Williams-Sonoma currently trades at $173.90 and has been a dream stock for shareholders. It’s returned 437% since May 2020, blowing past the S&P 500’s 107% gain. The company has also beaten the index over the past six months as its stock price is up 34.3% thanks to its solid quarterly results.

Is now the time to buy Williams-Sonoma, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Williams-Sonoma Not Exciting?

We’re happy investors have made money, but we don't have much confidence in Williams-Sonoma. Here are three reasons why there are better opportunities than WSM and a stock we'd rather own.

1. Stores Are Closing, a Headwind for Revenue

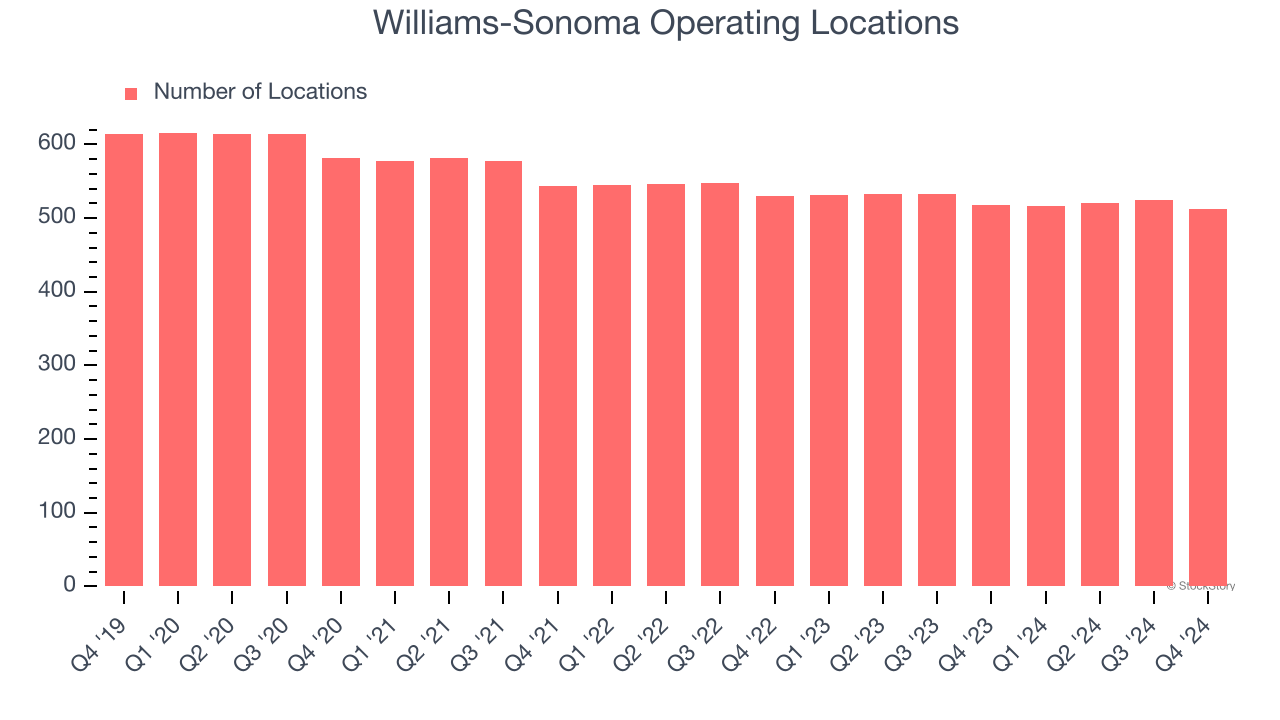

A retailer’s store count often determines how much revenue it can generate.

Williams-Sonoma operated 512 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 2.2% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

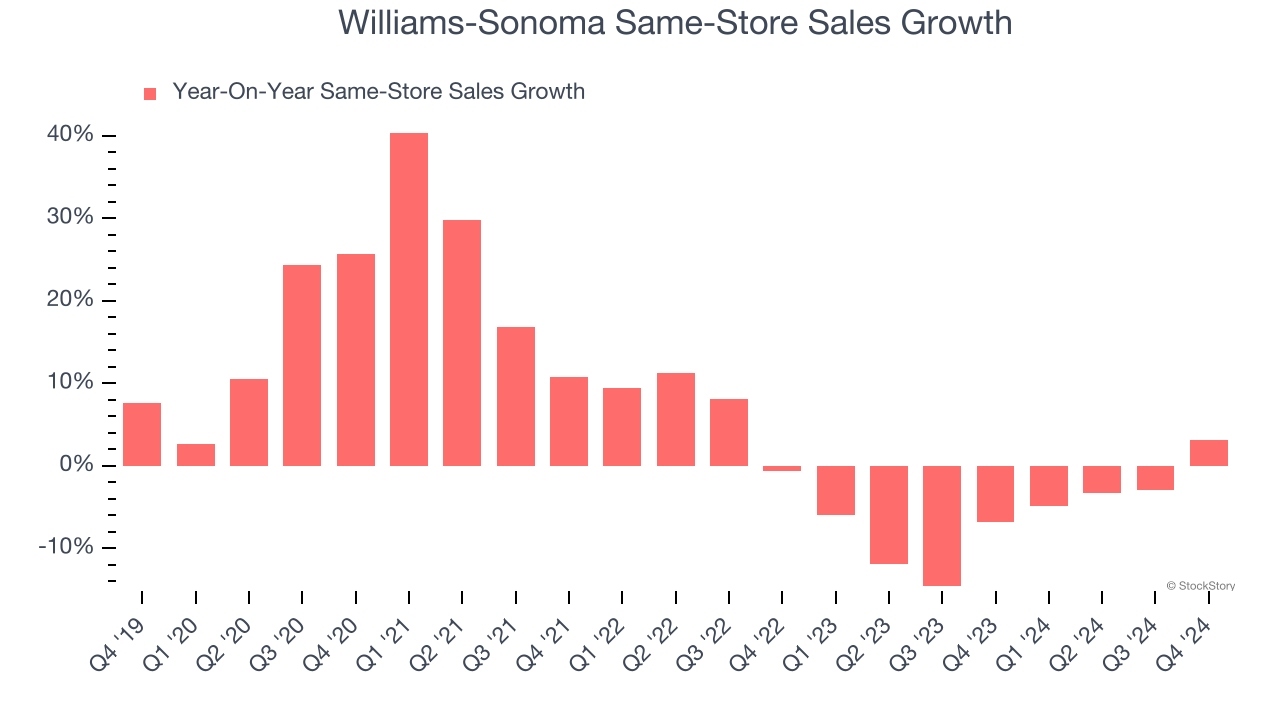

2. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Williams-Sonoma’s demand has been shrinking over the last two years as its same-store sales have averaged 5.9% annual declines.

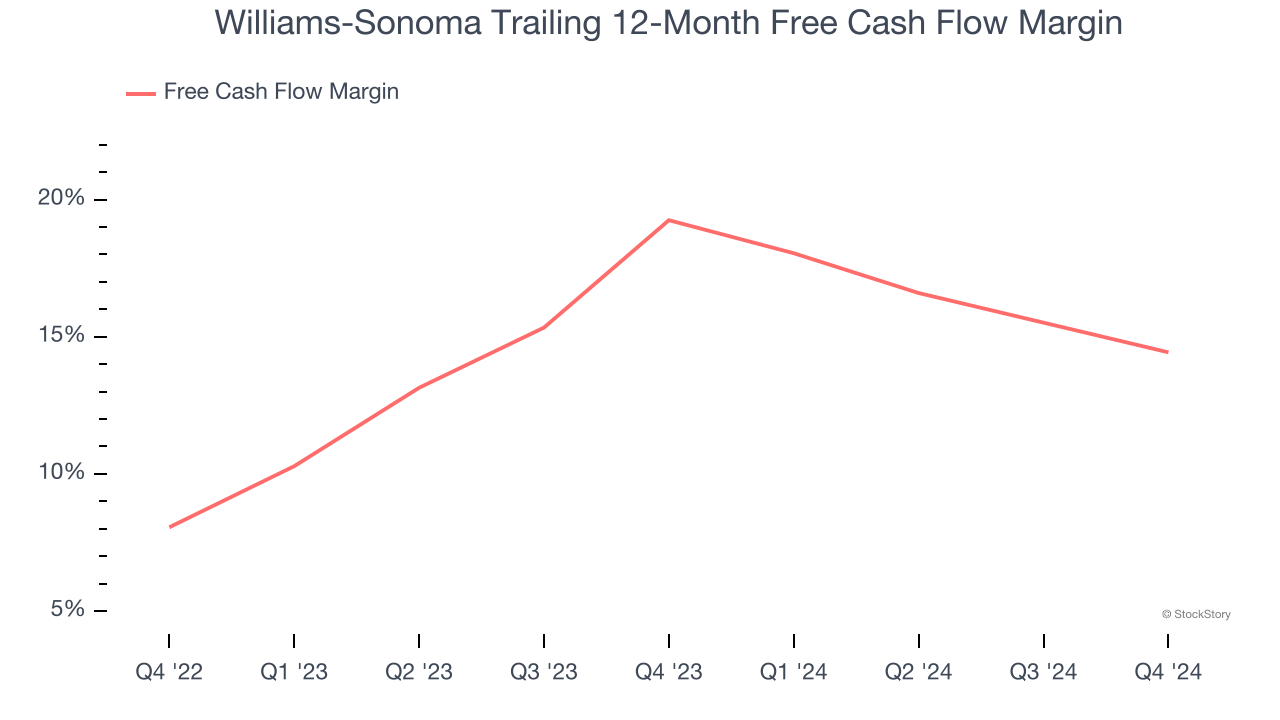

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Williams-Sonoma’s margin dropped by 4.8 percentage points over the last year. This decrease warrants extra caution because Williams-Sonoma failed to grow its same-store sales. Its cash profitability could decay further if it tries to reignite growth by opening new stores.

Final Judgment

Williams-Sonoma’s business quality ultimately falls short of our standards. With its shares outperforming the market lately, the stock trades at 20.3× forward P/E (or $173.90 per share). This multiple tells us a lot of good news is priced in - we think there are better investment opportunities out there. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Williams-Sonoma

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.