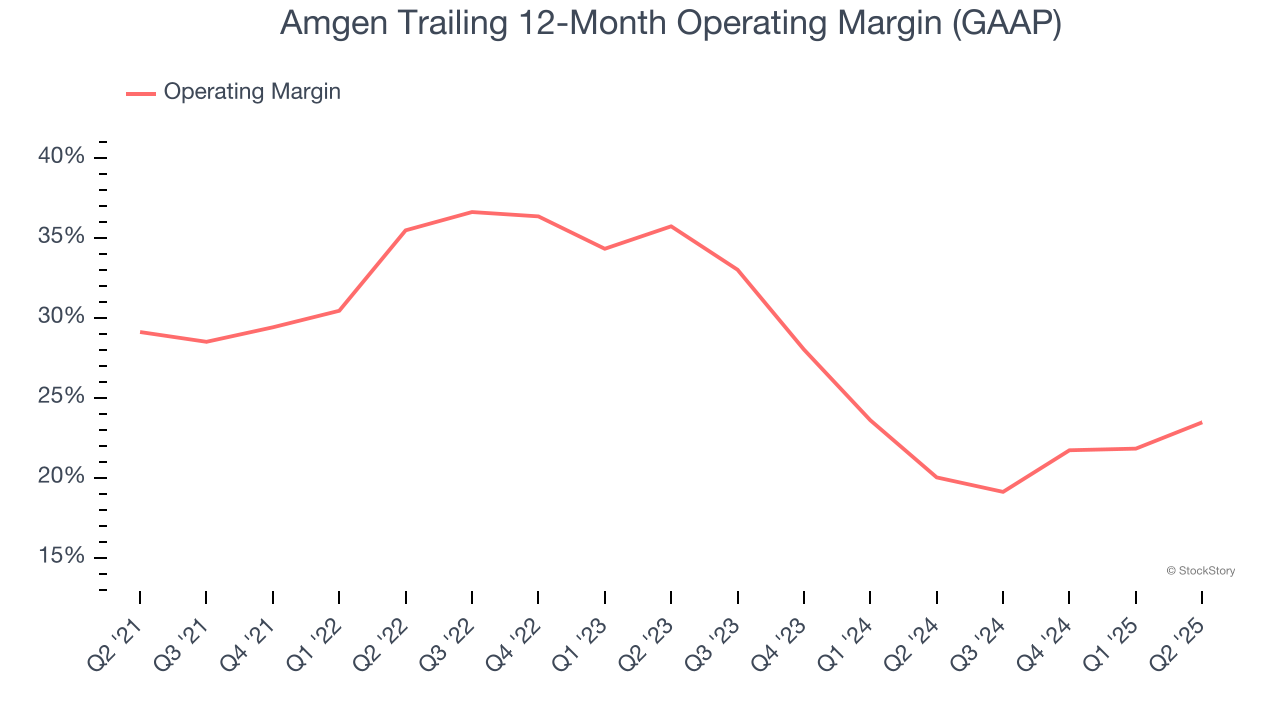

Amgen has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 28.2%.

Looking at the trend in its profitability, Amgen’s operating margin decreased by 5.6 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 12.3 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q2, Amgen generated an operating margin profit margin of 28.9%, up 6.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

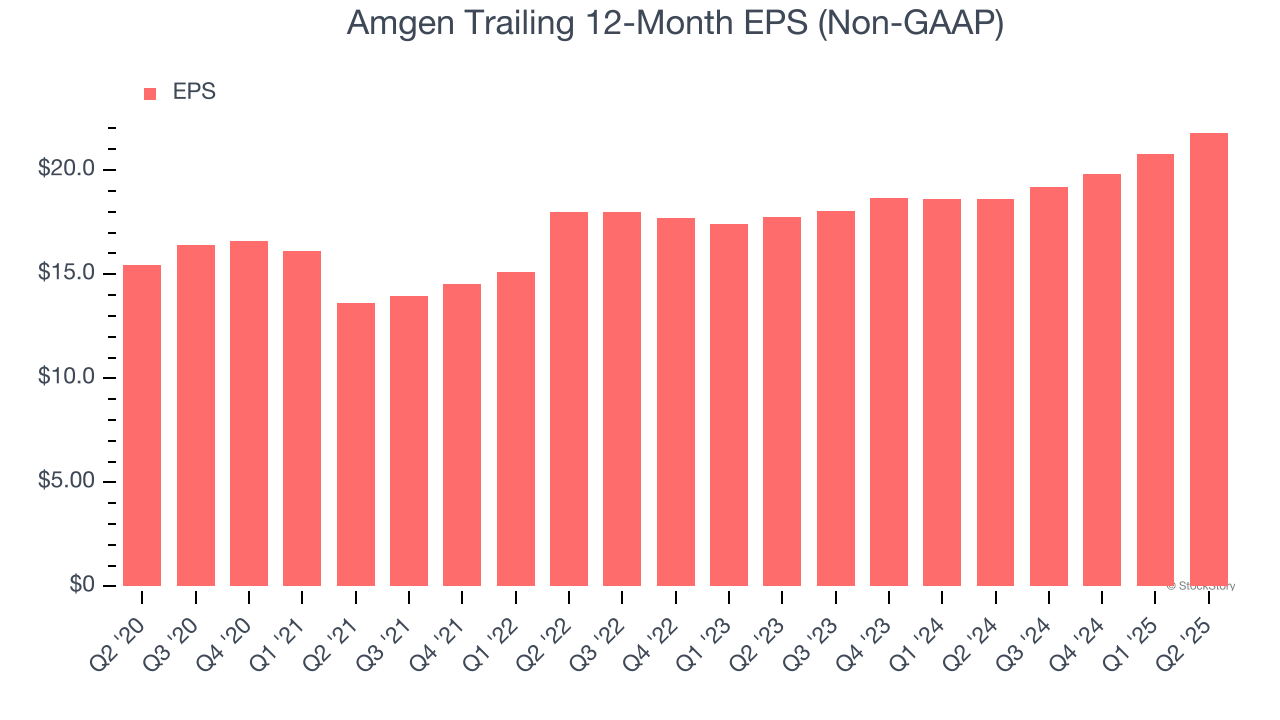

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Amgen’s solid 7.2% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q2, Amgen reported adjusted EPS at $6.02, up from $4.97 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Amgen’s full-year EPS of $21.81 to shrink by 3.4%.

Key Takeaways from Amgen’s Q2 Results

This was a beat and (slight) raise quarter. We enjoyed seeing Amgen beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance slightly missed despite a raise. Overall, this print had some key positives. The stock remained flat at $298.49 immediately following the results.

So do we think Amgen is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.