DuPont de Nemours, Inc. (DD), headquartered in Wilmington, Delaware, develops and supplies a broad range of technology-based materials and solutions, including specialty chemicals, materials for semiconductor fabrication and packaging, silicones, high-performance elastomers, industrial coatings, adhesives, water- and safety-related products, and more. It serves industries such as electronics, transportation, construction, health care, water treatment, and worker safety worldwide. DuPont’s market cap is around $17 billion.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and DD perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the specialty chemicals industry. As a pioneer in materials science, DuPont’s legacy of innovation and quality positions it favorably against competitors. Its continued R&D investments ensure the company remains at the forefront of specialty chemicals and advanced materials.

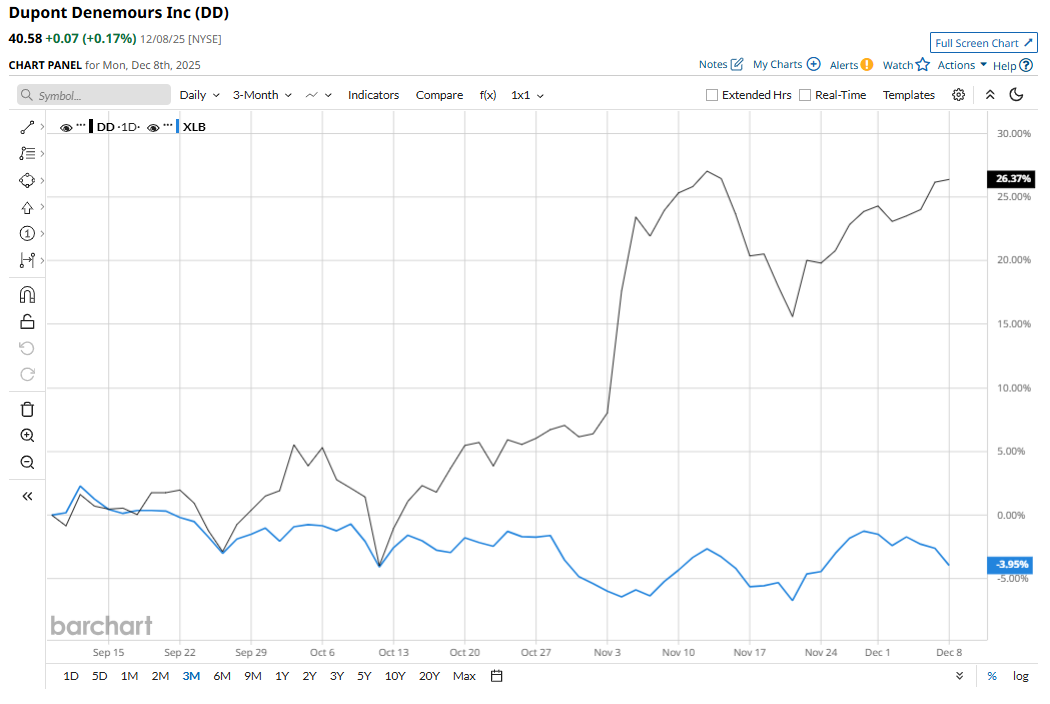

DD is down by just 1.6% from its 52-week high of $41.23, achieved on Nov. 12. Over the past three months, DD stock has gained 24.8%, outperforming the Materials Select Sector SPDR Fund’s (XLB) 5.5% decline during the same time frame.

In the longer term, shares rose 27.2% on a YTD basis and climbed 17.1% over the past 52 weeks, outpacing XLB’s YTD gains of 3.4% and a decline of 5.4% over the past year.

DD has been trading above its 50-day moving average since early June, but with some fluctuations. Also, it is trading above the 200-day moving average since mid-August.

DuPont de Nemours’ stock is rising in 2025 primarily due to its strategic portfolio transformation and strong performance in high-growth markets like electronics and healthcare. A key driver has been the successful spin-off of its Electronics business (now Qnity Electronics) in November 2025, a move that is expected to unlock value by creating two focused, more agile companies.

DD’s rival, PPG Industries, Inc. (PPG) shares plummeted 16% in 2025 and 20.1% over the past 52 weeks, underperforming DD.

Wall Street analysts are bullish on DD’s prospects. The stock has a consensus “Strong Buy” rating from the 16 analysts covering it, and the mean price target of $49.47 suggests a potential upside of 21.9% from current price levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.