Since December 2024, Renasant has been in a holding pattern, floating around $34.54.

Is there a buying opportunity in Renasant, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Renasant Not Exciting?

We're cautious about Renasant. Here are three reasons why you should be careful with RNST and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

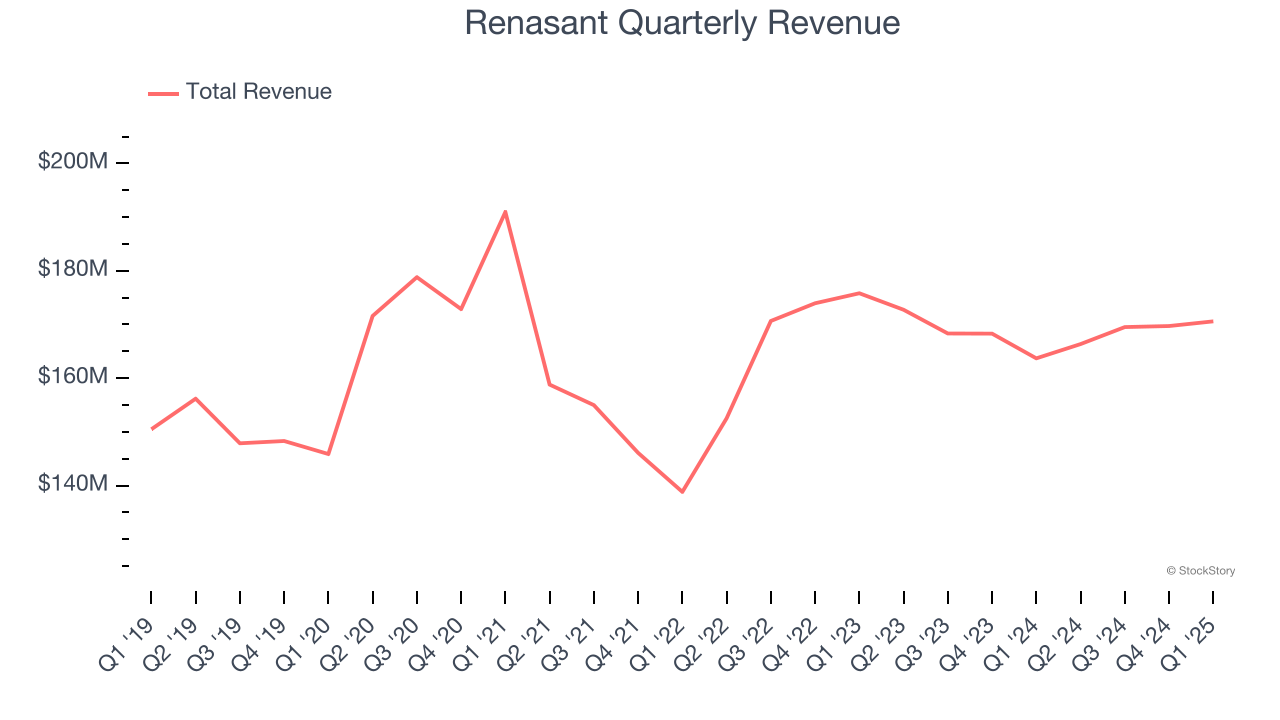

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income.

Regrettably, Renasant’s revenue grew at a tepid 2.5% compounded annual growth rate over the last five years. This was below our standards.

