CoreWeave (CRWV) is an AI cloud powerhouse, delivering specialized GPU infrastructure for training massive AI models. It powers top labs and enterprises with high-performance data centers packed with Nvidia (NVDA) chips, offering fast compute, storage, and software optimized for AI workloads like model training and inference. The company is backed by huge contracts from OpenAI and Meta (META), fueling the AI boom with scalable, efficient cloud services that outpace general clouds.

CoreWeave was founded in 2017, with headquarters in New Jersey, with its data centers spread across the United States and Europe.

CoreWeave Stock

CRWV stock is down 6.6% today amid high volume of 36 million shares, showcasing high volatility with its five-day change being flat but saw a 26% spike in a month. On the other hand, the stock is in the red on a medium-term view as it bleeds 91% in a quarter and 10% in six months.

Compared to the Nasdaq Composite ($NASX), CoreWeave outperforms dramatically over one month against the index’s flat performance and 52 weeks, fueled by Nvidia ties and AI data center deals.

CoreWeave Results

CoreWeave posted robust Q3 2025 results on Nov. 10, 2025, with revenue soaring to $1.36 billion, up 134% year-over-year (YoY), beating analyst estimates of $1.29 billion by 5%. EPS narrowed to -$0.22, far better than the expected -$0.57 loss (61% beat), reflecting strong AI cloud demand.

Key metrics shone for CoreWeave as adjusted EBITDA hit $838 million (61% margin, doubled YoY), adjusted operating income $217 million (16% margin), up from $125 million. Net loss improved to $110 million from $360 million. Cash reserves stood at $3 billion, and CapEx was $1.9 billion. Revenue backlog ballooned to $55.6 billion, nearly double Q2.

CoreWeave guided full FY 2025 revenue at $5.05-$5.15 billion (below some estimates of $5.29 billion), adjusted operating income $690-$720 million, CapEx $12-14 billion, and over 850 MW active power. No specific Q4 breakdown, but backlog signals sustained AI growth.

CoreWeave Upgraded By Analyst

Deutsche Bank upgrades CRWV stock to "Buy" from its previous “Hold” rating with a $140 price target, signaling a major 40% upside potential. The firm shifted from “Hold,” citing the company's strong 2026 outlook and Nvidia's fresh $2 billion investment plus deeper partnership to build over 5 GW of AI factories by 2030. Shares jumped 7% Tuesday morning on the news.

Analysts, led by Brad Zelnick, see this as strategic, not just cash, for CoreWeave. It speeds up the company's 5GW+ goal (beyond the 2.9GW backlog) via Nvidia's resources for land/power, ensures early access to new Nvidia chips, and may embed CoreWeave's software in Nvidia designs for high-margin cloud sales.

Deutsche highlights CoreWeave's edge: >1GW ready power amid shortages and a quick rollout of new platforms like Rubin. They'll watch Q4 2025 earnings, which are scheduled for March 3, expecting revenue of $1.54B and EPS of -$0.49.

Should You Buy CRWV Stock?

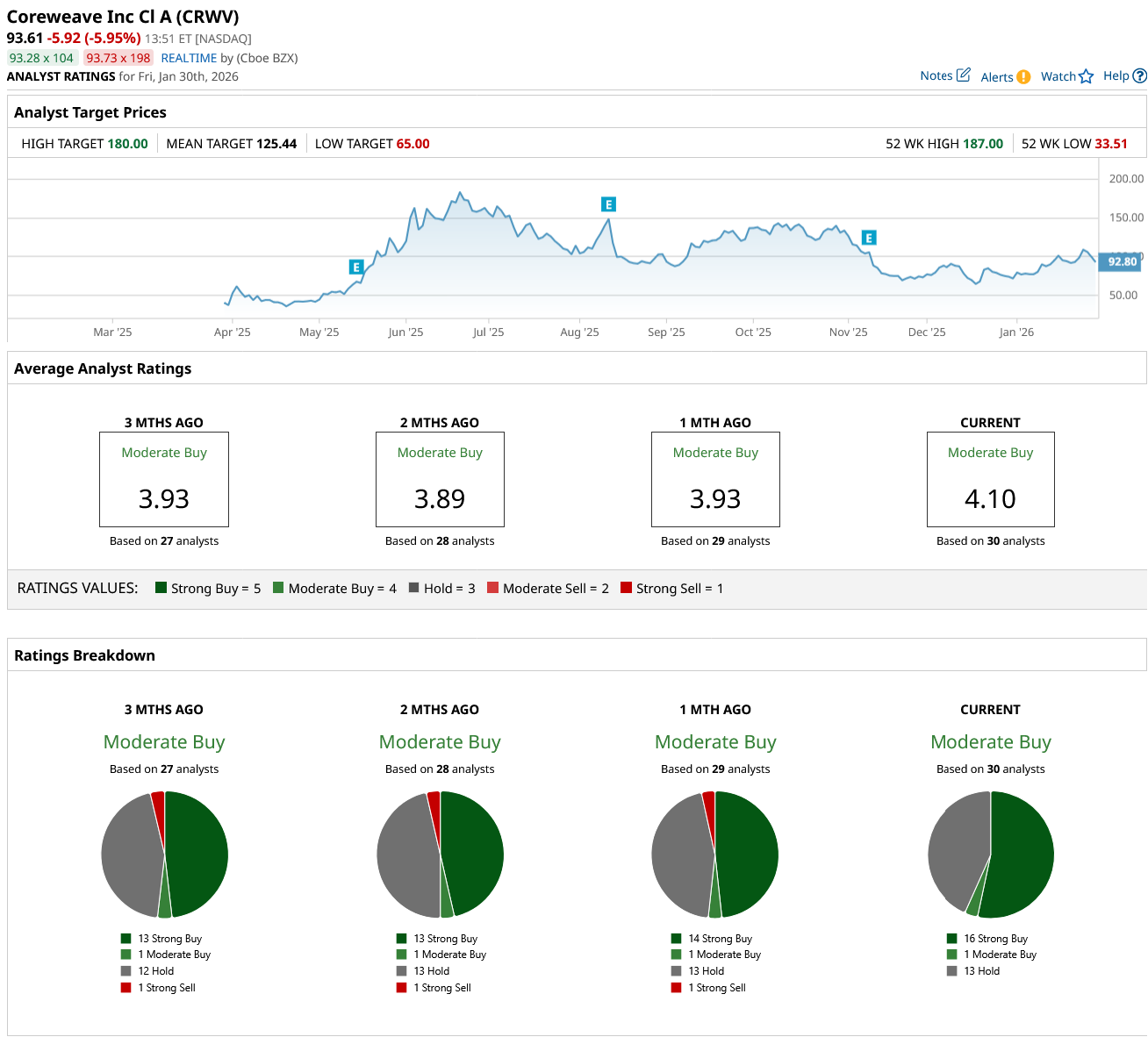

CoreWeave’s support on Wall Street has improved lately as the stock maintains its “Moderate Buy” consensus among analysts with a mean price target of $124.44, reflecting a 33% upside from the market price.

CRWV stock has been rated by 30 analysts, with 16 “Strong Buy” ratings, one “Moderate Buy” rating, and 13 “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart