Bethesda, Maryland-based Host Hotels & Resorts, Inc. (HST) is the largest lodging REIT in the U.S., owning a high-quality portfolio of luxury and upper-upscale hotels primarily in top U.S. markets. With a market cap of $11 billion, the company focuses on acquiring, renovating, and operating premium hotel properties through partnerships with leading hotel brands, benefiting from strong travel demand and prime locations.

Despite its premium hotel portfolio, Host Hotels & Resorts has struggled to keep pace with the broader market. HST stock has plummeted 8.6% on a YTD basis and 9.8% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 16.3% gains in 2025 and 17.7% returns over the past year.

Even within its own lane, the REIT has lagged peers, underperforming the Real Estate Select Sector SPDR Fund (XLRE), which soared marginally in 2025 and has dropped 7% over the past 52 weeks.

With the hotel sector facing secular challenges, like slower corporate travel recovery and increased competition from alternative lodging, HST’s lower growth profile and cautious guidance have led investors to favor higher-growth areas of the market, contributing to its relative underperformance.

For the full fiscal 2025, ending in December, analysts expect HST to report a 1.5% year-over-year drop in AFFO to $2 per share. On the positive note, the company has a solid earnings surprise history. It has matched or surpassed the Street’s bottom-line estimates in each of the past four quarters.

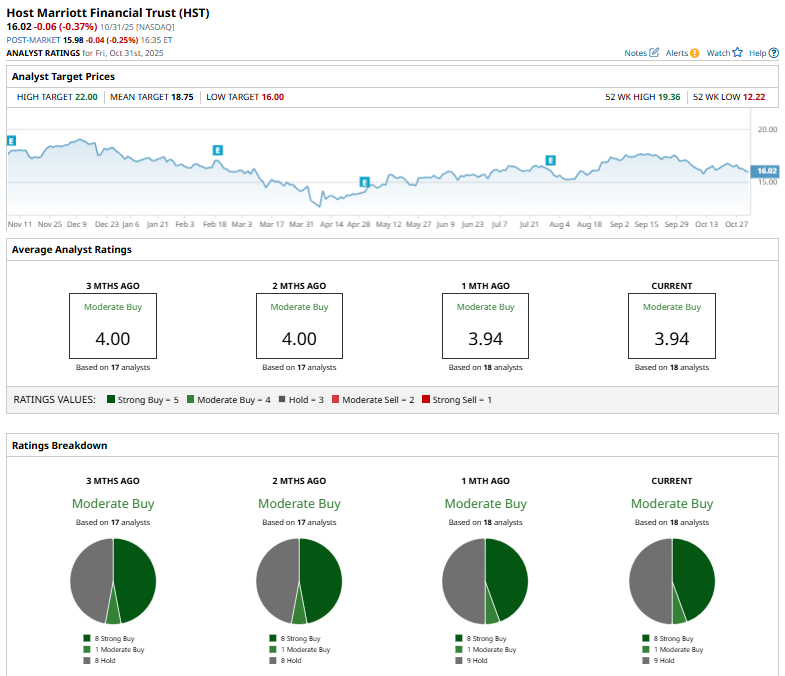

Host maintains a consensus “Moderate Buy” rating overall. Of the 18 analysts covering the stock, opinions include eight “Strong Buys,” one “Moderate Buy,” and nine “Holds.”

This configuration has been stable over the past few months.

On Oct. 4, Wells Fargo analyst Dori Kesten reaffirmed a “Buy” rating on Host Hotels & Resorts and kept the price target at $19.

Host’s mean price target of $18.75 represents a 17% upside potential. Meanwhile, the Street-high target of $22 suggests a notable 37.3% premium to current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart