BOSTON - September 3, 2018 - (Newswire.com)

IDTechEx Research recently released the report Quantum Dot Materials and Technologies 2018-2028: Trends, Markets, Players. This report provides a detailed analysis of QD technology and markets. It provides a ten-year technology roadmap, showing how various QD implementation approaches will rise and fall. It includes ten-year market forecasts, segmented by QD technologies and applications, showing how the market will grow and how the technology mix will be significantly transformed with time. In terms of displays, it considers edge type, film type, color filter type, on-chip type and emissive type of displays. This report also provides a thorough technical analysis, outlining many technical (material and device level) and market challenges that must be overcome to commercialize QD technologies. Finally, it provides detailed overviews of the key industry players.

Quantum dots in displays: the story so far

The primary market of quantum dots (QDs) today, beyond research uses, is in displays, Here, the driver is achieving wide color gamut displays thanks to the ultra-narrowband emission of QDs. This attribute is helping position LCDs as a viable competitor against large-sized premium-priced high color quality OLED displays.

Up until now, the QDs’ material characteristics have defined their use case. The QDs have been essentially only integrated into displays as ‘remote’ phosphors. In one implementation, the QDs are loaded into a resin which is then coated onto a film that is then sandwiched by two barrier (encapsulation) layers. This arrangement is called film-type QD or QD enhancement film (QDEF). In the other implementation, the QDs are put into tubes which are placed at the edge of displays. This is generally called Edge Optic QDs.

In both cases, QDs re-emit the light form the phosphor converted backlight LEDs and in doing so narrow the emission spectrum, thus achieving wide colour gamut and thus pushing the display industry further towards the Rec2020 standard. In both cases, ‘remote’ phosphor integration was adopted because QDs could not tolerate harsher heat or light flux stress conditions which a closer proximity to the light source (LED) would have imposed upon them.

The edge optic QD implementation is now essentially obsolete. Its main proponent (QD Vision) lost an IP battle against the market leader (Nanosys), and consequently had to sell its patent portfolio at a bargain price to a leading QD user (Samsung). The film-type QD implementation however is continuing its growth.

Transition away form Cd based QDs will soon be complete?

Several key trends today characterize the market and technology dynamics of film-type QDs (or QDEFs). Below we will discuss two key trends: transition away from Cd based and reducing implementation cost.

The ban on cadmium (Cd) in Europe is finally announced for October 2019. Even prior to this announcement, Cd QDs had appeared only as a transitory solution, a technology on borrowed time.

To respond, the industry has been developing InP based QDs as an alternative to Cd based ones. In the early days, the performance gap between Cd and InP QD technologies was vast. Now however, the quantum yield (QY) difference has all but disappeared, whilst the FWHM gap has also been notably narrowed (note: QY affects efficiency and FWHM affects colour gamut).

The FWHM gap however stubbornly persists with InP QDs today achieving around 40nm commercially. Pushing it down towards 38nm commercially (or even 35nm in the lab) remains a challenge. This is because the emission bandwidth is not just a function of the control of the monodispersity of the QDs during the synthesis, but it is also a function of the shape and crystalline structure of the particles.

Despite this continued performance discrepancy, the market transition appears largely complete. This is shown below: in 2002, the market share of Cd based QDs was nearly. But the IDTechEx Research report shows, today, in 2018, we expect it to drop to 20%.

Approaches for reducing implementation costs

As with all display components, the pressure to achieve more-for-less is relentless and perennial. QDs are no exception. In case of QD films, it means lowering the cost of entire solution including QD materials, substrate, coating, barrier, etc

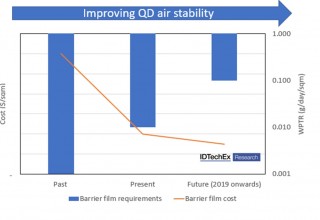

In fact, the barrier layers are a significant cost contributer. Their cost however can be lowered if barrier performance requirements are relaxed, leading to simpler barrier film structures. This, in turn, can only be achieved if QD materials become more air stable.

