Industrial materials and tools company Kennametal (NYSE: KMT) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 2.1% year on year to $481.9 million. The company expects next quarter’s revenue to be around $490 million, slightly below analysts’ estimates. Its non-GAAP profit of $0.29 per share was 13.4% above analysts’ consensus estimates.

Is now the time to buy Kennametal? Find out by accessing our full research report, it’s free.

Kennametal (KMT) Q3 CY2024 Highlights:

- Revenue: $481.9 million vs analyst estimates of $484.9 million (in line)

- Adjusted EPS: $0.29 vs analyst estimates of $0.26 (13.4% beat)

- The company reconfirmed its revenue guidance for the full year of $2.05 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $1.50 at the midpoint

- Gross Margin (GAAP): 31.3%, down from 33.1% in the same quarter last year

- Operating Margin: 7.5%, down from 9.2% in the same quarter last year

- Free Cash Flow was $21 million, up from -$3.04 million in the same quarter last year

- Organic Revenue fell 2% year on year (0% in the same quarter last year)

- Market Capitalization: $2.07 billion

"While we continue to generate strong cash flow from operations, softer market conditions in a number of our end markets have led sales to come in on the lower end of our expectations," said Sanjay Chowbey, President and CEO.

Company Overview

Involved in manufacturing hard tips of anti-tank projectiles in World War II, Kennametal (NYSE: KMT) is a provider of industrial materials and tools for various sectors.

