Columbia Threadneedle Investments today announced the results of a survey of financial advisors that reveals yield and market complexity are top concerns when establishing municipal bond exposure for clients.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180905005047/en/

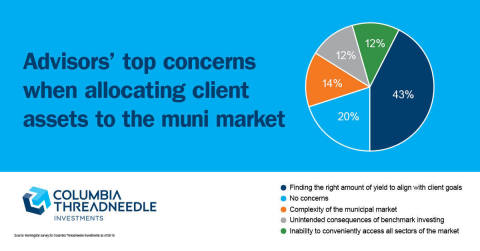

A little less than half (43 percent) of financial advisors report that their biggest concern with the asset class is finding the right amount of yield to align with their clients' goals and preferences. (Graphic: Columbia Threadneedle Investments)

A little less than half (43 percent) of financial advisors report that their biggest concern with the asset class is finding the right amount of yield to align with their clients’ goals and preferences. The next most highly-cited concern (14 percent) was complexity in the muni market post-2008, followed by unintended consequences of benchmark investing (12 percent), and an inability to conveniently access all sectors of the muni market (12 percent). 111 financial advisors participated in the industry survey.

Credit and interest rate environments also have a noteworthy impact on financial advisors’ municipal investment recommendations. In fact, the overwhelming majority of respondents (85 percent) said their muni investment decisions are at least moderately affected by credit and interest rate environments. While most advisors report their decisions being moderately impacted by these factors (60 percent), credit and interest rate environments are more likely to have a large impact than a limited impact on decisions (25 percent and 15 percent, respectively).

“Financial advisors are concerned about yield and market complexity when it comes to allocating client dollars to the muni space. This market has changed significantly in the last ten years, but there are still smart ways to invest in it if you know what to look for,” said Catherine Stienstra, Head of Municipal Investments at Columbia Threadneedle. “Traditional benchmark indices exclude viable investment options, are debt-weighted and can be over-concentrated in less attractive sectors. This puts advisors in a tough position when they try to balance cost-efficiency with investment opportunity. As passive investing continues to grow, rather than simply accept an imperfect benchmark portfolio, municipal bond investors with a preference for passive solutions should think about adopting a smart beta approach.”

Financial Advisors Juggle Preference for Active and Focus on Cost

Although the majority of respondents favor actively managed investments (54 percent), interest in a muni bond strategic beta ETF is strong, according to the survey. More than half (55 percent) said they would consider investing in a muni bond strategic beta ETF or are already invested in these products and would consider others. Cost continues to be an important issue when allocating to a strategic beta fixed income solution. In the last year, price increased as a top consideration, rising from 34 percent in June 2017 to 39 percent in June 2018.

“Financial advisors are being pulled in multiple directions as they remain committed to doing what’s best for their clients,” said Marc Zeitoun, Head of Strategic Beta at Columbia Threadneedle. “The competing priorities of price and preference for active management are a good example of the balancing act they face. Strategic beta ETFs present a great middle ground between ‘best thinking active investment insight’ and passive implementation. It’s no wonder that track record and a firm’s expertise as an active fixed-income manager remain the most important factors when considering strategic beta ETFs.”

About Columbia Threadneedle Investments

Columbia Threadneedle Investments is a leading global asset manager that provides a broad range of investment strategies and solutions for individual, institutional and corporate clients around the world. With more than 2,000 people, including over 450 investment professionals based in North America, Europe and Asia, we manage $482 billion1 of assets across developed and emerging market equities, fixed income, asset allocation solutions and alternatives.

Columbia Threadneedle Investments is the global asset management group of Ameriprise Financial, Inc. (NYSE: AMP).

For more information, please visit https://www.columbiathreadneedleus.com/. Follow us on Twitter.

1As of June 30, 2018.

Investment products offered through Columbia Management Investment Distributors, Inc., member FINRA. Advisory services provided by Columbia Management Investment Advisers, LLC.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies.

AdTrax 2217565

View source version on businesswire.com: https://www.businesswire.com/news/home/20180905005047/en/

Contacts:

Liz Kennedy, 617-888-9543

Liz.Kennedy@ampf.com