- Tariff effects loom as job health and tax refunds may mask ills for Main Street economy

- Bankruptcy legal inquiries jump in Q1 following three quarters of high consumer stress

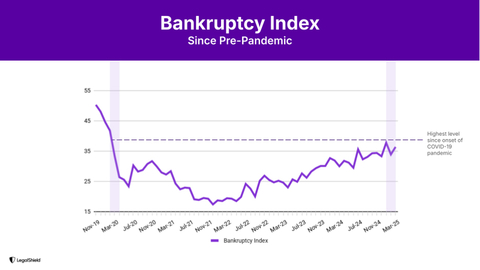

Bankruptcy inquiries surged in the first quarter to their highest level since early 2020, signaling a potential summer wave of filings, LegalShield reported today. The legal service provider's data, historically a leading indicator of bankruptcy and other consumer financial trends, suggests record consumer debt and new tariffs could push financially strained households past their breaking point.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250416889571/en/

Bankruptcy Index

"Bankruptcy inquiries hit the highest we've seen since early 2020, just before Americans' checkbooks were boosted by COVID checks from the government," said Matt Layton, LegalShield senior vice president of consumer analytics. "When you combine record debt, rising delinquencies, and prolonged financial stress, topped by price pressures driven by tariff uncertainty, the risk of a summer surge in bankruptcy filings becomes very real."

Historically LegalShield’s Bankruptcy Index is a leading indicator of actual bankruptcy filings by two quarters.

The bankruptcy warning signs come amid a third straight quarter of elevated consumer stress measured by LegalShield’s Consumer Stress Legal Index (CSLI), pointing to a heightened financial strain that has become a "new normal" for American households.

The CSLI has remained elevated since a spike in July of 2024, leveling off slightly to close Q1 2025 at 65.3, down from 67.3 at the end of 2024. The decline was driven by a significant drop in consumer finance inquiries amidst tax refund season and relatively strong employment numbers, which may be masking greater concerns as bankruptcy and foreclosure inquiries increased before tariff announcements sent the markets into turmoil.

Why it matters: The CSLI, based on over 35 million legal service requests from LegalShield members, offers a unique, real-time view into American households’ financial well-being.

Many American households may be poised for a breaking point in the first half of 2025 as they deal with new tariffs, rising prices, increased debt and sustained elevated interest rates. U.S. bankruptcy filings surged 14.2% year-over-year by the end of 2024, according to the U.S. Courts, and LegalShield data indicates filings may continue to rise.

Key Findings:

1. Bankruptcy Risk Rising Quickly

- Index: 36.4 (up from 33.3 in Q4; 30.0 in Q1 2024)

- Insight: Consumers are buried by record debt. The Federal Reserve Bank of New York reported that the share of households 90+ days late on credit cards and car loans hit a 14-year high at the end of 2024, and delinquencies are still climbing. Credit card balances hit a record high of $1.21 trillion.

2. Mortgage Pressure Intensifying

- Foreclosure Index: 41.3 (up from 40.1 in Q4; 36.2 in Q1 2024)

- Insight: Elevated mortgage rates and affordability constraints are stressing homeowners and freezing inventory.

3. Consumer Finance Concerns Ease—For Now

- Consumer Finance Index: 97.9 (down from 108.5 in Q4; 99.7 in Q1 2024)

- Insight: Tax refunds and strong job growth gave consumers a temporary cushion—but risks remain as tariff-driven price increases are expected.

4. Housing Market Signals Softness

- Housing Construction Index: 114.1 (down from 118.4 in Q4; 115.3 YoY)

- Housing Sales Index: 94.1 (down from 97.9 in Q4; slightly up from 92.3 YoY)

- Insight: Higher material costs driven by tariffs and elevated mortgage rates are dampening both buyer interest and builder activity. Housing starts are a leading indicator of broader economic activity. Reduced residential construction not only limits future housing supply, putting upward pressure on home prices, but also weakens associated industries like construction materials, labor markets, and durable goods.

What is the CSLI: The CSLI tracks approximately 150,000 calls per month from everyday Americans seeking legal help, comprising a dataset of more than 35 million consumer requests since 2002. The index is built on three subindices tracking calls for legal assistance for issues related to Bankruptcy, Foreclosure and Consumer Finance, which measures inquiries regarding a variety of consumer financial concerns such as billing disputes, debt issues and loan modifications.

About the LegalShield Consumer Stress Legal Index:

As part of LegalShield’s mission to ensure every person has equal access to justice, the company mines its data for insights policymakers can use to make a real, positive impact in their decision making. The LegalShield Consumer Stress Legal Index comprises three subindices that reflect the demand for various legal services. LegalShield’s dataset includes more than 35 million consumer requests for legal assistance since 2002, averaging approximately 150,000 calls received monthly. The CSLI uncovers the daily challenges people are facing and provides actionable intelligence to help policymakers and industry leaders bridge those gaps. Released quarterly, view past reports on the CSLI page on LegalShield.com.

About LegalShield:

For more than 50 years, LegalShield has provided everyday Americans with easy and affordable access to legal advice, counsel, protection, and representation. Serving millions, LegalShield is one of the world's largest platforms for legal, identity, and reputation management services protecting individuals and businesses across North America. Founded in 1972, LegalShield, and its privacy management product, IDShield, has provided individuals, families, businesses, and employers with tools and services needed to affordably live a just and secure life. Through technology and innovation, LegalShield is disrupting the traditional legal system and transforming how and where people receive legal guidance and services, with access to hundreds of qualified, trusted attorneys and law firms. LegalShield and IDShield are products of Pre-Paid Legal Services, Inc. To learn more about LegalShield and IDShield, visit LegalShield.com and IDShield.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250416889571/en/

Contacts

LegalShield Media Contact:

Hollon Kohtz, Director of Communications

hollonkohtz@pplsi.com