Affirm has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 9.8% to $75.95 per share while the index has gained 11.3%.

Is now the time to buy Affirm, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Affirm Not Exciting?

We're sitting this one out for now. Here are two reasons we avoid AFRM and a stock we'd rather own.

1. Previous Growth Initiatives Have Lost Money

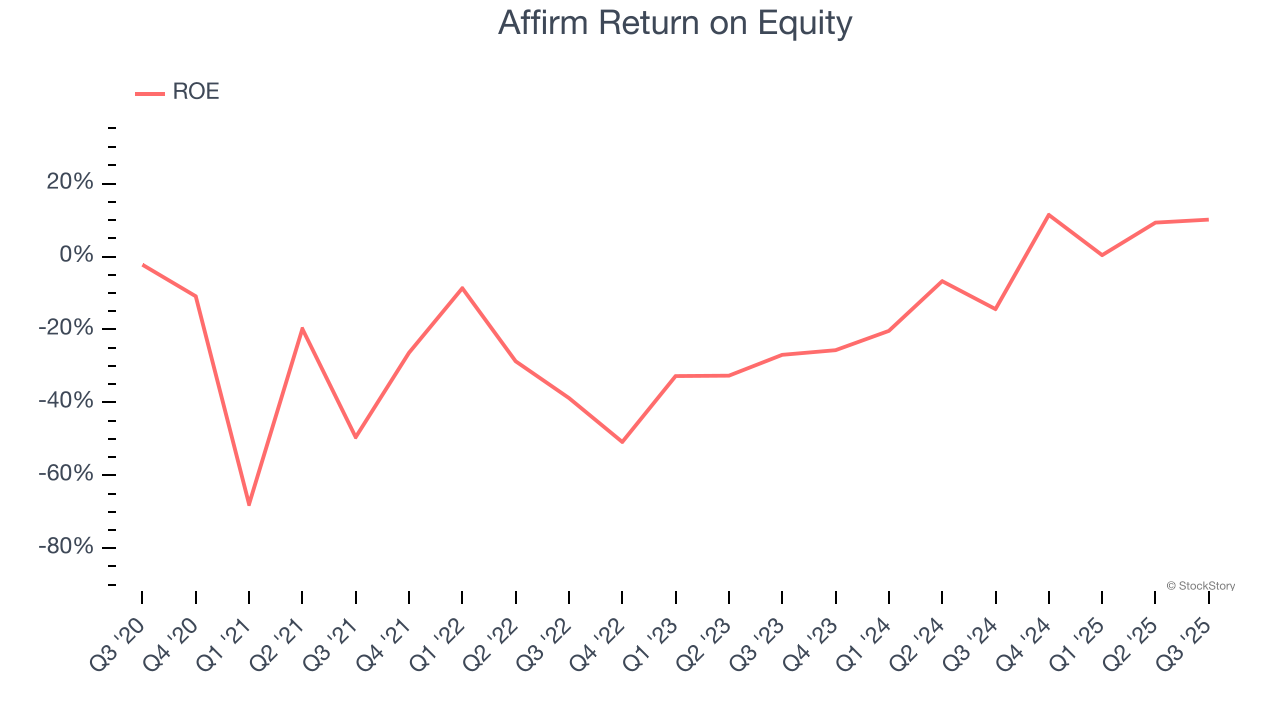

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Affirm has averaged an ROE of negative 21.5%, a bad result not only in absolute terms but also relative to the majority of firms putting up 25%+. It also shows that Affirm has little to no competitive moat.

2. High Debt Levels Increase Risk

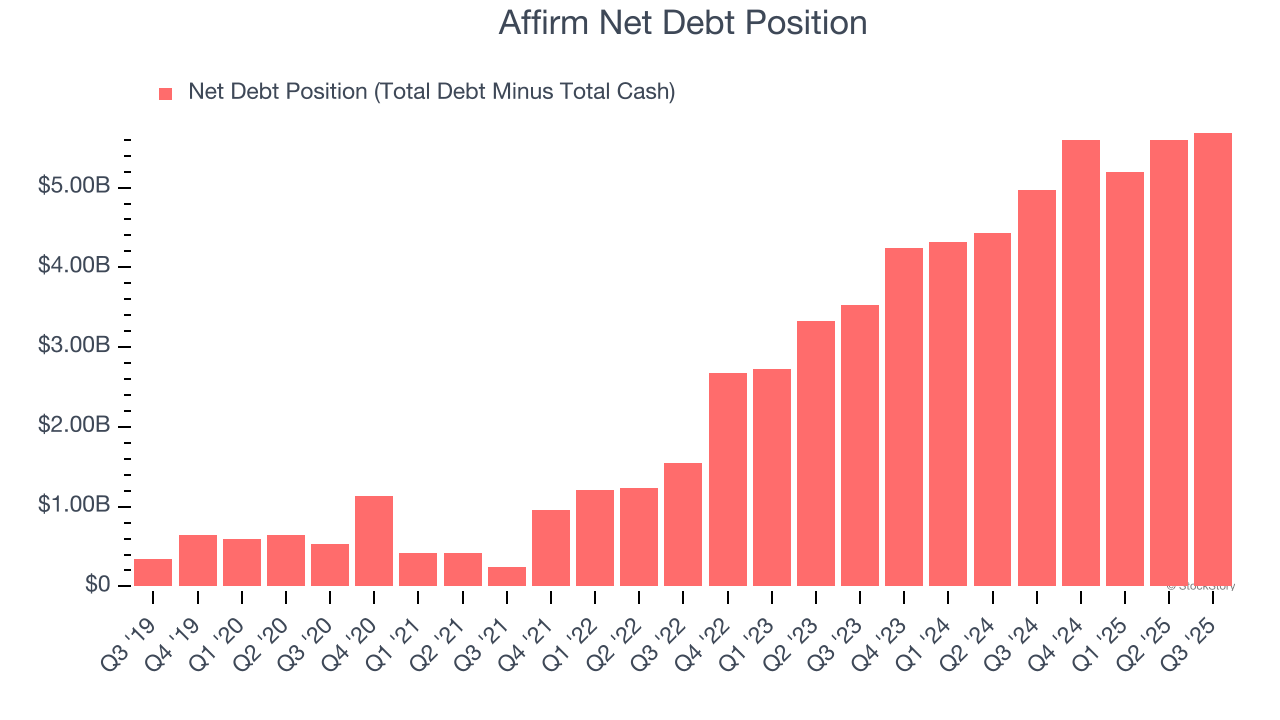

Affirm reported $2.24 billion of cash and $7.93 billion of debt on its balance sheet in the most recent quarter.

As investors in high-quality companies, we primarily focus on whether a company’s profits can support its debt.

With $953.5 million of EBITDA over the last 12 months, we view Affirm’s 6.0× net-debt-to-EBITDA ratio as inadequate. The company’s lacking profits relative to its borrowings give it little breathing room, raising red flags.

Final Judgment

Affirm isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 23.1× forward P/E (or $75.95 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Like More Than Affirm

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.