This release has been corrected from the earlier version by correcting a date error in the prior headline and inserts the correct graphic for Annual Originations in Millions of Units.

ANN ARBOR, MI / ACCESSWIRE / September 8, 2023 / University Bancorp, Inc. (OTCQB:UNIB) announced that it had an unaudited net income attributable to University Bancorp, Inc. common stock shareholders in 2Q2023 of $1,557,298, $0.32 per share on average shares outstanding of 4,929,518 for the second quarter, versus an unaudited net income of $141,370, $0.03 per share on average shares outstanding of 4,929,518 for 2Q2022.

For the 6 months ended June 30, 2023, net income was $2,413,116, $0.49 per share on average shares outstanding of 4,929,518 for the period, versus $2,483,009, $0.51 per share on average shares outstanding of 4,907,851 for the 6 months ended June 30, 2022.

For the 12 months ended June 30, 2023, net income was $3,719,507, $0.76 per share on average shares outstanding of 4,929,518 for the period.

Shareholders' equity attributable to University Bancorp, Inc. common stock shareholders was $78,550,184 or $15.93 per share, based on shares outstanding at June 30, 2023 of 4,929,518.

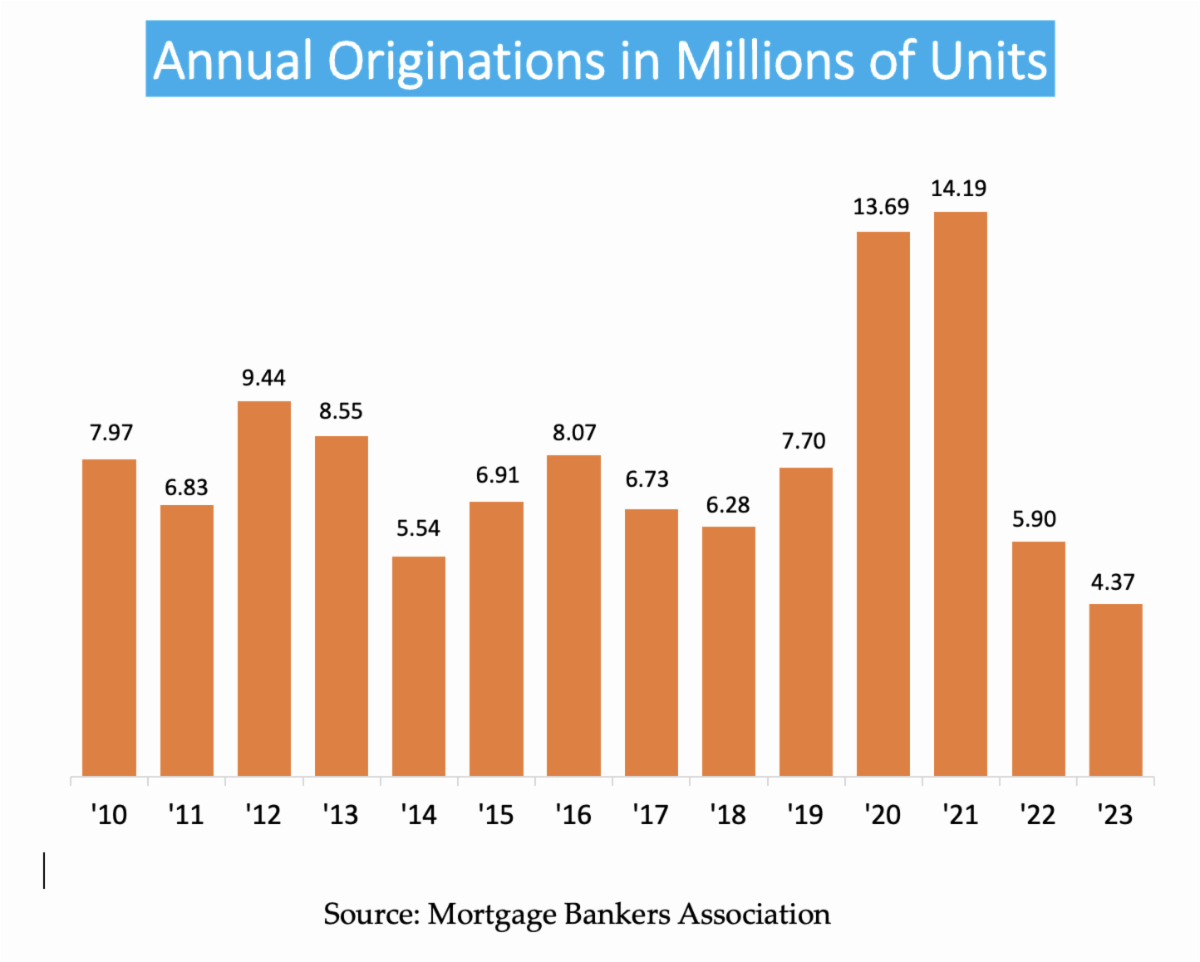

President Stephen Lange Ranzini noted, "Industry-wide mortgage origination volumes are at 27-year lows. The Mortgage Bankers Association notes that mortgage applications have not been this low since December 1996." Here is a chart of U.S. mortgage origination volume going back to 2010, not in dollars but in millions of units. The 2023 number is an estimate:

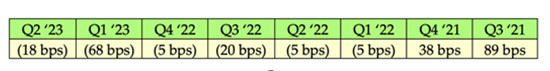

President Stephen Lange Ranzini noted, "Industry-wide gain on sale margins also dropped to record low levels in 1Q2023 and have now been negative for six quarters." Here is a chart of industry-wide profitability each quarter since Q32021:

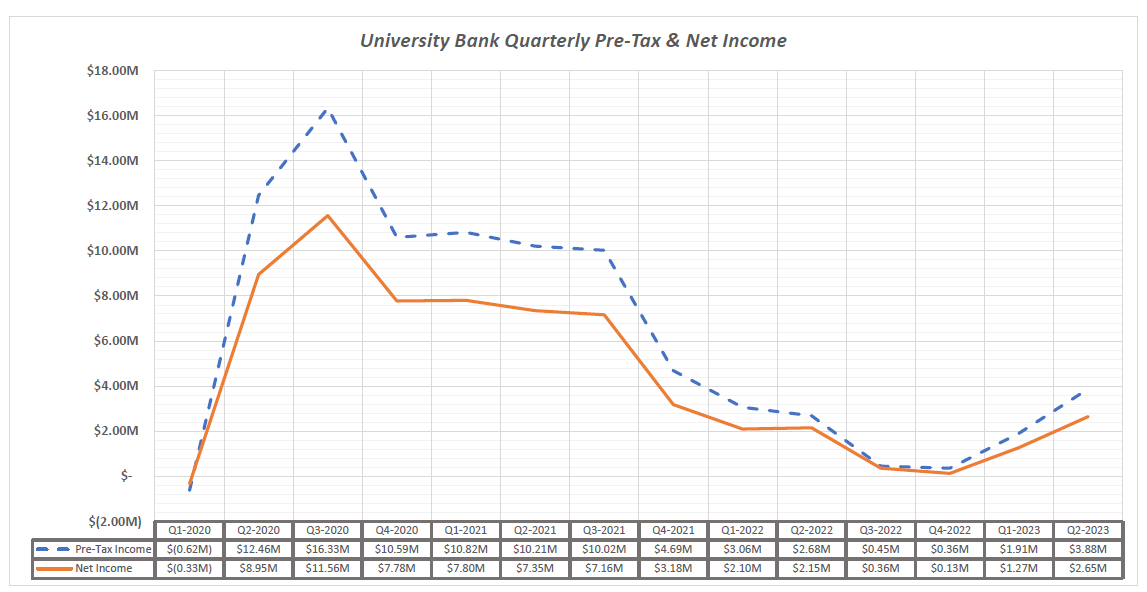

"Despite the extremely poor industry conditions, during the six quarters that the mortgage origination industry lost money, University Bank earned profits each quarter, and our profitability has been steadily rising since December 2022, due to a shift in strategy."

