What a year it has been so far! Congrats to all the twitter followers and readers who moved on opportunities the entire year, for those who still haven't taken advantage and seen gains, there is still time. I continue to see in smallcaps and low floaters high probability of big gains, specifically in the bio sector, therefore i will keep them in my portfolio. As always, don't forget to use a stop loss or a trailing stop for these particular cases. Trading small caps stocks can be risky, however where there are great risk, there can also be great rewards and we should act accordingly. As an independent trader, my mission is always to share ideas based in something real, news, catalysts and chart patterns, it does not matter if it is a small, mid or a big cap. For next week, i selected the following stocks based on the pattern and price action. Keep in mind, the months of September and October are typically the most volatile months for the markets, and it will be interesting to see how this story continues to play out. Honestly, i continue to see more highs for the indexes in the coming months, as the economy continues to show healthy momentum. God bless you guys. Be safe and enjoy the weekend.

( click to enlarge )

( click to enlarge )Johnson & Johnson (NYSE: JNJ) continues to act strong setting new six-month highs. Daily technical indicators are not yet overbought so higher prices are likely in the intermediate term. Price is expected to at least rally the next resistance at $139 and even go higher to test the $145 level. Long setup on wacth.

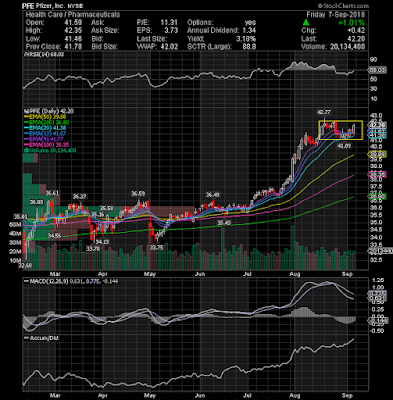

( click to enlarge )

( click to enlarge )Pfizer Inc. (NYSE: PFE) is consolidating below the highs in the trading range of 41-42.5. A move above this level, would confirm the break of the three-month consolidation. Stops should be set in the 40.5 area.

( click to enlarge )

( click to enlarge )Evofem Biosciences Inc (NASDAQ: EVFM) turned into one of the hottest stocks last month and posted some incredible profits for my twitter and blog followers. As i tweeted yesterday, i followed my trading plan and sold all my shares around the 4.5 area. From a technical standpoint, the EMA200 at 4.97 is a level to watch now.

( click to enlarge )

( click to enlarge )Innovate Biopharmaceuticals Inc (NASDAQ: INNT) has pulled back on declining volume to previous resistance, where it seems to be finding support. If this support holds next week, it will keep alive the chances of a rise to $7 once again immediately and will increase the probability of a breach of 7.50. Short-term momentum is displaying positive divergences on the hourly charts and RSI is oversold. I took a position Friday before the close.

( click to enlarge )

( click to enlarge )Tyme Technologies Inc (NASDAQ: TYME) is another bio smallcap that i brought to my Twitter followers attention lately. This stock is in the process of bottoming and we expect a pop above $2.4 at some point in the coming days. Technically, the daily trajectory of the MACD and Slow Sto are also pointing to higher prices. Let's see what Monday brings.

( click to enlarge )

( click to enlarge )Zosano Pharma Corp (NASDAQ: ZSAN) is showing early signs of reversal. A high volume move through the 4.25 (declining EMA50) price level would be buyable. The MACD is showing a positive divergence and the RSI is attempting to breach line 50 level forcing me to think the possibility of a trend reversal.

( click to enlarge )

( click to enlarge )Congrats to those of you who made bank on Gemphire Therapeutics Inc (NASDAQ: GEMP) stunning delivery last week. I bot the stock on the break of the trend line around the 1.55 level, and sold well abv 2.25. Unfortunately, i sold too early. We can't be perfect but we always strive to be perfect in following the pivot points. Might re-enter again around the 1.7 area.

( click to enlarge )

( click to enlarge )Merck & Co., Inc. (NYSE: MRK) Keep a close eye on this one next week, looks ready to break out into new high territory.

( click to enlarge )

( click to enlarge )Bristol-Myers Squibb Co (NYSE: BMY) Looking at the chart above the stock is inching closer and closer to another breakout move (ascending triangle pattern). Buying momentum is still positive and strengthening. Breakout watch above 61.59

( click to enlarge )

( click to enlarge )STRATA Skin Sciences Inc (NASDAQ: SSKN) broke above resistance in Friday's trading session after a period of consolidation. I still like this stock and will be watching it again on Monday, expecting to see a continuation move.

( click to enlarge )

( click to enlarge )I took a long position in Stellar Biotechnologies Inc (NASDAQ: SBOT) Friday, it's an aggressive buy but the risk/reward ratio is good. The stock is also trading well below cash. Honestly, i think the stock is attractive at these levels and fundamental growth prospects look very promising IMO but only the time will tell. Stop 1.32

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC