VF Corp’s stock price has taken a beating over the past six months, shedding 27.5% of its value and falling to $14.50 per share. This may have investors wondering how to approach the situation.

Is now the time to buy VF Corp, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think VF Corp Will Underperform?

Even though the stock has become cheaper, we don't have much confidence in VF Corp. Here are three reasons why you should be careful with VFC and a stock we'd rather own.

1. Declining Constant Currency Revenue, Demand Takes a Hit

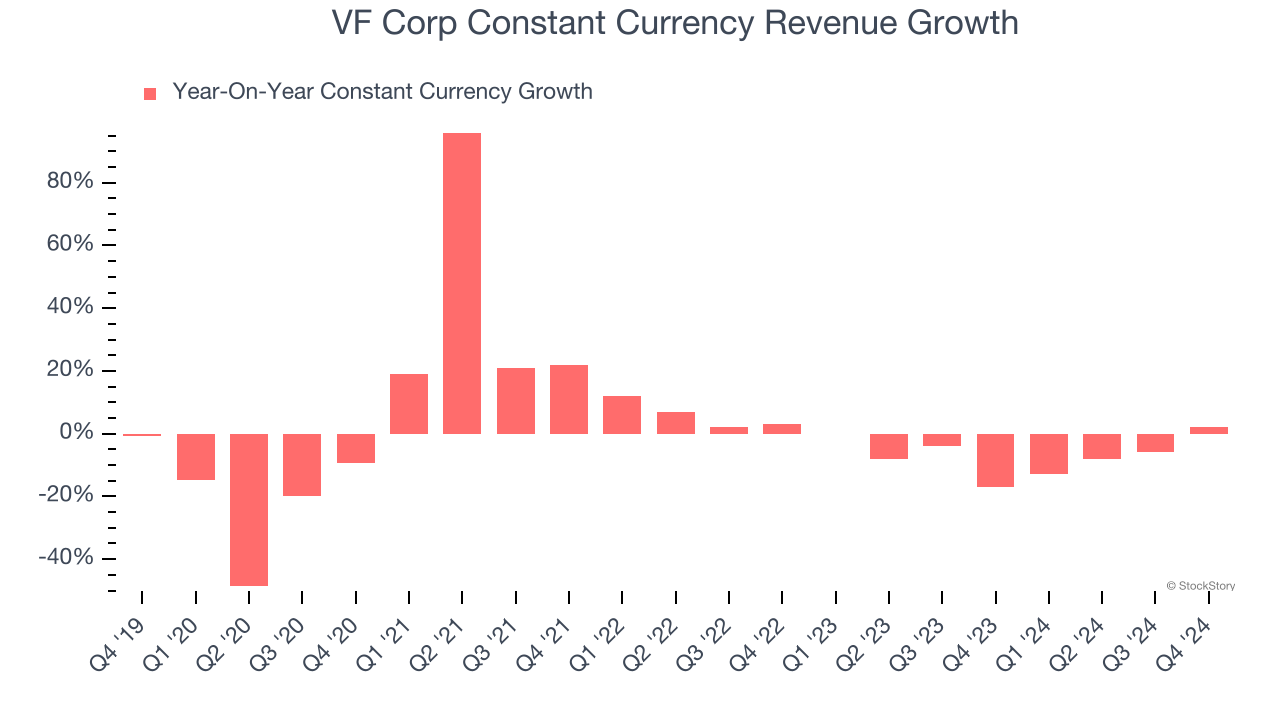

Investors interested in Apparel and Accessories companies should track constant currency revenue in addition to reported revenue. This metric excludes currency movements, which are outside of VF Corp’s control and are not indicative of underlying demand.

Over the last two years, VF Corp’s constant currency revenue averaged 6.8% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests VF Corp might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. New Investments Fail to Bear Fruit as ROIC Declines

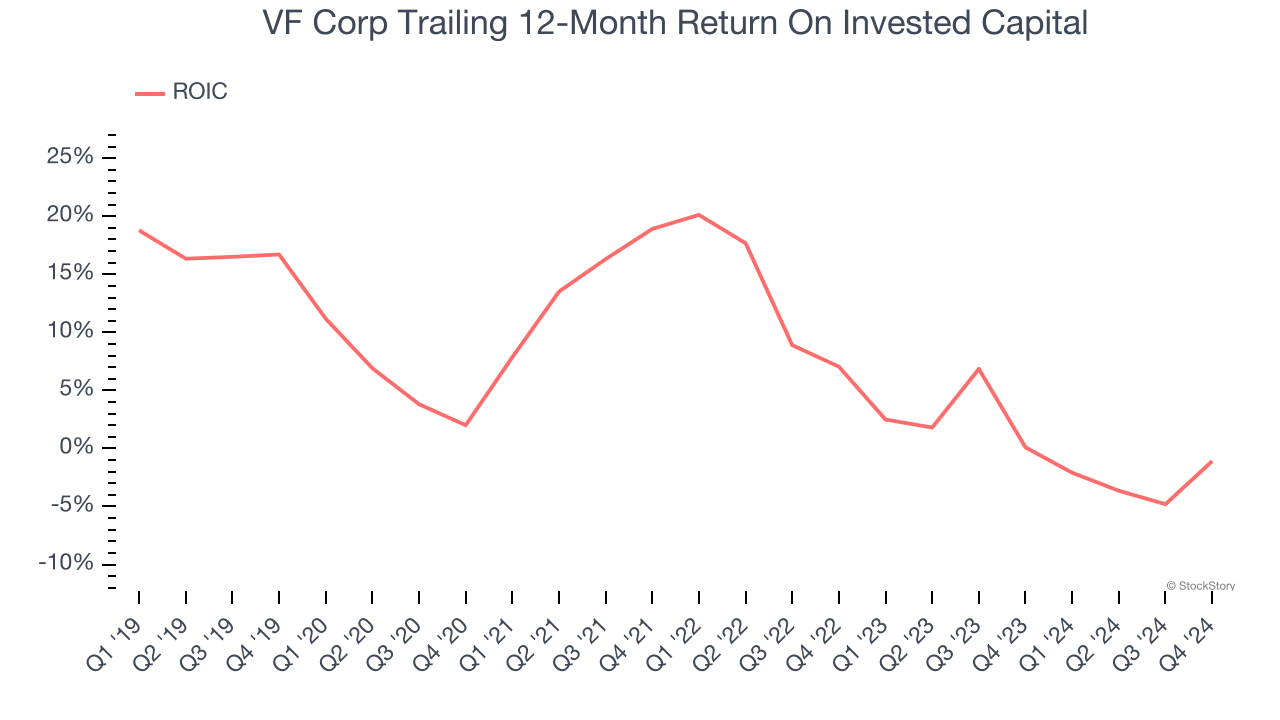

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, VF Corp’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

3. High Debt Levels Increase Risk

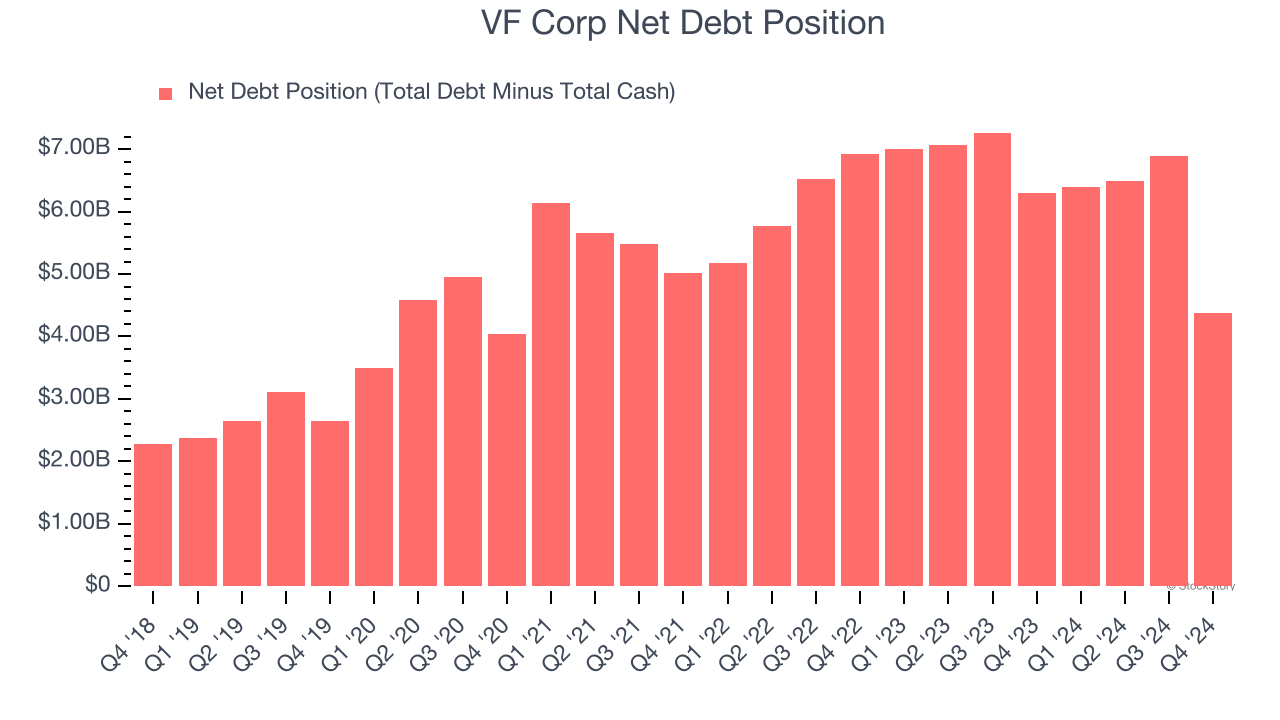

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

VF Corp’s $5.75 billion of debt exceeds the $1.37 billion of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $740.4 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. VF Corp could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope VF Corp can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

VF Corp falls short of our quality standards. After the recent drawdown, the stock trades at 15.7× forward P/E (or $14.50 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are more exciting stocks to buy at the moment. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than VF Corp

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.