Dublin, Ireland-based Accenture plc (ACN) provides strategy and consulting, industry X, song, and technology and operation services. Valued at $148.8 billion by market cap, the company delivers a range of specialized capabilities and solutions to clients across all industries and operates a network of businesses providing outsourcing and alliances.

Shares of this leading global professional services company have underperformed the broader market considerably over the past year. ACN has declined 32.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.2%. In 2026, ACN stock is down 31.4%, while the SPX is down marginally on a YTD basis.

Narrowing the focus, ACN has also lagged behind the SPDR S&P Software & Services ETF (XSW). The exchange-traded fund has declined about 25.1% over the past year. Moreover, the ETF’s 20.8% losses on a YTD basis outshines the stock’s dip over the same time frame.

On Dec. 18, 2025, ACN shares closed down more than 1% after reporting its Q1 results. Its adjusted EPS of $3.94 exceeded Wall Street expectations of $3.73. The company’s revenue was $18.7 billion, topping Wall Street forecasts of $18.6 billion. ACN expects full-year adjusted EPS in the range of $13.52 to $13.90.

For the current fiscal year, ending in August, analysts expect ACN’s EPS to grow 7.2% to $13.86 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

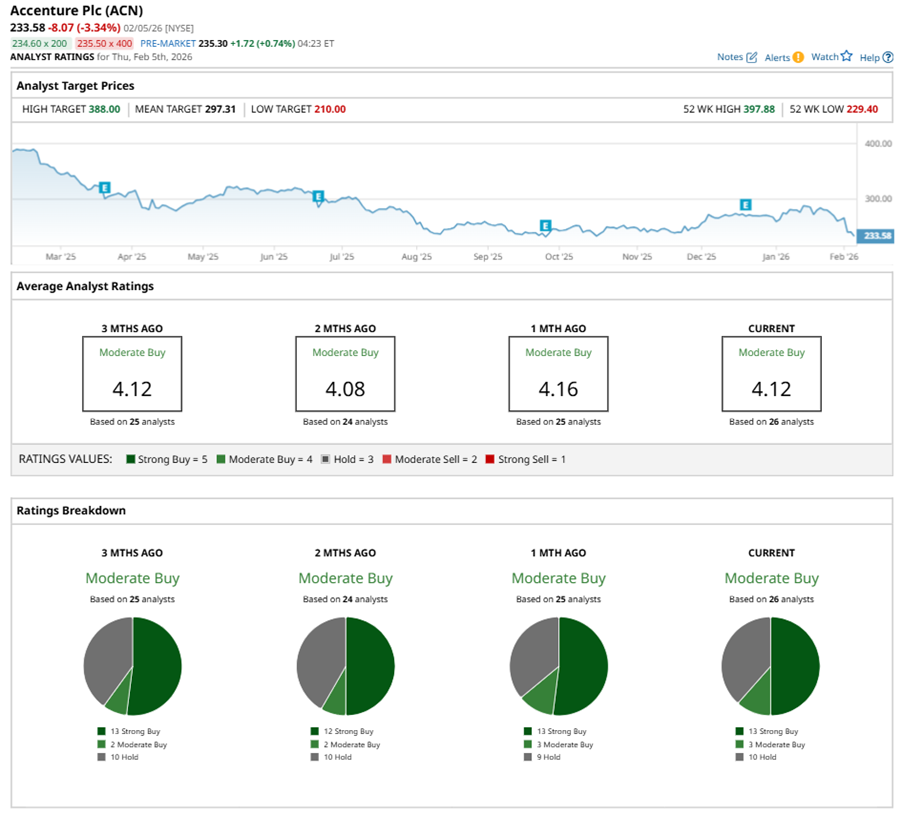

Among the 26 analysts covering ACN stock, the consensus is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, three “Moderate Buys,” and 10 “Holds.”

This configuration is more bullish than two months ago, with 12 analysts suggesting a “Strong Buy,” and two advising a “Moderate Buy.”

On Feb. 2, Morgan Stanley (MS) analyst James Faucette reiterated a “Buy” rating on ACN and set a price target of $320, implying a potential upside of 37% from current levels.

The mean price target of $297.31 represents a 27.3% premium to ACN’s current price levels. The Street-high price target of $388 suggests an ambitious upside potential of 66.1%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart