Shares of GameStop (NYSE: GME) plunged more than 20% today after the company reported a miss on profit and sales estimates and declined to offer more details about the outlook for 2021.

Fundamental analysis: More leadership changes announcedGameStop made a profit of $1.34 per share in the fourth-quarter to miss on the $1.35 that the surveyed market analysts were calling. Sales for the quarter were reported at $2.12 billion to miss on the Wall Street estimates of $2.21 billion.

The company is working to accelerate the shift to digital sales after Q4 sales rose 175% while same-store sales gained 6.5%

“The past year also saw us take steps to accelerate our de-densification efforts and streamline our store footprint, leverage our retail locations to provide same-day delivery and curbside pickups, and continue to enhance our suite of E-Commerce platforms,” George Sherman, the chief executive officer of the company, said in a press release.

Investors were also not happy that the company declined to offer guidance for this quarter and for the full-year, except for the fact that February comparable store sales gained 23%.

“As we look ahead, we are excited by the opportunities that are in front of us as we begin prioritizing long-term digital and E-Commerce initiatives while continuing to execute on our core business during this emerging console cycle,” Sherman added.

GameStop also said it hired Jenna Owens for the role of Chief Operating Officer (COO). Owens is arriving from Amazon, where she acted as a director and general manager for Distribution and Multi-Channel Fulfillment.

Following last night’s results, Wedbush analyst Michael Pachter moved to downgrade the stock to “Underperform” from “Neutral” due to high market valuation.

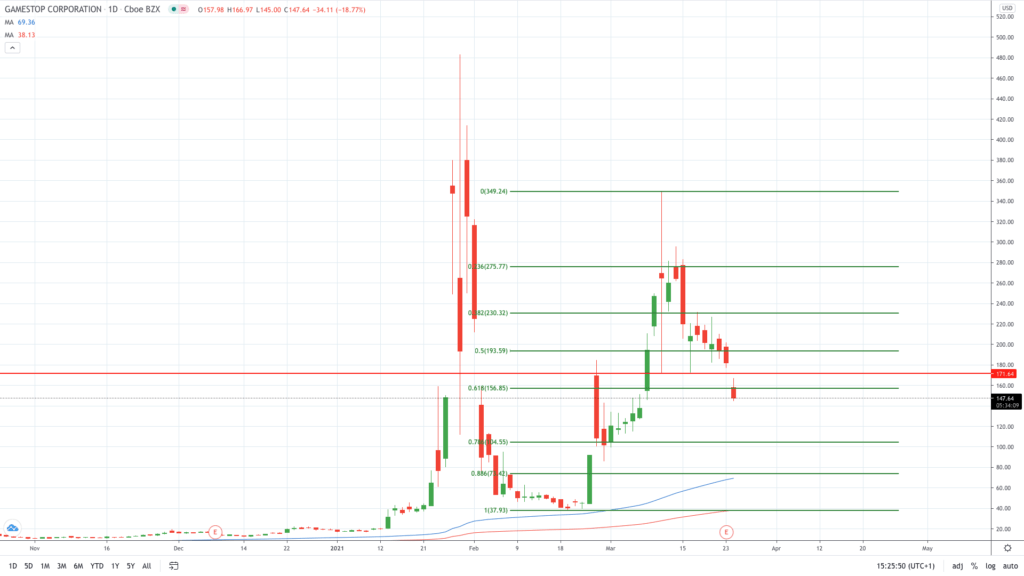

Technical analysis: Breaking key NT supportGameStop stock price has plunged over 20% to trade below the $150 mark for the first time in nearly 3 weeks. The stock is now down over 27% to trim monthly gains to below 45%. GME stock lost almost 70% in February.

GameStop daily chart (TradingView)

GameStop daily chart (TradingView) The price action is now testing, and what it looks like, breaking below the key near-term support of 61.8% Fibonacci retracement line near $157.00. The next support is located in the low $110s where retail investors are likely waiting to buy GME stock.

SummaryGameStop reported weaker-than-expected quarterly results that resulted in the stock trading over 20% lower today.

The post GameStop (GME) stock price falls over 20% after missing on profit and sales estimates, analyst downgrades to ‘Underperform” appeared first on Invezz.