Progress continues to be made here. As the IDTechEx Research report suggests, the barrier requirements appear to have been relaxed from 1E-4 g/day/sqm to 1E-3 g/day/sqm and 1E-2 g/day/sqm, and now even the target of 1E-1 g/day/sqm seems feasible in the near future.

The QD material cost should also be reduced. One way is to increase the efficiency and the brightness of the QDs, leading to a lower consumption per sqm for a given output. Another method would be to lower the cost of QD production per Kg. This of course will stem from greater scale and but also from innovation in the synthesis procedure.

As to the latter, companies have explored a low temperature molecular seeding process, a continuous (vs batch) process in heated microcapillary reactors, a one-pot synthesis process for core-shell (or graded core-shell) structures, and so on. In all cases however it remains challenging to balance reaction time and temperature against the need to maintain high size and shape monodispersity, to achieve excellent shelling process, to minimise built-in stresses and CTE mismatches, and to obtain full ligand surface coverage (more so when ligands are exchanged away from as-grown ones to promote compatibility with a resin, a photoresist, or an ink since this is often a time consuming process). There is continued progress all around, but often of an incremental nature.

Pricing strategy on the cusp of major change

With cost reduction comes renewed questions about the pricing strategy of QD enabled display makers. Originally, display makers positioned QD TVs as ultra-premium. This reflected the need to counter the value proposition of the (then) emerging white OLED TVs and also the actual cost of implementation.

Now though that the implementation cost has fallen, and is expected to fall further, new pricing options have become viable. Some makers are seizing this opportunity to create a product range covering a spectrum of prices, whereas others are still struggling to maintain the ultra-premium aura with the help of price signals. This latter position however increasingly appears untenable in the long term. This long-term pricing trend will also present a challenge to large-sized WOLED unless that too can reduce its production costs.

Overall, we find that film-type implementation will continue its volume (sqm of displays sold) growth in the short and medium terms. But a major question is whether this trend will last, and if so for how long? This is because alternative implementation approaches are being developed

The pending decline of film type QDs?

In the IDTechEx Research report Quantum Dot Materials and Technologies 2018-2028: Trends, Markets, Players we have developed a ten-year technology roadmap and market forecasts (segmented by QD integration type), assessing how the QD technology will transition from edge optic (now almost obsolete) and film type towards color filter type, on-chip type and finally emissive type. These emerging approaches have vastly different technology readiness levels as well as requirements and material- and device-level challenges.

These alternative approaches are not limited (vs film type) by value proposition, but by technical challenges. Therefore, as these challenges are overcome, film type QDs will first begin to lose their exclusive control of the QD display market, and will then enter into a decline phase. Indeed, we find that film type will have to share the market first with color filter type, then with on-chip type (e.g., microLED displays), and finally with emissive type (long term development but ultimate prize).

Innovate or die?

These transitions may open the market to new comers who either came too late or were barred by IP issues. In any case, they condemn the suppliers and users to continue to invest in R&D so as not be left behind as these transitions occur.

This is exciting because many material improvements are needed: reduce self-absorption, increase air/heat/light stability, improve dispersion and processability in photoresists or inkjets without too much degradation, boost blue absorbance, find optimal device stack, and so on. Quantum Dot Materials and Technologies 2018-2028: Trends, Markets, Players provides a detailed assessment of all these directions of material improvements and outlines the latest progress.

For more see www.IDTechEx.com/qd.

IDTechEx guides your strategic business decisions through its Research and Events services, helping you profit from emerging technologies. To find out more visit www.IDTechEx.com.

Media Contact:

Charlotte Martin

Marketing & Research Co-ordinator

c.martin@IDTechEx.com

+44(0)1223 810286

Related Links

Further IDTechEx Research

Printed Electronics USA 2018

Related Images

Press Release Service by Newswire.com

Original Source: Quantum Dot Films in Displays: Major Technology and Market Trends Examined in IDTechEx Research reportQuantum Dot Films in Displays: Major Technology and Market Trends Examined in IDTechEx Research Report