Professional Tools and Equipment

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

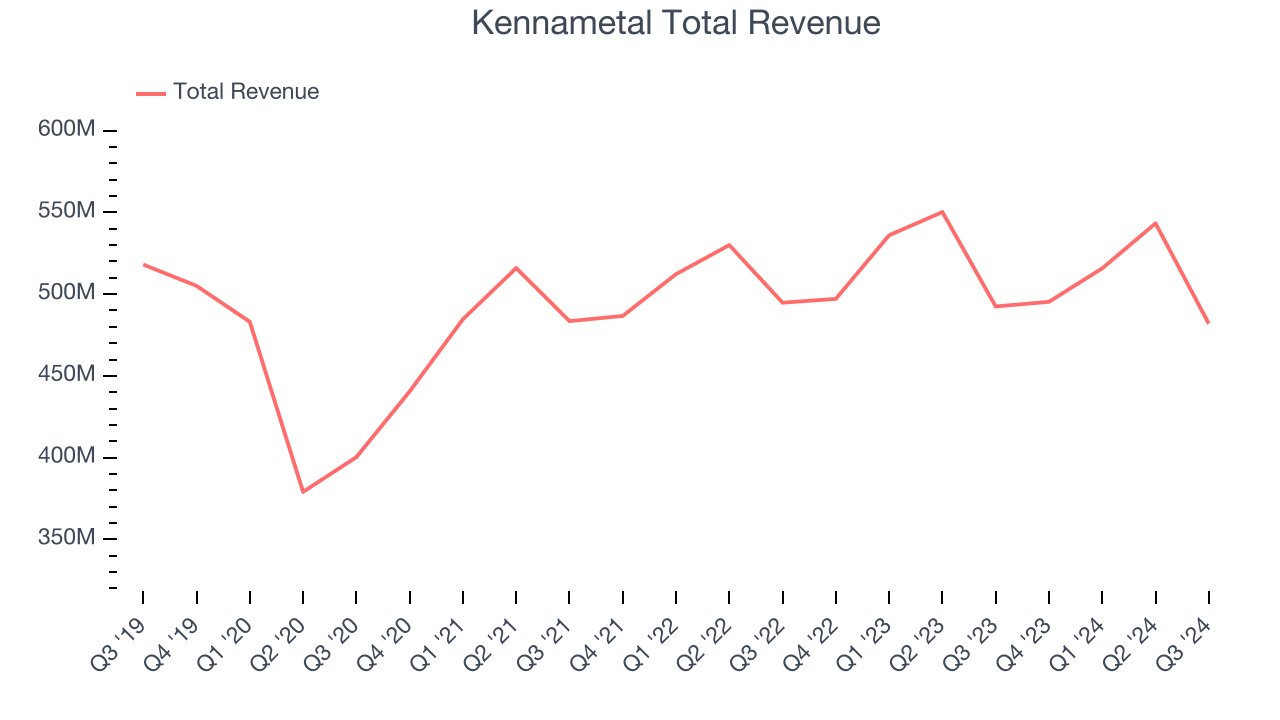

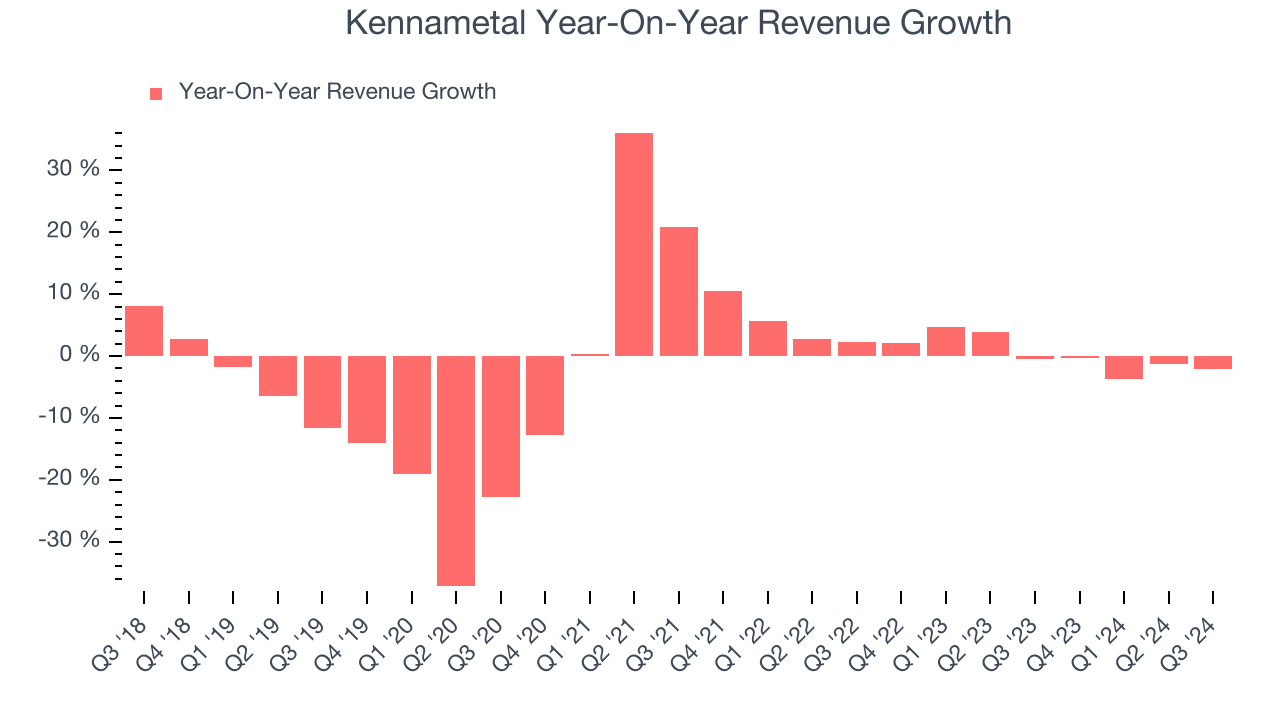

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Kennametal’s demand was weak over the last five years as its sales fell by 2.5% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Kennametal’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop in sales.