Here is a chart that shows the quarterly profitability of University Bank starting in 1Q2020:

Starting in March 2022, we began to increase our residential loans held for investment. Overall, our loan portfolio, which was $190.5 million at 12/31/2021, rose as we retained a mix of 7-year ARMs and monthly adjusting first mortgage HELOCs. At 12/31/2022 our loan portfolio held for investment was $553.9 million, and at 6/30/2023 it was $621.5 million. ROE at University Bank is now reaching acceptable levels, with the annualized ROE as follows:

April 2023 8.3%

May 2023 12.6%

June 2023 17.4%

July 2023 14.3%

August results are not yet finalized and appear to be in line with June's. The improvement in results is driven by net interest income generated from the larger portfolio of loans held for investment combined with multiple rounds of cost-cutting.

Our subservicing business, Midwest Loan Services, has been negatively impacted by financial institution customers opting to sell MSRs to book gains on sale to offset the lower profitability from loan originations. The number of mortgages serviced fell to 166,030, approximately 24,000 mortgages under the recent high-water mark. The escrow deposits controlled by Midwest fell in line with the lower numbers of loans subserviced and the substantial decline in mortgage payoff activity. In June 2023, Midwest generated an average balance of $388.7 million of non-interest-bearing escrow deposits. While the recent trend is disappointing, improved marketing led by a new CEO, following the retirement of the incumbent, has resulted in a robust pipeline of new business development.

Overall, our business development efforts continue at a rapid pace. For example, in February 2023 we opted to become a Financial Holding Company instead of a Bank Holding Company and then used this new status to form a captive insurance company, Crescent Assurance, PCC, with an initial capital investment of $250,000. Crescent was licensed by the Government of the District of Columbia Department of Insurance, Securities and Banking. Included in the 6M2023 results is net income from Crescent of $243,378. In December 2022, University Bank purchased 12.5% of Credit Union Trust for an investment of $1,093,075, and we are working with the management team of both organizations to roll-out some new products and services to our customer base. We are also in discussions with other mortgage origination firms about a merger or acquisition, which would improve profitability of the combined enterprise, with teams of profitable mortgage originators about lift-outs, and we continue to pursue a long list of other organic growth opportunities.

Earnings in 2Q 2023, were assisted by three factors that had a net positive impact of $7,246 before taxes as follows:

-

Mortgage Servicing Rights Valuation adjustment:

With the rise in long term mortgage interest rates during the quarter the valuation of our MSRs increased $229,754;

-

Mortgage Origination Pipeline valuation adjustment:

The fair market value of the hedged mortgage origination pipeline (FMV) fell $151,508 as the value of locked loans fell over the level at 1Q 2023;

-

Allowance for Loan Losses adjustment:

The Allowance for Loan Losses was increased by $71,000.

Earnings in 1Q 2023, were assisted by two factors that with a net positive impact of $316,858 before taxes as follows:

-

Mortgage Servicing Rights Valuation adjustment:

With the fall in long term mortgage interest rates during the quarter the valuation of our MSRs decreased $476,817;

-

Mortgage Origination Pipeline valuation adjustment:

The fair market value of the hedged mortgage origination pipeline (FMV) rose $793,675 as the amount of locked loans rose over the level at 4Q 2022 due to seasonal factors.

Mortgage origination volumes decreased in 1H2023, with closings of $549.0 million versus $678.9 million in 1H2022, a decrease of 19.1%.

For 2Q2023, the Company had an annualized return on equity attributable to common stock shareholders of 8.2% on initial common stockholders' equity of $76,283,525. Return on equity over the trailing twelve months was 4.9% on initial equity attributable to common stock shareholders of $75,003,103.

Total Assets at 6/30/23 were $833,497,000 versus $776,141,240 at 3/31/2023, $778,783,995 at 12/31/2022, $665,502,653 at 9/30/2022, $555,384,087 at 6/30/2022, $478,421,302 at 3/31/2022 and $484,491,457 at 12/31/2021.

The Tier 1 Leverage Capital Ratio at 6/30/2023 declined to 10.27% on average net assets of $833,497,000 from 10.31% at 3/31/23 on net average assets of $760,014,000, from 10.30% at 12/31/22 on net average assets of $686.5 million, 10.37% at 9/30/2022 on net average assets of $606.2 million, 11.06% at 6/30/2022 on net average assets of $457.5 million, 12.30% at 3/31/2022 on net average assets of $432.4 million, and 10.30% at 12/31/2021 on net average assets of $522.7 million.

Basel 3 Common Equity Tier 1 Capital at 6/30/2023 was $85,576,000, at 3/31/2023 was $78,339,000, at 12/31/2022 was $70,672,000, at 9/30/2022 was $62,896,000, at 6/30/2022 was $50,592,000, at 3/31/2022 was $53,186,000 and at 12/31/2021 was $53,824,000.

At 6/30/2023, the Company had $28 million of subordinated debt outstanding and one class of preferred stock outstanding. The subordinated debt was issued to facilitate the change in strategy to expand University Bank's balance sheet with additional portfolio loans. The subordinated debt, which matures 1/31/2033, has interest for the first five years fixed at 8.25% and floats at a variable rate of 4.87% over SOFR for the second five years, however the Company entered into an interest rate swap agreement which effectively fixes the interest rate for the second five years of the term at 8.08%. The preferred stock is convertible at $10 per share with a liquidation preference of $2,400,000. Management intends to trigger the conversion of this preferred stock in December 2023, which would result in the issuance of 240,000 shares of common stock. At 6/30/2023 cash & equity investment securities at the Company, available to meet working capital needs and to support investment opportunities at University Bancorp were $22 million. The company also has a $10 million line of credit available with no amount currently drawn. This line of credit matures October 2025 with interest at Prime Rate, capped at 6.25%.

Treasury shares as of 6/30/2023 were 277,381 shares.

The performance of our portfolio loans and our overall asset quality continues to perform well. We had two foreclosed other real estate owned properties at quarter-end (both residential homes related to GNMA buybacks) with a balance of $551,379, and substandard assets were 5.09% of Tier 1 Capital at 6/30/2023. The allowance for portfolio loan losses stood at $3,599,778 or 0.57% of the amount of portfolio loans, excluding the loans held for sale.

At 6/30/2023, we had the following with respect to delinquent loans (including both delinquent portfolio loans and delinquent loans held for sale):

Delinquent 30 Days to 59 Days, $567,071

Delinquent 60 Days to 89 Days, $542,809

Delinquent Over 90 Days & on Non-Accrual, $1,613,861*

*This balance consisted of seven residential loans, and excludes GNMA loans that are 100% guaranteed. Subsequent to quarter-end, one of these loans in the amount of $233,305 paid in full. In addition, we own $336.8 million of MSR's related to GNMA originated residential mortgage pool loans, of which $2,743,318 have reached a 90-day delinquency status and are therefore included on our balance sheet per GAAP, and $551,379 in GNMA loans that we have repurchased from GNMA pools that are delinquent over 90 days. Most of these loans are 100% principal guaranteed by FHA, others have smaller percentage guarantees.

Other Key statistics as of 6/30/2023:

| · 10-year annual average revenue growth*, | 16.0% |

| · 5-year annual average revenue growth*, | 14.9% |

| · 1H2023 vs. 1H2022 revenue growth*, | 1.1% |

| · TTM Revenue | $95,142,985 |

| · 10 Year Average ROE | 27.9% |

| · 5 Year Average ROE | 36.4% |

| · LLR/NPAs>90 % | 166.2% |

| · Debt to equity ratio, | 34.6% |

| · Current Ratio, # | 169.5x |

| · Efficiency Ratio, %+ | 69.5% |

| · Total Assets, | $833,497,000 |

| · Loans Held for Sale, before Reserves, | $81,616,000 |

| · NPAs >90 days | $1,613,861 |

| · TTM ROA% | 0.74% |

| · TCE/TA % | 10.31% |

| · Total Capital Ratio % | 14.60% |

| · NPAs/Assets % | 0.45% |

| · Texas Ratio % | 4.19% |

| · NIM % | 3.85% |

| · NCOs/Loans | -0.008% |

| · Trailing 12 Months P-E Ratio | 18.2x |

*Using TTM, 1H2023, 1H2022, 2022, 2021, 2020, 2019, 2018, 2017, 2016, 2015 and 2014 revenue which were $95,142,985, $51,847,468, $50,782,234 $94,077,751, $133,175,856, $136,991,511, $69,112,502, $55,988,570, $54,493,179, $50,948,149, $43,644,425 and $36,598,052, respectively.

#Parent company only current assets divided by 12-month projected cash expenses.

+Calculated as: (non-interest expense/ (net interest income + non-interest income)).

xBased on last sale of $13.75 per share.

Excluding goodwill & other intangibles related to the acquisition of Midwest Loan Services and Ann Arbor Insurance Center, net tangible shareholders' equity attributable to University Bancorp, Inc. common stock shareholders was $77,713,408 or $15.76 per share at 6/30/2023. Please note that we view the current market values of our insurance agency and Midwest Loan Services as substantially in excess of their carrying value including this goodwill.

Shareholders and investors are encouraged to refer to the financial information including the investor presentations, audited financial statements, strategic plan and prior press releases, available on our investor relations web page at: http://www.university-bank.com/bancorp/. A detailed income statement, balance sheet and other financial information for University Bank as of 6/30/2023 are available here: https://www.university-bank.com/wp-content/uploads/2023/09/University-Bank-Detailed-Financial-Information-June-2023.pdf.

Ann Arbor-based University Bancorp owns 100% of University Bank which, together with its Michigan-based subsidiaries, holds and manages a total of over $36 billion in financial assets for over 175,000 customers, and our 489 employees make us the 5th largest bank based in Michigan. University Bank is an FDIC-insured, locally owned and managed community bank, and meets the financial needs of its community through its creative and innovative services. Founded in 1890, University Bank® is the 15th oldest bank headquartered in Michigan. We are proud to have been selected as the "Community Bankers of the Year" by American Banker magazine and as the recipient of the American Bankers Association's Community Bank Award. University Bank is a Member FDIC. The members of University Bank's corporate family, ranked by their size of revenues are:

- UIF, a faith-based banking firm based in Southfield, MI;

- University Lending Group, a retail residential mortgage originator based in Clinton Township, MI;

- Midwest Loan Services, a residential mortgage subservicer based in Houghton, MI;

- Community Banking, based in Ann Arbor, MI, which provides traditional community banking services in the Ann Arbor area;

- Midwest Loan Solutions, a reverse residential mortgage lender and warehouse lender based in Southfield, MI;

- Ann Arbor Insurance Centre, an independent insurance agency based in Ann Arbor.

CAUTIONARY STATEMENT: This press release contains certain forward-looking statements that involve risks and uncertainties. Forward-looking statements include, but are not limited to, statements concerning future growth in assets, pre-tax income and net income, budgeted income levels, the sustainability of past results, mortgage origination levels and margins, valuations, and other expectations and/or goals. Such statements are subject to certain risks and uncertainties which could cause actual results to differ materially from those expressed or implied by such forward-looking statements, including, but not limited to, economic, competitive, governmental and technological factors affecting our operations, markets, products, services, interest rates and fees for services. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to update any information or forward-looking statement.

Contact:

Stephen Lange Ranzini, President and CEO

Phone: 734-741-5858, Ext. 9226

Email: ranzini@university-bank.com

SOURCE: University Bancorp, Inc.

View source version on accesswire.com:

https://www.accesswire.com/782310/correction-by-source-university-bancorp-2q2023-net-income-1557298-032-per-share