Trading earnings report reactions are one of the riskiest trading strategies. However, when asymmetrical risk and reward apply favorably, then the upside gains and downside risk are defined and capped. The upside reward is evident if the stock forms a price gap that continues to rise. However, the downside can be detrimental if the stock gaps down and continues to dump. Therefore, buying a stock in front of earnings is often shunned by traders.

You can limit some of your risk with directional call directional call options, but you will lose all your investment if the stock reacts negatively, especially if it was an out-of-the-money (OTM) call option with a hefty premium. However, if you're willing to cap your upside while limiting your downside to a 2-to-1 ratio, then an asymmetric risk-reward situation arises using call debit spreads.

What is a Call Debit Spread?

A call debit spread enables you to gain upside on the underlying stock price gain but limits your downside if the stock collapses. It also enables you to play long calls at a cheaper cost. A call debit spread comprises 2 legs: a long OTM call and a short OTM call.

Is UiPath Being Overlooked Among AI Stocks?

UiPath Inc. (NYSE: PATH) is the leader in artificial intelligence (AI) powered robotic process automation (RPA) and business process automation (BPA) platforms in the computer and technology sector. A recent MarketBeat Original article by Chris Markoch explores how ARK Investment Management head Cathie Wood is a believer in UiPath since it’s the second largest holding in her Ark Innovation ETF (NYSEARCA: ARKK).

UiPath benefits from two secular tailwinds: AI and automation. The company is scheduled to report its earnings after the bell on March 13, 2024. The stock has been severely lagging behind AI stocks, with its counterpart, C3.ai Inc. (NYSE: AI), forming a strong price gap and breakout on its most recent earnings. Unusually, PATH didn't get much upside sympathy momentum from AI's gap-and-go earnings beat. This leaves investors with 1 of 2 conclusions.

Either the market knows something and expects PATH to miss its expectations for EPS of 16 cents and $383.6 million in revenues or lower guidance, or the market has overlooked the potential for a strong quarter. In its last quarter, PATH had a modest earnings beat as shares squeezed up to a high of $26.53 after its earnings report. If PATH should follow in the footsteps of AI and beat and raise its number, then we can consider taking a call debit spread.

The daily candlestick chart on PATH illustrates that the gap-fill areas at $22.14 and $20.31 have not been broken since its last earnings report. The daily relative strength index (RSI) is winding up for a bounce through the 50-band.

Putting on the Call Debit Spread Trade.

With earnings to be reported after the bell on March 13, 2024, we can select the March 15, 2024, expiration. It expires in 9 days.

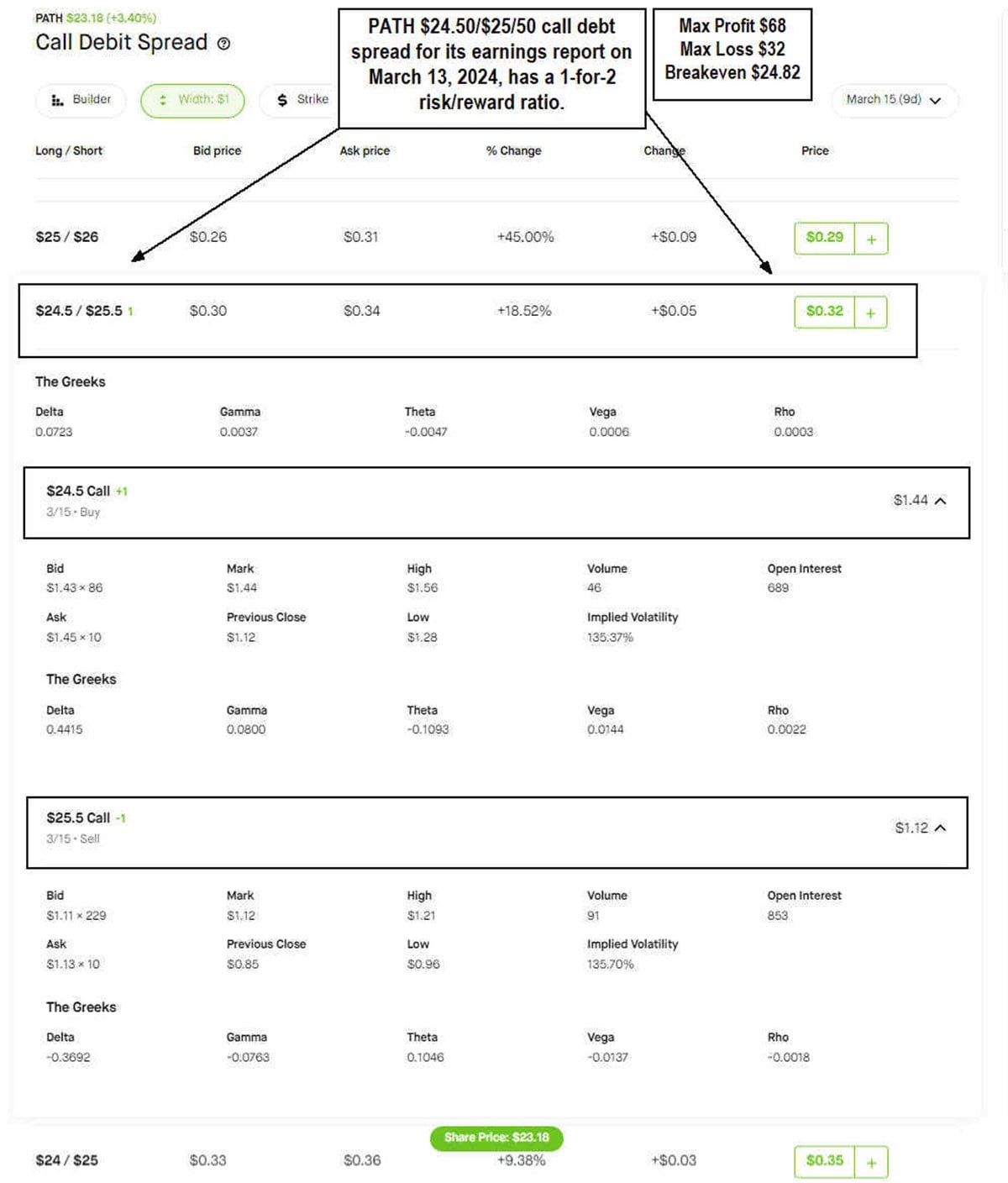

We opt for a one-point spread and choose the $24.50/$25.50 call debit spread. Depending on your brokerage platform, you can either select the call debit spread in one trade or manually place two trades by going long the $24.50 call at $1.44 and short the $25.50 call at $1.12 for a net debit of 32 cents.

Credit Debit Spread is Cheaper Than Just Buying the $24.5 Call Option Alone.

This is much cheaper than deciding just to take the direction $24.50 call at $1.44. Since it is OTM, there is no intrinsic value, which means it is worth zero at PATH's current stock price of $23.18. In fact, PATH would have to close above $25.94 on expiration in order to breakeven on the trade since it cost us $1.44 to buy the call option. By playing the call debit spread, we would get a 1-for-2 risk-to-reward payout at $25.94 rather than break even if we just took the $24.50 call option long.

Potential Outcomes of the Call Debit Spread

Since the call debit spread expires on March 15, 2024. there's no intrinsic value. The max profit is 68 cents x 100 shares or $68 per contract if PATH closes above $25.50 on expiration. The max loss is the 32 cents x 100 or $32 paid for the spread trade. The breakeven price is $24.85. We are willing to risk $32 to make $68 for a 1-for-2 risk-reward asymmetrical trade.