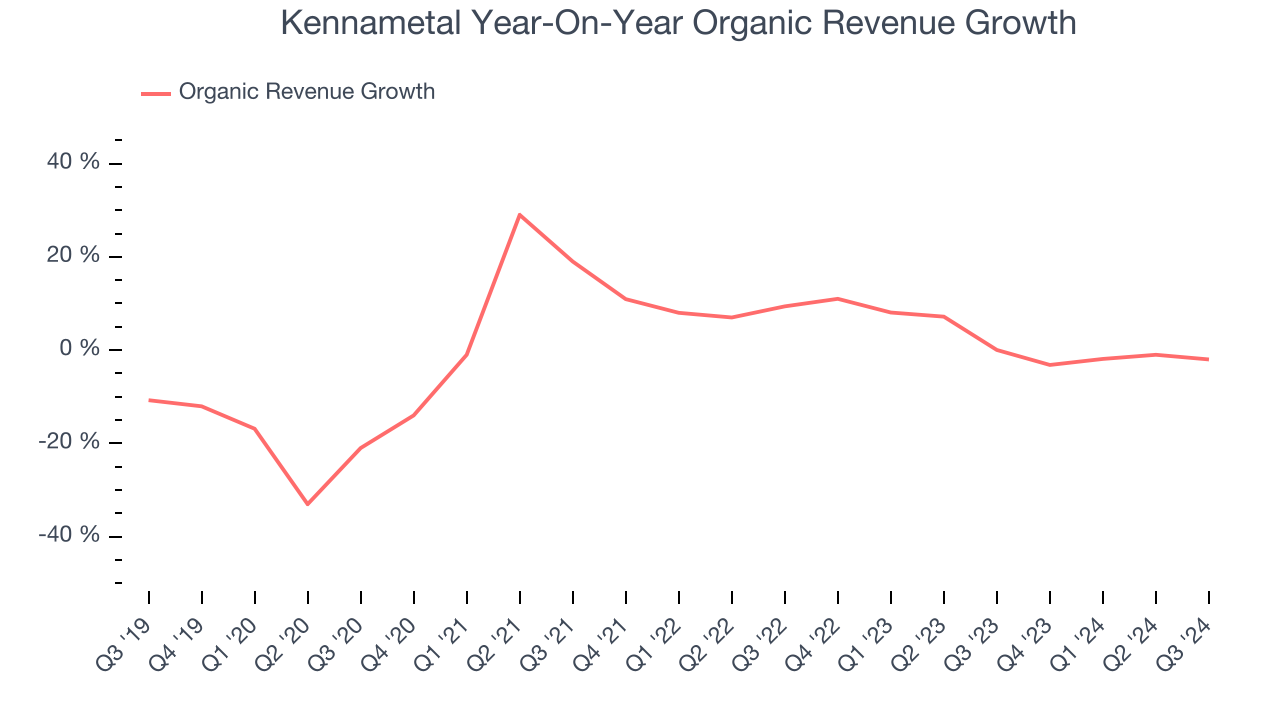

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, Kennametal’s organic revenue averaged 2.3% year-on-year growth. Because this number is better than its normal revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline performance.

This quarter, Kennametal reported a rather uninspiring 2.1% year-on-year revenue decline to $481.9 million of revenue, in line with Wall Street’s estimates. Management is currently guiding for a 1.1% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months, an improvement versus the last two years. Although this projection illustrates the market believes its newer products and services will spur better performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

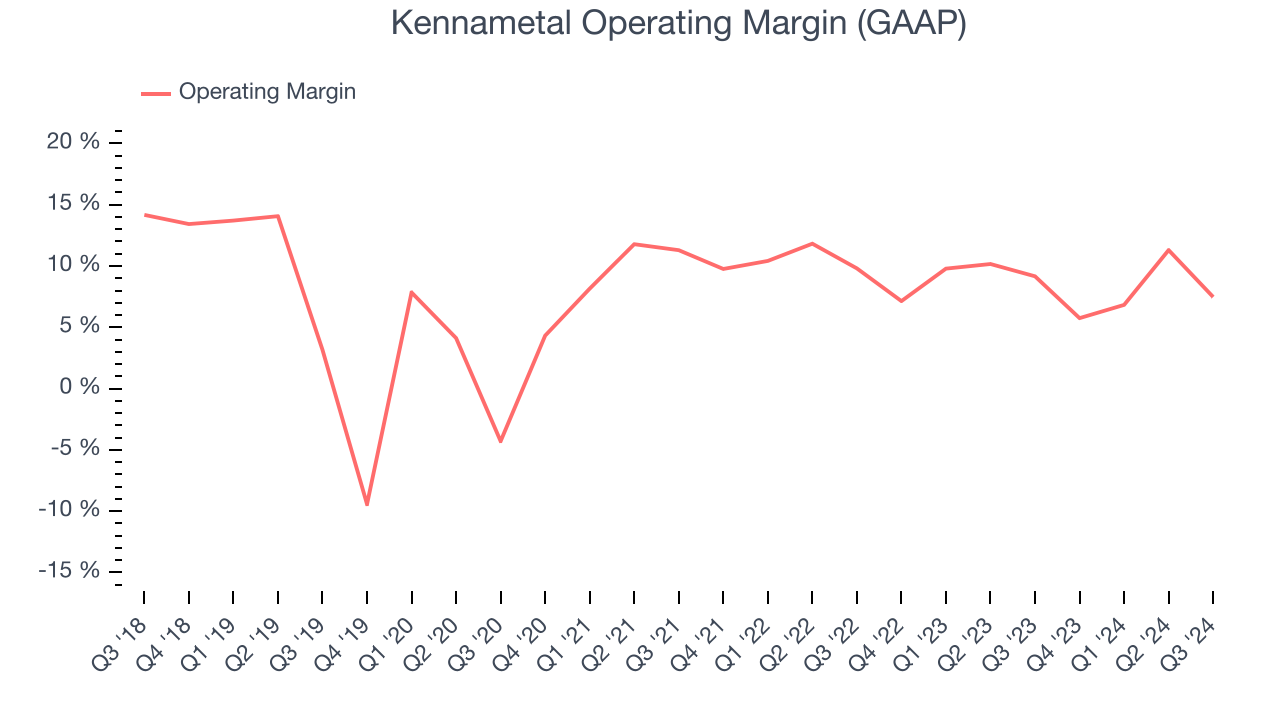

Kennametal was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.4% was weak for an industrials business.

