Achieving U.S. FinCEN registration marks a key milestone in Chobes Digital Asset Center's global compliance roadmap and reinforces its commitment to regulatory transparency and institutional trust.

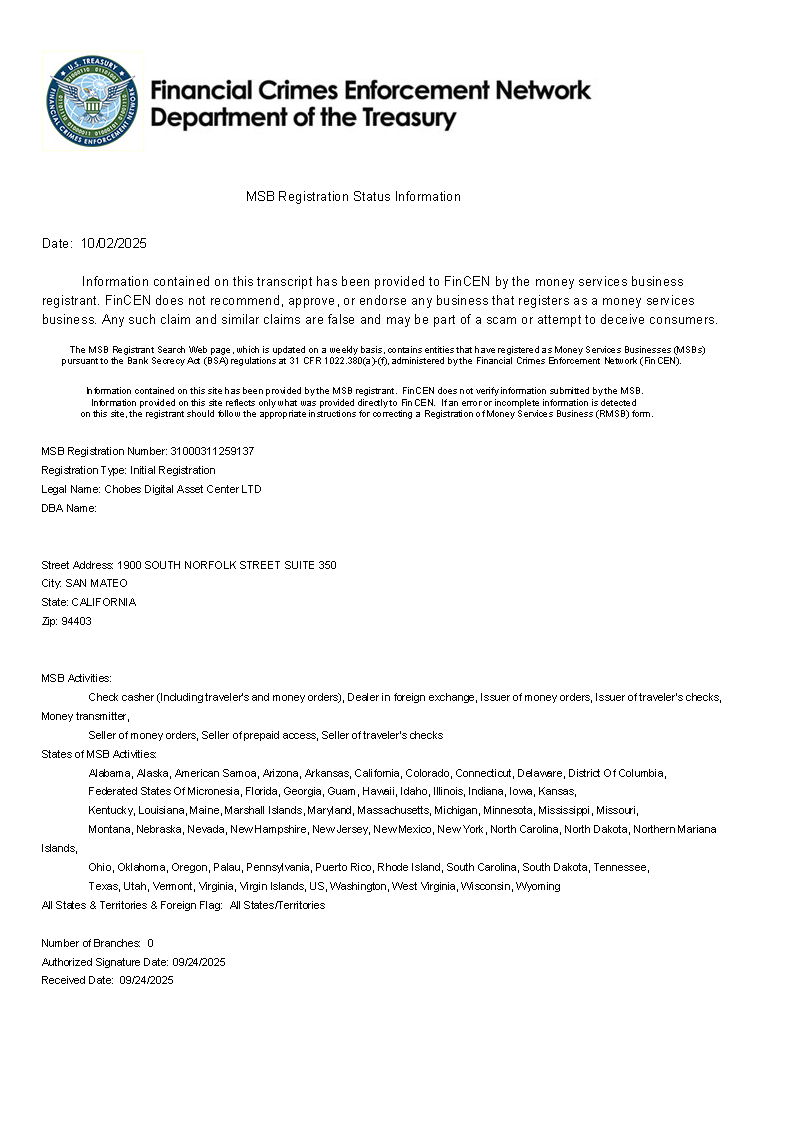

NEW YORK CITY, NEW YORK / ACCESS Newswire / November 4, 2025 / Chobes Digital Asset Center, a global digital asset trading and financial technology platform, has successfully obtained registration as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

This regulatory approval marks a significant advancement in Chobes' global compliance roadmap, reinforcing the company's dedication to operating under internationally recognized financial standards.

Strengthening Regulatory Alignment and Market Integrity

The MSB registration serves as a foundational requirement for entities engaged in money transmission, currency exchange, and digital asset-related services within the United States.

By obtaining this credential, Chobes Digital Asset Center demonstrates full alignment with U.S. federal oversight, specifically in areas governed by Anti-Money Laundering (AML), Counter-Terrorist Financing (CFT), and Know Your Customer (KYC) obligations.

As an MSB-registered entity, Chobes operates under a framework that includes:

Continuous transaction monitoring and suspicious activity reporting.

Enhanced due diligence for institutional and retail participants.

Comprehensive data protection and identity verification protocols.

Transparent reporting mechanisms supporting regulatory and audit readiness.

Nathan Grayson, Director of Compliance Affairs at Chobes Digital Asset Center, commented:

"Regulatory integrity is central to our mission. The MSB registration ensures that Chobes' global operations meet the highest standards of transparency, oversight, and user protection."

Expanding Within a Structured Global Compliance Framework

With the FinCEN registration in place, Chobes Digital Asset Center continues to enhance its international compliance infrastructure.

The company is building a unified regulatory foundation that supports consistent operational standards across all regions where it operates - ensuring that users and institutional partners experience the same level of protection, governance, and accountability worldwide.

Its compliance architecture integrates automated risk assessment, adaptive monitoring systems, and policy engines designed to adjust dynamically to evolving legal requirements and jurisdictional expectations.

Building Trust Through Accountability and Oversight

In alignment with its compliance-first philosophy, Chobes Digital Asset Center has established additional internal governance layers, including a dedicated compliance committee, periodic third-party audits, and structured reporting frameworks that ensure continued regulatory readiness.

These initiatives underscore Chobes' commitment to not only meeting but exceeding industry standards - positioning the platform as a benchmark for responsible digital asset operations.

By reinforcing transparency, risk management, and data security, Chobes continues to strengthen its institutional trust and user confidence.

About Chobes Digital Asset Center

Chobes Digital Asset Center is a next-generation digital asset infrastructure platform built for professional and institutional use.

Focused on security, transparency, and performance, Chobes provides advanced solutions for digital asset trading, liquidity management, and risk oversight.

Media Contact

Company Name: Chobes

Contact Person: Nicole Foster

Email: service@chobes.com

Website: https://chobes.com

SOURCE: Chobes

View the original press release on ACCESS Newswire