Robinhood, an online trading company, reportedly raised more than $1 billion from its existing investors on Thursday night as it struggles to cope with the demand from retail investors.

Fundamental analysis: CEO denies liquidity issuesRobinhood, who has been used by WSB retail investors to attack short-selling hedge funds, has been forced to reach out to its existing investors – including Sequoia Capital and Rabbit Capital – and ask for a cash injection.

“This is a strong sign of confidence from investors that will help us continue to further serve our customers,” Robinhood said.

This represents a u-turn as Vlad Tenev, the company’s co-founder and chief executive previously denied reports his company is facing issues.

Robinhood has been widely accused of siding with short-selling hedge funds after it halted trading in certain stocks on its platform. This way, retail investors were locked out of their positions. A number of retail investors have already sued the online broker as it appears that the company sold users’ shares without their consent.

After it increased its liquidity, Robinhood said it will keep monitoring the situation and make adjustments accordingly.

“To be clear, the decision was not made on the direction of any market maker we route to or other market participants,” it said.

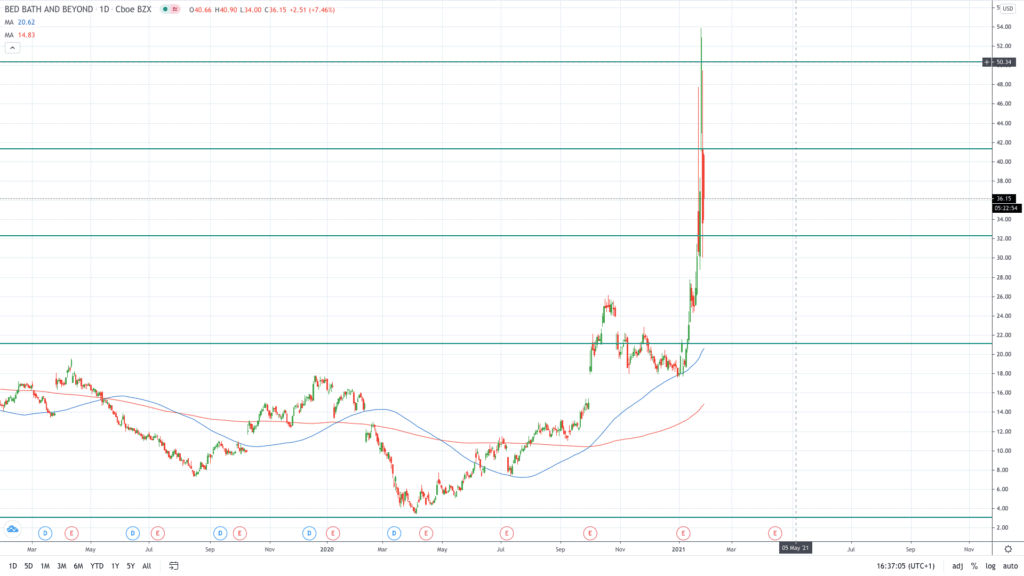

Technical analysis: BBBY, Trivago, and Lumen price analysisAside from GameStop and AMC Entertainment, shares of Bed Bath & Beyond (NASDAQ: BBBY), Trivago and Lumen – formerly known as CenturyLink – have also attracted significant trading interest. BBBY saw its stock price rising about 200% compared to the start of the month after it found itself on a list of stocks WSB investors were buying aggressively.

Bed Bath & Beyond daily chart (TradingView)

Bed Bath & Beyond daily chart (TradingView) Shares are trading around 8% higher today at $36.50, with any dip towards $28.00 likely to be seen as a buying opportunity. Trivago stock price arrived later to the WSB party but it still managed to close more than 50% higher yesterday, although it traded nearly 200% higher at one point.

WSB may have given up on the stock as it has nearly returned to prices it traded before the short-selling saga. Anyway, a pullback towards $2.00 will provide an opportunity to buy the stock for investors looking to do so.

Finally, Lumen share price plunged more than 22% yesterday after gaining about 60% since the weekend. Shares are now moving lower as they approach the support line at $11.60.

SummaryRobinhood was forced to raise over $1 billion from existing investors on Thursday to handle extremely high trading volatility on its platform specialized for retail investors.

The post BBBY, Trivago, and Lumen: Here are the next targets for WSB investors appeared first on Invezz.