Atlassian (TEAM) builds simple, powerful tools that help teams collaborate and get work done. The company's portfolio includes Jira for project tracking, Confluence for team knowledge sharing, Trello for visual task boards, and Loom for quick video updates. Over 300,000 customers — including 80% of Fortune 500 firms — rely on Atlassian to ship faster, solve issues, and align efforts.

Founded in 2002, Atlassian is headquartered in Sydney, Australia, with a U.S. base in San Francisco, California serving clients in more than 200 nations and territories globally. Here's what investors should know about TEAM stock moving forward

Atlassian Stock Struggles

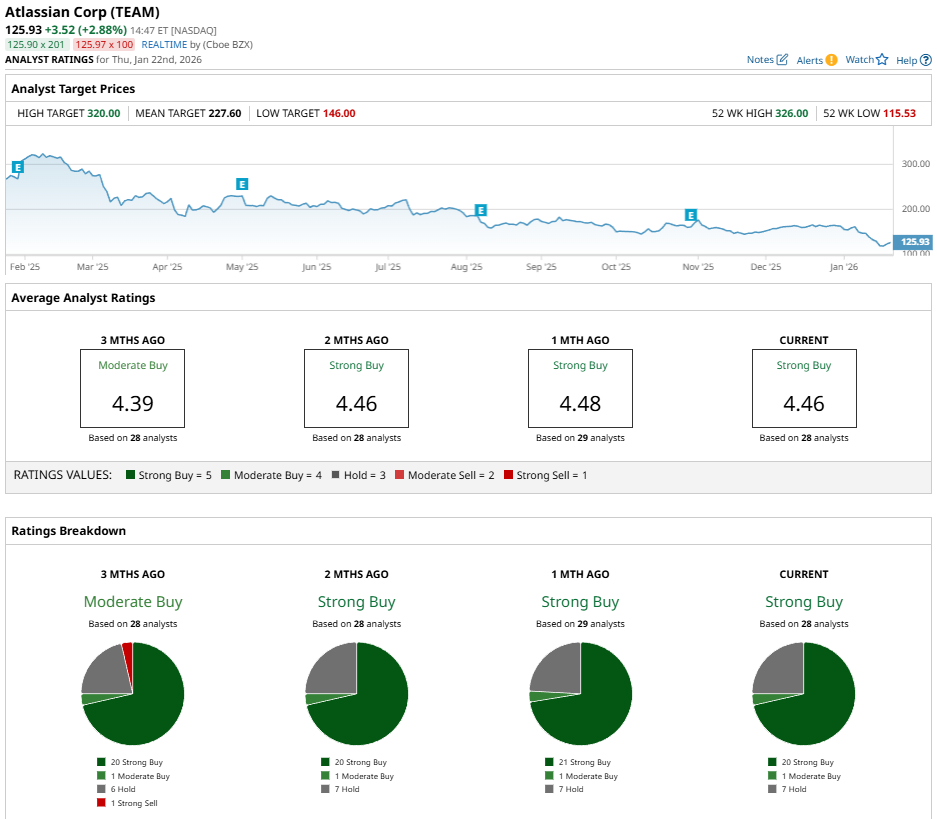

TEAM stock is down 60% from its 52-week high of $326 and trades for about $131 per share, near its 52-week low of $115.53 set earlier this month. The stock has declined 19% over the past month and 35% over the past six months.

Compared to its index, the Nasdaq Composite ($NASX), TEAM stock is largely underperforming. The Nasdaq Composite has gained 12% in the past six months and returned 17% in the past 52-week period. Trading below its moving averages, Atlassian lags the market due to AI competition and macro headwinds.

Atlassian's Latest Results

Atlassian posted its first-quarter fiscal 2026 results on Oct. 30, reporting revenue of $1.43 billion, up 21% year-over-year (YOY) and beating analyst estimates of $1.4 billion. Cloud revenue grew the fastest at $998 million, up 26% YOY. Net income per share was $1.04, topping forecasts of $0.83. Strong enterprise sales and cloud migrations drove the beats.

Non-GAAP operating margin was a solid 23%, with gross margin at 82%. Operating cash flow came in at $129 million. Remaining Performance Obligations (RPO) — future committed revenue — jumped 42% YOY to $3.3 billion, showing customer confidence.

For Q2, the company’s revenue guidance is at $1.535 billion to $1.543 billion, edging past analyst estimates. Meanwhile, the non-GAAP operating margin is expected to be 24.5%. Full fiscal 2026 revenue is eyeing for 20.8% growth, while the company is also introducing a fresh $2.5 billion share buyback program.

What Do Analysts Think of TEAM Stock?

Down 25% year-to-date (YTD) at the time of Morgan Stanley's evaluation, TEAM stock is "deeply discounted" according to analyst Keith Weiss. While it is presently one of the worst performers in large-cap software, the situation creates an attractive setup ahead of Q2 results.

Investors worry about AI hurting Atlassian's seat-based model, but Weiss sees AI as a tailwind bringing in more developers, complex projects that need coordination, and AI-powered tools that boost customer stickiness, cloud migrations, and upsells. About 50% of users are “non-technical” per Morgan Stanley, while Jira Service Management (JSM) makes for 15% to 20% of the company's business.

Enterprise momentum, diverse products, and steady IT budgets point to conservative guidance. Morgan Stanley expects more than 22% revenue growth and a 26% operating margin in Q2, making the dip in TEAM a smart long-term buy.

Despite the heavy losses Atlassian investors have suffered of late, analysts generally remain firm on TEAM with a consensus “Strong Buy” rating. The mean price target sits at $226.80, reflecting potential upside of 73% from the current market rate. Based on 28 market experts with coverage, TEAM has 20 “Strong Buy” ratings, one “Moderate Buy” rating, and seven “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why the Big 3 Cruise Stocks Are Looking More and More Like Sinking Ships

- Buy the Dip in Apple Stock Before January 29, According to Goldman Sachs

- Micron’s 2026 Earnings Upside Makes MU Stock Hard to Ignore

- Blue Origin Is Gunning for AST SpaceMobile. Should You Sell ASTS Stock Now or Keep Betting on Gains?