The October Investor Movement Index® decreased for the first time in six months, falling to 6.10, TD Ameritrade, Inc.1 announced today. The Investor Movement Index, or the IMXSM, is a proprietary, behavior-based index created by TD Ameritrade that aggregates Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181105005117/en/

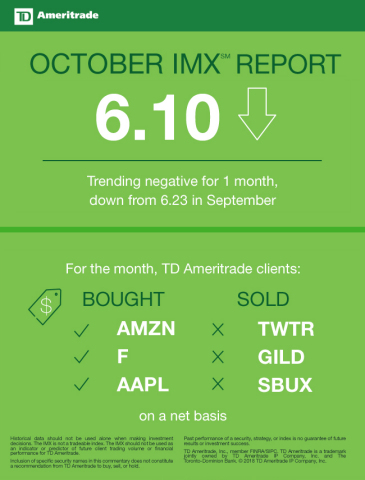

TD Ameritrade October 2018 Investor Movement Index (Graphic: TD Ameritrade)

October IMX

The October 2018 Investor Movement Index for the four weeks ended October 26, 2018 reveals:

- Reading: 6.10 (compared to 6.23 in September)

- Trend direction: negative

- Trend length: 1 month

- Score relative to historic ranges: Middle

October was a tumultuous month as increased volatility led to market swings and indexes broached negative territory for the year. The S&P 500 and Dow Jones Industrial Average were down 8.8 percent and 6.7 percent, respectively, and the Nasdaq Composite fell into correction territory. While investors focused on slowing global growth and increasing trade tensions, rising fear levels pushed the Cboe Volatility Index (VIX) close to 25 by the end of the period – up nearly 100 percent during the period.

While market indices moved lower and volatility surged higher, TD Ameritrade client accounts experienced reduced exposure as a result of decreased relative volatility in widely held names, including Apple Inc. (AAPL), Facebook Inc. (FB) and Microsoft Inc. (MSFT).

“Reflecting what was happening in the market, TD Ameritrade clients appeared to take some profits on stocks for the month,” said JJ Kinahan, chief market strategist at TD Ameritrade. “The IMX was only down slightly, however, indicating that this was not a panicked sell-off, but likely profit-taking and price-specific buying opportunities for our clients.”

TD Ameritrade clients were net buyers of stocks in the October IMX period. Some of these names include:

- Microsoft Corp. (MSFT), which overtook Amazon.com Inc. (AMZN) to become the second most valuable company by market cap in the world and beat on earnings.

- Amazon.com Inc. (AMZN), which announced it was raising its minimum wage to $15/hr, but the stock traded lower during the period.

- Ford Motor Company (F), after posting better than expected revenue during the period.

- Apple Inc. (AAPL), after the iPhone XR – the cheapest of its three new iPhone models – went on sale during the period.

- AT&T Inc. (T), which completed the first successful test of a 5G hotspot using a commercial-grade device.

TD Ameritrade clients seemed to take profits in popular names, including:

- Qualcomm Inc. (QCOM) and Advanced Micro Devices Inc. (AMD), both of which were down double-digits during the period.

- Twitter Inc. (TWTR), which moved higher after beating on revenue and earnings.

- Gilead Sciences Inc. (GILD), which beat on earnings and boosted revenue guidance.

- Starbucks Corp. (SBUX), which was up roughly 20 percent from June lows as it executed a $5 billion share buyback.

Retail investors have plenty of potentially market-moving events to consider in the month ahead. Earnings season continues, as do the ongoing U.S.-China conversations on tariffs and trade. Midterm elections on November 6 could also impact the direction of economic reform.

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of more than 11 million funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX.

For more information on the Investor Movement Index, including historical IMX data going back to January 2010; to view the full report from October 2018; or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or TD Ameritrade Mobile Trader platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold.

Past performance of a security, strategy, or index is no guarantee of future results or investment success.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade.

For the latest TD Ameritrade news and information, follow the company on Twitter, @TDAmeritradePR.

Source: TD Ameritrade Holding Corporation

About TD Ameritrade Holding Corporation

TD Ameritrade

provides investing

services and education

to more than 11 million client accounts totaling approximately $1.3

trillion in assets, and custodial

services to more than 6,000 registered investment advisors. We are a

leader in U.S. retail trading, executing an average of approximately

800,000 trades per day for our clients, more than a quarter of which

come from mobile devices. We have a proud history

of innovation, dating back to our start in 1975, and today our team

of nearly 10,000-strong is committed to carrying it forward. Together,

we are leveraging the latest in cutting edge technologies and one-on-one

client care to transform lives, and investing, for the better. Learn

more by visiting TD Ameritrade’s newsroom

at www.amtd.com,

or read our stories at Fresh

Accounts.

1TD Ameritrade, Inc. is a broker-dealer subsidiary of TD Ameritrade Holding Corporation. Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) /SIPC (www.SIPC.org).

View source version on businesswire.com: https://www.businesswire.com/news/home/20181105005117/en/

Contacts:

For Media:

Becky

Niiya, 402-574-6652

Corporate Communications

rebecca.niiya@tdameritrade.com

@TDAmeritradePR

or

For

Investors:

Jeff Goeser, 402-597-8464

Investor Relations

jeffrey.goeser@tdameritrade.com