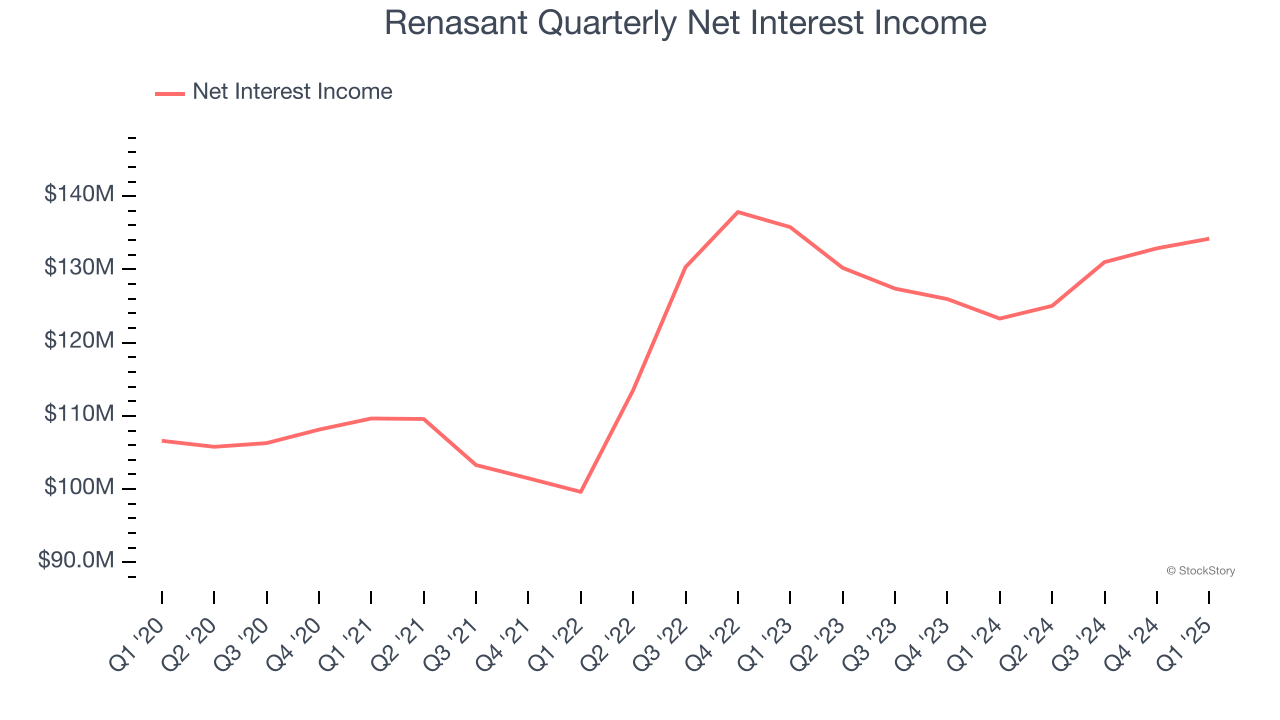

2. Net Interest Income Points to Soft Demand

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

Renasant’s net interest income has grown at a 5% annualized rate over the last four years, worse than the broader bank industry.

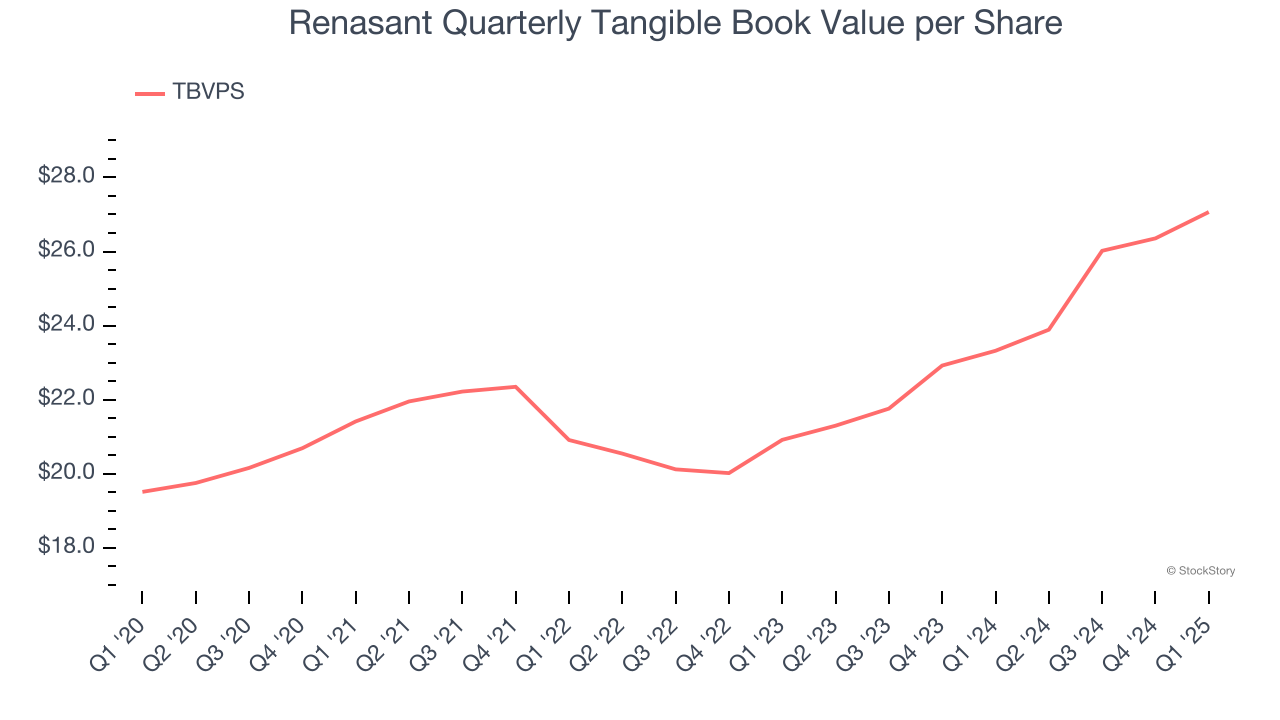

3. TBVPS Projections Show Stormy Skies Ahead

A bank’s tangible book value per share (TBVPS) increases when it generates higher net interest margins and keeps credit losses low, allowing it to compound shareholder value over time.

Over the next 12 months, Consensus estimates call for Renasant’s TBVPS to shrink by 9.9% to $24.40, a sour projection.

Final Judgment

Renasant isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 0.8× forward P/B (or $34.54 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Renasant

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.