On the plus side, Kennametal’s annual operating margin rose by 8.6 percentage points over the last five years.

This quarter, Kennametal generated an operating profit margin of 7.5%, down 1.7 percentage points year on year. Since Kennametal’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

Earnings Per Share

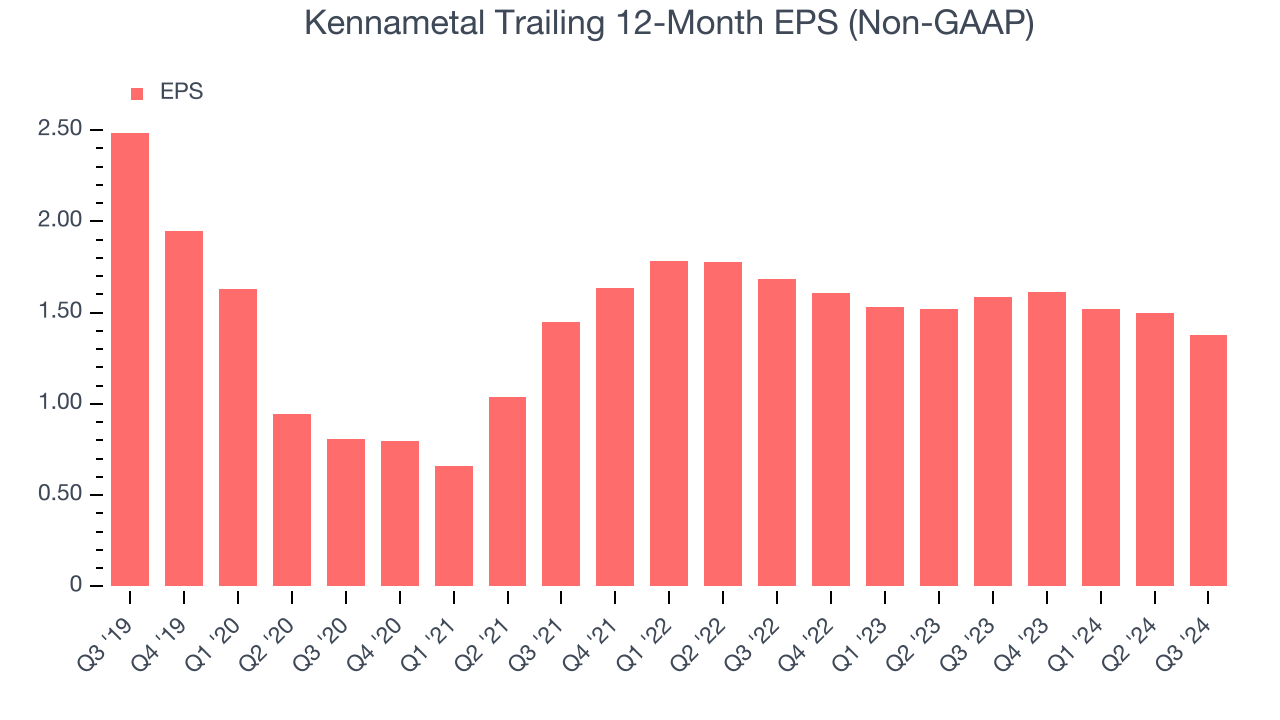

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sadly for Kennametal, its EPS declined by more than its revenue over the last five years, dropping 11.1% annually. However, its operating margin actually expanded during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

Kennametal’s two-year annual EPS declines of 9.5% were bad and lower than its flat revenue.In Q3, Kennametal reported EPS at $0.29, down from $0.41 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Kennametal’s full-year EPS of $1.38 to grow by 17.1%.

Key Takeaways from Kennametal’s Q3 Results

We were impressed by Kennametal’s optimistic full-year EPS forecast, which blew past analysts’ expectations. We were also excited its EPS outperformed Wall Street’s estimates. On the other hand, its EPS forecast for next quarter missed and its revenue fell short of Wall Street’s estimates. Overall, this quarter was mixed but the strong full year EPS guidance seems to be lifting shares. The stock traded up 4.3% to $27.72 immediately after reporting.

So should you invest in Kennametal right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.